This week’s stock market experienced a significant amount of anxiety. There was a notable decrease in the value of technology stocks, whereas there was a rise in the demand for safe-haven stocks such as utilities and pharmaceuticals. Nasdaq The market has entered a correction phase, dropping by over 10% from its recent peak. The release of a jobs report showing fewer jobs created than expected (114,000 compared to the estimated 185,000) has raised concerns about a potential recession, leading to selling of stocks by some investors. It is common for investors to feel nervous during such periods, but it is important to remember that market pullbacks are a regular occurrence.

I am excited about these prospects. Investors can now buy stocks at fair prices instead of at their peak levels.

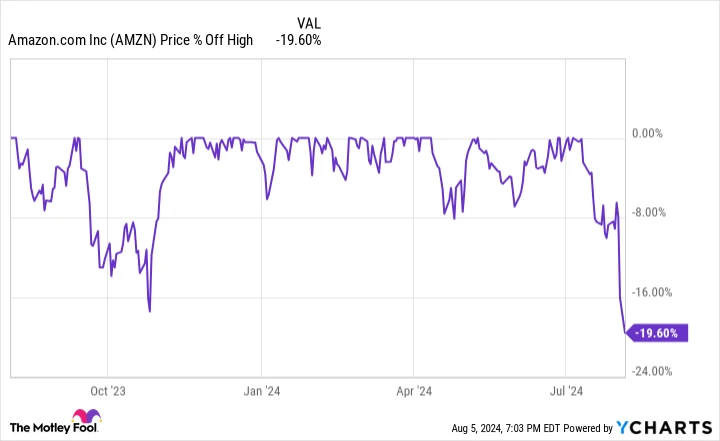

Even the “Seven magnificent individuals” Stocks can be affected by a correction. Amazon ( AMZN 0.69% ) is currently trading at a 20% discount from its most recent peak, as illustrated below.

The economic decline appears to be a favorable chance for investors to purchase shares at a discounted rate.

Here’s why.

Did Amazon really have “poor” earnings?

Amazon’s second-quarter earnings did not meet the market’s expectations, with a 10% increase in net sales to $148 billion in Q2, compared to 13% growth in Q1. This was anticipated due to the overall slowdown in consumer spending. However, Amazon’s operating income saw a significant 91% rise from $7.7 billion in Q2 last year to $14.7 billion this year, although it was 4% lower sequentially. Despite concerns about a slowdown in growth and recession fears, Amazon’s performance in AWS was outstanding.

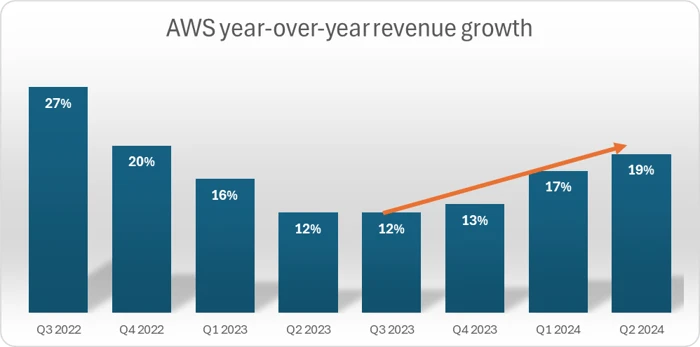

Amazon Web Services (AWS) is a major source of revenue for Amazon. The cloud division generated $66 billion in operating profits from 2021 to 2023, representing 89% of the company’s total operating profit. Despite a challenging 2023 with businesses reducing data spending in fear of an upcoming recession that did not materialize, the cloud service providers are now benefiting greatly from the growth of artificial intelligence (AI). AI programs that generate content Significant data and computing capabilities are needed, and AWS stands to gain significantly from this.

As demonstrated, the revenue growth of AWS has increased in each of the past three quarters.

Source of information: Amazon.

This development is promising and indicates positive expectations for Amazon’s performance and stock in the future.

Should one consider purchasing Amazon stock at this time?

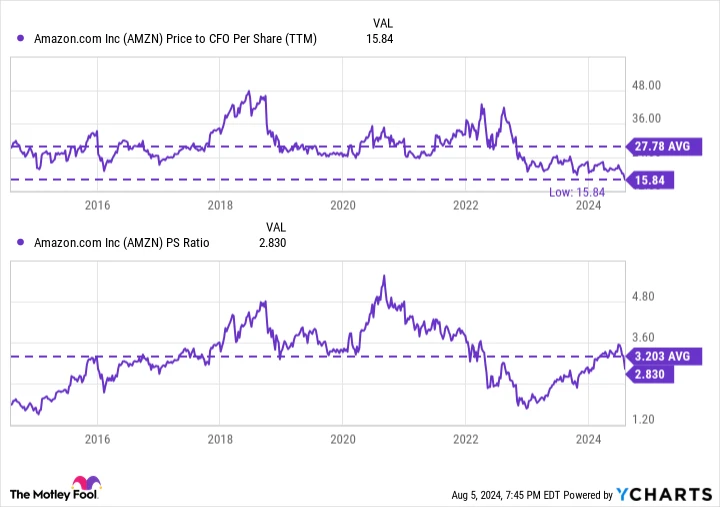

When evaluating Amazon’s worth, I prefer to consider its price-to-sales (P/S) ratio and its price-to-operating cash flow (CFO). Operating cash flow, also known as cash from operations, is significant as it indicates the amount of money the company’s core operations produce.

According to the information presented, Amazon is currently valued 13% lower in terms of sales and 75% lower in terms of cash flow in comparison to its average values over the past 10 years.

AMZN price to cash flow from operations per share (trailing twelve months) data by YCharts

This is the least it has been traded for in more than a decade based on cash flow.

Assessing Amazon’s value goes beyond just considering the price-to-earnings (P/E) ratio, however, it is noteworthy that the current P/E ratio of 38 is the lowest it has been in over a decade.

Amazon is expected to maintain its sales growth at around 10%, with management forecasting a growth rate between 8% and 11% for the next quarter. Despite this, AWS stands out as a profitable division due to its AI advancements and increasing growth trajectory. In challenging times like these, it is wise to heed Warren Buffett’s advice of seizing opportunities when others are hesitant and recognizing the stock market as a mechanism that rewards patience over impulsiveness. Following this guidance could prove beneficial for investors in Amazon.