Contents

Executive Moves at Berkshire Hathaway: A Closer Look

When a top executive at a major corporation decides to make a significant open-market purchase or sale, it inevitably draws attention. This is especially true for Berkshire Hathaway, where moves by executives are scrutinized closely. Recently, Ajit Jain, the Vice Chairman of Berkshire Hathaway, made headlines by selling $139 million worth of Berkshire stock—over half of his total stake. This raises the question: Should Berkshire investors be concerned?

Ajit Jain’s Legacy: A 38-Year Journey

Ajit Jain’s remarkable 38-year tenure at Berkshire Hathaway underscores his importance to the company. Joining in 1986 to oversee the insurance operations, Jain has been a pivotal figure, praised by Warren Buffett himself as more integral to Berkshire than even Buffett. The insurance sector is not just a vital component of Berkshire’s business but also provides the “dry powder” necessary for investment opportunities.

In his 2016 annual letter, Buffett lauded Jain’s contributions, stating: “Ajit has created tens of billions of value for Berkshire shareholders. If there were ever to be another Ajit and you could swap me for him, don’t hesitate. Make the trade!” In 2018, Jain was appointed Vice Chairman alongside Greg Abel, who is expected to succeed Buffett as CEO.

Given this backdrop, Jain’s decision to sell more than half of his Berkshire stake is noteworthy. On September 9, Jain sold 200 Class A shares at $695,418 each but retains 116 shares through direct holdings and family trusts. Additionally, his charitable organization, the Jain Foundation, holds 50 shares. So, should shareholders be alarmed by this sale? Let’s delve deeper.

Retirement on the Horizon?

Speculation about Jain’s potential retirement may offer some context for his decision. At 73, managing one of the world’s largest insurance companies, with an annual float of $169 billion, is undoubtedly demanding. Berkshire boasts a wealth of talent within its insurance division, bolstered by strategic acquisitions like Alleghany Insurance in 2022 and a significant stake in Chubb. Although Berkshire’s current stake in Chubb is 6.4%, some analysts suggest Chubb could be an excellent acquisition target.

Valuation and Tax Implications

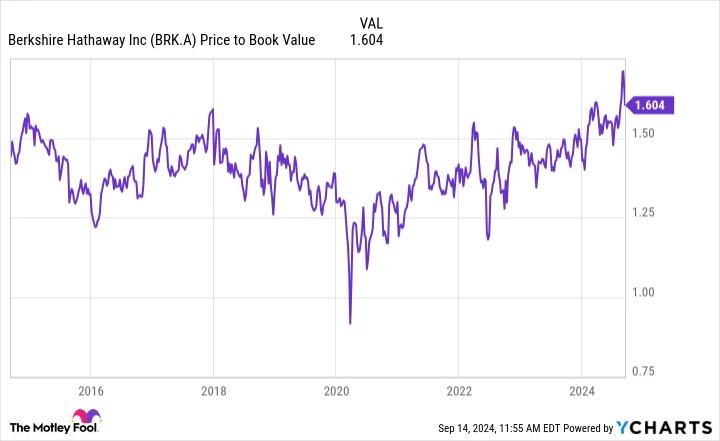

Even if retirement isn’t imminent, Jain’s timing might be influenced by other factors, such as Berkshire’s valuation and potential tax changes. Berkshire recently surpassed the $1 trillion market cap threshold, driven partly by margin expansion. Its price-to-book ratio also hit a decade-high, exceeding 1.6 times. While this isn’t excessively high for an insurance-centric stock, it’s a peak valuation for Berkshire.

Tax Considerations

Tax considerations may have also played a role in Jain’s decision. At Berkshire’s annual meeting in May, Warren Buffett mentioned tax implications as a factor in his recent sale of Apple stock. With the U.S. debt and deficit in focus, higher taxes seem likely. The corporate tax rate, reduced from 35% to 21% in the 2017 Tax Cuts and Jobs Act, may rise when many provisions expire in 2025. While a full return to 35% is unlikely, an increase above 21% is possible.

Additionally, proposed changes could affect individual capital gains taxes. Vice President Kamala Harris has suggested raising the top capital gains rate from 20% to 28% for high earners, along with increasing the net investment income tax from 3.8% to 5% for gains over $200,000 annually. If enacted, these changes could raise Jain’s total capital gains tax rate from 23.8% to 33%.

Should Berkshire Investors Be Concerned?

Jain’s stock sale likely stems from a mix of personal circumstances, Berkshire’s valuation, and tax considerations. If you view Berkshire as a long-term investment, there’s no immediate reason to panic. However, if you’re concerned about the company’s future post-Buffett, or plan to sell within the next five years, trimming your stake now, as Jain did, might be wise.

A Second Chance at Lucrative Investments

Ever felt like you missed out on investing in successful stocks? Consider this your second chance.

Occasionally, our expert analysts issue a “Double Down” recommendation for stocks poised for significant growth. If you fear you’ve missed the opportunity, now is the time to act before it’s too late. Just look at the numbers:

– Nvidia: A $1,000 investment in 2009 would be worth $308,807 today.

– Apple: A $1,000 investment in 2008 would have grown to $42,091.

– Netflix: A $1,000 investment in 2004 would now be $375,918.

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and opportunities like this are rare.

Discover the 3 “Double Down” stocks ›

Stock Advisor returns as of 09/16/2024