Putting your money into exchange-traded funds (ETFs) can offer a good way to diversify your investment portfolio. However, there are instances where these ETFs may have a large concentration in a few individual stocks, which can undermine the diversification benefits they are meant to provide. It is common to see top-performing ETFs achieving success as a result of holding significant positions in a small number of stocks.

Nvidia, Apple, and Microsoft are among the most popular stocks held in numerous investment funds.

If you are putting your money into growth or technology-oriented funds, you will frequently come across large technology companies. Nvidia , Apple , and Microsoft hold significant positions in those ETFs.

As an illustration, the The Invesco QQQ Fund. has increased by approximately 150% over the last five years. The Technology Select Sector SPDR Fund is an investment fund that focuses on technology companies. Has increased by 170%. You may believe that these are exceptional investments that can also provide great diversification to mitigate your risk. However, is this truly accurate?

Nvidia, Apple, and Microsoft account for almost a quarter of the Invesco QQQ Fund’s assets. In the Technology Select fund, their share increases to over 46%. The performance of these three stocks significantly influences the direction of the ETFs. These companies are not only major components of these funds but are also top players in the industry, making their performance a good indicator of the overall technology sector’s health.

This prompts a straightforward query: Is it more advantageous to keep only these three stocks, or opt for another option? ETF ?

The comparison between the major three companies and exchange-traded funds.

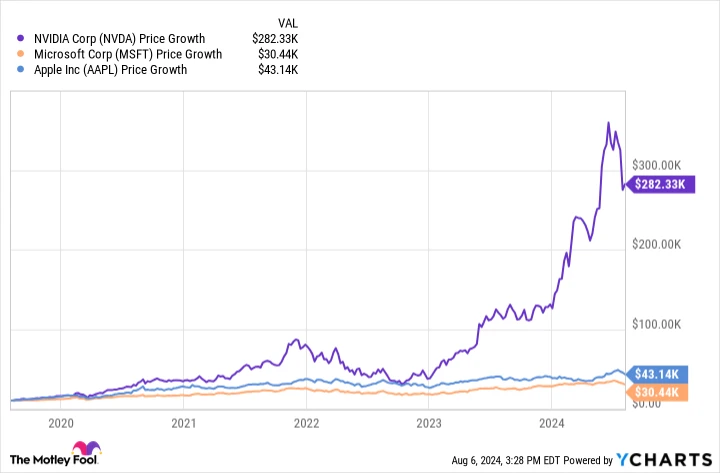

Imagine if you had put $10,000 into each of the top three stocks five years ago. If you had done so, the total value of those investments today would be $353,000, mostly thanks to Nvidia, which alone would be valued at an impressive $280,000.

Suppose you opt for the more secure choice of investing all the money in a single ETF. In this scenario, you would invest $30,000 in a fund like the Invesco QQQ ETF, providing you with exposure to the top 100 non-financial stocks. Nasdaq The Technology Select fund is concentrated on the technology industry. S&P 500 Additionally, we should incorporate the SPDR S&P 500 ETF is an exchange-traded fund that tracks the performance of the S&P 500 index. , which can offer an increased level of diversification. Below is the current value of a $30,000 investment made five years ago in each of those funds:

- The Technology Select Sector SPDR Fund is currently valued at $80,000.

- The Invesco QQQ Fund is valued at $73,000.

- SPDR S&P 500 ETF is valued at $56,000.

The returns from those investments are nowhere near the profits you could have made by investing in the top three technology companies. Even if we leave out Nvidia, which has seen significant growth in recent years due to its strong position in the chip industry, investing $10,000 in Microsoft and Apple alone would have resulted in a portfolio value of approximately $73,000. With a combined investment of $20,000, the returns would be similar to what you would achieve by investing $30,000 in the QQQ Fund.

Would it be more advantageous to invest in individual top-performing stocks or an Exchange-Traded Fund (ETF)?

Peter Lynch coined the term “diworsification” to emphasize the downside of over-diversification. When investors spread their portfolio too thin, they risk diluting their potential returns. It is often more beneficial to focus on a few strong stocks rather than holding numerous small positions that may lead to disappointing outcomes.

Diversifying your investments can be beneficial if you lack confidence in selecting individual stocks. However, generally speaking, investing in the leading companies can also be a sound strategy. tech stocks Investing in this sector has typically proven to be a wise decision for investors over time. Although there may be some years of poor performance, ultimately, it is expected to yield significant profits for your investment portfolio. Opting for well-established and prominent companies in the industry can also help minimize potential risks.

If you lack knowledge about a specific industry or prefer having a wide range of investments, an ETF could be a suitable choice for you. However, for most investors, selecting individual stocks is effective because it eliminates the need for extensive research to identify profitable investments. Often, high-quality and low-risk stocks are easily discoverable. Opting to invest in and hold shares of three technology companies might be a more advantageous decision compared to searching for the perfect ETF.