Contents

- 1 The Federal Reserve’s Anticipated Rate Cut: Implications for the Stock Market

- 2 Achieving Inflation Goals

- 3 The Impact of Interest Rate Cuts on Stocks

- 4 Historical Performance of the S&P 500 Following Rate Cuts

- 5 Looking Ahead: What It Means for Investors

- 6 Investment Opportunities: The Motley Fool’s “Double Down” Alert

The Federal Reserve’s Anticipated Rate Cut: Implications for the Stock Market

The moment that economists and investors have eagerly awaited is finally here. This week, the Federal Reserve convenes to potentially initiate the first interest rate cut in four years. After a series of 11 rate hikes since 2022, aimed at curbing rampant inflation, the benchmark rate now stands at 5.5%—the highest in over two decades.

Achieving Inflation Goals

These rate hikes have effectively tamed inflation, bringing it down to 2.5%, close to the Fed’s target of 2%. The Federal Open Markets Committee considers this level optimal for maintaining maximum employment and price stability.

Economic analysts and traders are speculating that the Fed will announce a rate reduction of at least 25 basis points, with some anticipating a cut of 50 basis points. This leads investors to ponder the potential impact on the stock market, a curiosity that can be informed by historical trends.

The Impact of Interest Rate Cuts on Stocks

Why Rate Cuts Matter

Understanding why interest rate cuts are significant for the stock market and investors is essential. Higher interest rates can negatively affect corporate earnings and dampen investor enthusiasm for stocks. As the federal funds rate increases, so do borrowing costs for both individuals and corporations.

For companies, particularly those in high-growth sectors that depend on loans for expansion, increased borrowing expenses can be daunting. This might make investors wary about these companies’ growth prospects and deter them from investing. On the consumer side, higher borrowing costs reduce disposable income, affecting spending habits.

Investors may become cautious, avoiding stocks likely to suffer in such an environment, like nascent tech companies or sectors dependent on discretionary spending, such as entertainment and travel. They might also shift their focus to investments that perform well in high-rate settings, such as bonds.

Conversely, when interest rates decrease, borrowing becomes more affordable for businesses and individuals, and consumers have more disposable income for non-essential purchases. This improved economic landscape can boost corporate earnings, thereby increasing investor confidence in the stock market.

Historical Performance of the S&P 500 Following Rate Cuts

Learning from the Past

As we anticipate the Fed’s decision, it’s instructive to examine how past rate cuts have influenced the stock market. During the last two rate cut cycles, the S&P 500 index experienced double-digit growth in the year following the initial cut. Specifically, after rate cuts on March 3, 2020, and August 1, 2019, the S&P 500 rose by 27% and 10%, respectively, over the subsequent 12 months.

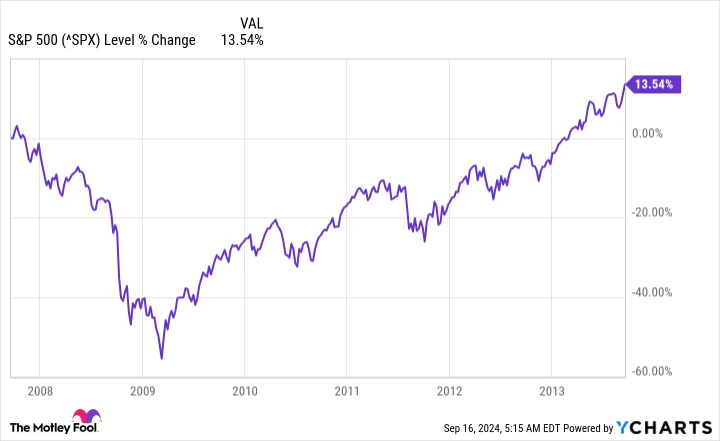

However, during the Great Recession, which coincided with the housing market crash of 2007-2008, the S&P 500 took a longer time to recover following the first rate cut in September 2007. This period was an exceptional economic downturn and may not be a suitable comparison for current conditions.

Looking Ahead: What It Means for Investors

While predicting the exact movements of the S&P 500 is challenging, recent history suggests a favorable trend following rate cuts. Nonetheless, a single rate cut won’t immediately ease borrowing conditions for companies and consumers; it will take multiple cuts to see substantial effects.

The encouraging news is that if the Fed proceeds with a rate cut this week, it could set the S&P 500 on a trajectory aligned with recent positive historical trends, potentially leading to growth over the next year.

Investment Opportunities: The Motley Fool’s “Double Down” Alert

Time to Seize the Moment

The Motley Fool Stock Advisor has achieved a total average return of 755%, significantly outperforming the S&P 500’s 165% return since 2002*. Their analysts are adept at identifying when to double down on stocks, leading to remarkable returns.

For example:

– Nvidia: A $1,000 investment during a 2009 double down would now be worth $308,807!*

– Netflix: A $1,000 investment from a 2004 double down would have grown to $375,918!*

– Apple: A $1,000 investment during a 2008 double down would now be valued at $42,091!*

Currently, “Double Down” alerts have been issued for three extraordinary companies, offering a rare opportunity that may not arise again soon.

See the stocks ›

*Stock Advisor returns as of 09/17/2024