Airbnb ( ABNB -2.16% ) One of the most controversial stocks is being discussed. Optimists believe the company is transforming the travel industry and still has significant room for expansion, whereas pessimists are concerned that regulations and opposition from consumers could result in a “Airbnb Apocalypse.” Pessimists seem to be more accurate recently, as the stock dropped by 13% in the summer after reporting its second-quarter earnings, which revealed a decrease in demand in North America.

The stock has decreased by 47% from its highest point. This suggests that it may be a good opportunity to examine Airbnb and its future possibilities.

Reducing the number of bookings in North America

Airbnb had a positive financial performance in the second quarter, with revenue increasing by 11% compared to the previous year, reaching $2.75 billion. The Gross Booking Value (GBV), which represents the total value of transactions on the Airbnb platform, also rose by 11% to $21.2 billion. Earnings and cash flow continued to be robust.

What caused the decline in Airbnb stock? The drop was attributed to concerns about the time gap in North America. In essence, people are currently booking accommodations for upcoming stays in the region. Nevertheless, there has been a decrease in bookings for stays that are scheduled further ahead in the future, like during Thanksgiving or Christmas.

Investors are worried because a decrease in demand for bookings made further in advance suggests that people are feeling less sure about their ability to travel during the winter, potentially causing a slowdown in Airbnb’s growth. The North American market is crucial for the company, and it is expected that Wall Street has lowered its growth projections for Airbnb in the upcoming quarters as a result of this development.

There is a great opportunity for expansion on a global scale and to enter new markets.

Although North America is currently Airbnb’s primary region, the company is focusing on expanding globally in the near future. At present, its main revenue-generating countries are the United States, Canada, France, the United Kingdom, and Australia. In the upcoming years, Airbnb plans to invest significantly in new markets such as Japan, South Korea, Latin America, India, and Southeast Asia to increase the availability and demand for unique accommodations.

Due to the high demand for these areas as tourist spots, investors should be optimistic about Airbnb’s future growth. If Airbnb can expand its market share in other countries to match that of well-established markets, its Gross Booking Value (GBV) could potentially double or triple within the next five to ten years.

In addition to expanding beyond accommodation and vacation rentals, Airbnb has plans to reintroduce its Experiences section. These Experiences consist of tours and activities tailored for travelers, which can complement the services offered to Airbnb users. Through a new user interface, increased supply investments, and an updated marketing approach, Airbnb aims to significantly boost bookings for Experiences. This initiative has the potential to enhance revenue growth, even in the event of a decline in demand from North America.

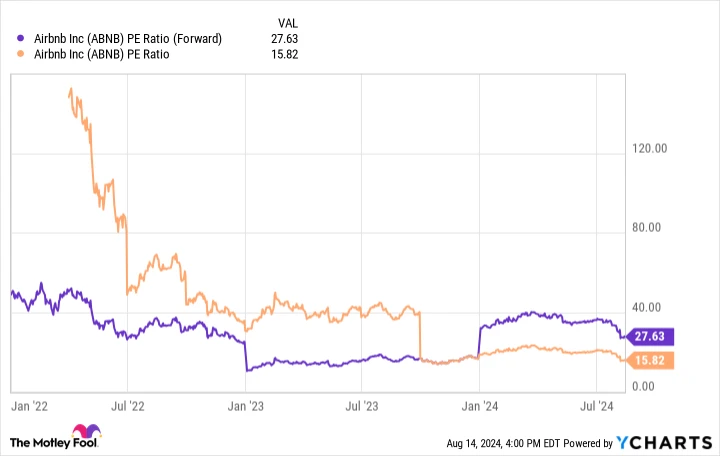

Data by YCharts .

Should one purchase or dispose of Airbnb shares?

Despite Airbnb’s stock price dropping nearly 50% from its highest point, it continues to have a high forward price-to-earnings ratio. P/E The trailing P/E ratio is lower due to a one-time accounting charge that boosted earnings, resulting in a high P/E of 28 overall. S&P 500 The forward P/E ratio for sports is less than 22.

Airbnb still has a significant opportunity for growth ahead, which could increase profits and decrease its valuation. Consider investing in the stock if you are highly optimistic about the company’s global expansion and Experiences initiatives. However, for cautious investors who prioritize a safety buffer, the current price of Airbnb stock appears too high.

I will keep an eye on it, as it is a good company, but I would rather purchase it when the price is lower.