Intel ‘s ( INTC -2.08% ) In early July, the stock price showed a strong upward trend, increasing by 12% during the first half of the month. Investors were optimistic due to the increasing competition in the chip industry between the U.S. and China, particularly regarding Intel’s strategy to construct chip factories across the U.S. However, this positive sentiment shifted following the release of the company’s financial performance for the second quarter of 2024 on August 1.

The semiconductor company’s shares have dropped by 32% following the financial report, leading to a significant decrease in its market capitalization. Intel failed to meet analyst expectations on several fronts and announced cost reduction strategies that unsettled investors. Operating income and free cash flow Intel has experienced a decrease of 100% and 238% in the past three years, putting the company in a challenging situation.

Intel aims to become the leading producer of artificial intelligence (AI) chips globally and continues to invest in American chip fabrication facilities, making it a persuasive stock to purchase in the future. Nevertheless, it may be challenging to choose Intel’s stocks over other technology companies that offer better value and reliability.

I’m wondering if it’s still a good time to buy shares of Intel.

The value of Intel’s stock has dropped significantly following its latest earnings report.

Investors on Wall Street have become skeptical of Intel’s long-term strategy following disappointing financial results. The company’s revenue in Q2 2024 dropped by 1% compared to the previous year, reaching $13 billion, which fell short of analysts’ expectations by $150 million. Additionally, the company’s operating losses increased from approximately $1 billion in the previous year to around $2 billion in Q2.

Subpar profits were announced together with troubling information that Intel intends to cut over 15,000 jobs and cancel its Q4 2024 dividend to lower expenses.

Intel had a reputation for offering a relatively high dividend compared to other technology companies. Its dividend per share increased from $0.22 to $0.37 from 2013 to January 2023. In February 2023, the dividend was reduced to $0.13 and has stayed at that level since then. The potential complete removal of the dividend may indicate concerns about Intel’s financial security in the short run according to analysts.

Intel’s recent decline in stock value resulted in a loss of $32 billion in market capitalization, prompting a lawsuit from a group of shareholders. These investors allege that they were caught off guard by the latest financial results, arguing that the company misrepresented its business and production abilities, leading to an artificial increase in its stock price.

Intel’s second-quarter profits have caused dissatisfaction among investors, which will require a period of sustained and positive financial progress to diminish. Therefore, individuals considering investing in the company’s stock must be prepared for a long-term commitment.

A more precarious investment when contrasted with other technology stocks.

Intel is strategically planning for the future by prioritizing potential long-term benefits over its current financial status.

With various AI chip launches in the past year and the commencement of building the initial chip manufacturing plant in the U.S. out of the proposed four, the company has the potential to establish a profitable foothold in the AI sector in the coming decade. The upcoming chip factory in Ohio is expected to become the largest AI chip plant globally, potentially boosting Intel’s profits in the long run due to increasing demand. processing units specialized in handling graphics keeps rising.

However, its stock is considered risky due to recent earnings and a low valuation in comparison to other options. AI stocks .

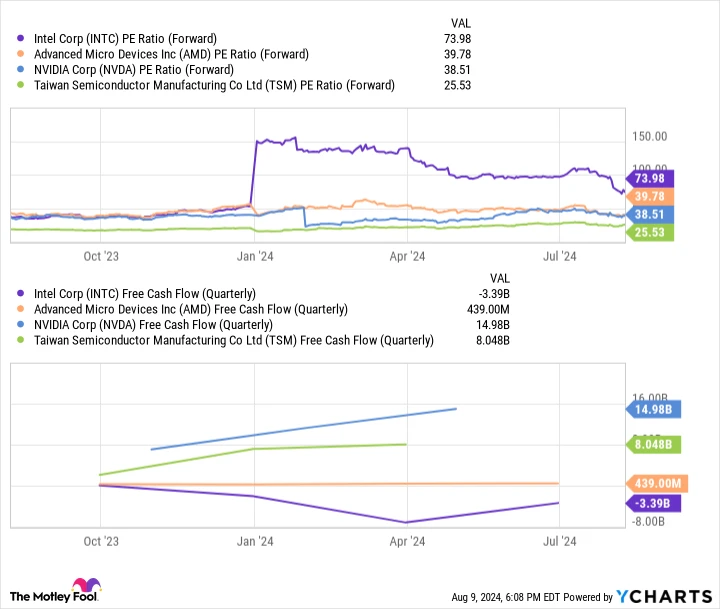

Data by YCharts

According to this chart, Intel clearly has the highest. the ratio of a company’s stock price to its earnings per share Compared to other companies in the AI and chip industry, it is suggested that this company’s stock is the least valuable. Additionally, it also has the lowest price. free cash flow highlighting its weak financial situation among these companies.

Nvidia , AMD , and Taiwan Semiconductor Manufacturing Corporation is a leading semiconductor foundry company based in Taiwan. Both companies have stronger footholds in the field of AI and are currently offering stocks at more attractive prices. Therefore, it is difficult to justify investing in Intel when there are more dependable and cost-effective alternatives on the market.

It may still be a good opportunity to invest in Intel, given its promising long-term strategy that is expected to yield returns over time. Nevertheless, it is advisable to wait for indications of the company’s recovery and explore investment options in alternative tech companies targeting similar markets. It might be worth considering diversifying your portfolio. too early to put money into Intel.