Contents

Uncovering Opportunities in a High-Market Landscape

As Wall Street indexes hover near historic peaks, the hunt for investment bargains becomes increasingly challenging. While this scenario presents an intriguing dilemma, it also tests investors’ abilities to strategically allocate their capital. Despite the high valuations of many stocks, the market still offers pockets of opportunity. After thorough analysis, three Fool.com contributors have highlighted SentinelOne (-3.85%), Netflix (-2.47%), and Sea Limited (-0.88%) as promising stocks poised for market-beating growth in the coming year.

SentinelOne: A Powerhouse in Cybersecurity and AI

Justin Pope on SentinelOne

SentinelOne is making waves in 2024, and its momentum shows no signs of slowing. This company stands at the intersection of cybersecurity and artificial intelligence (AI), two of Wall Street’s most dynamic sectors. Using advanced AI, SentinelOne’s autonomous security platform offers state-of-the-art protection against cyber threats, earning accolades from industry testers. As the repercussions of breaches grow costlier, companies are increasingly drawn to high-caliber solutions like those offered by SentinelOne, fueling robust revenue growth.

In the fiscal second quarter ending July 31, SentinelOne achieved a 33% year-over-year revenue increase and is advancing towards profitability. This progress has bolstered investor confidence, driving the stock up nearly 40% over the past year, with potential for further substantial gains.

Recently, SentinelOne partnered with Lenovo, the leading PC manufacturer, to integrate its security software into new PC shipments. This move follows a similar collaboration between Dell Technologies and CrowdStrike, which added over $50 million in revenue. If SentinelOne replicates this success, it could significantly impact their projected revenue of $815 million this year and approximately $1 billion next year. Future earnings calls will likely provide more insights into the Lenovo partnership.

Despite its impressive performance, SentinelOne remains undervalued compared to high-tech peers like CrowdStrike, Zscaler, and Palo Alto Networks, making it an attractive buy even after this year’s meteoric rise.

Netflix: Leading the Streaming Revolution

Jake Lerch on Netflix

Netflix has surged over 45% year-to-date, confirming its status as a high-flying stock. Looking ahead, 2025 could be even brighter for the streaming leader.

The streaming wars continue, yet Netflix is clearly gaining dominance. Nielsen data from June shows streaming accounts for about 40% of total TV usage, with cable and broadcast trailing. Within streaming, Alphabet’s YouTube holds the lead at 9.9%, followed closely by Netflix at 8.4%. Other contenders like Amazon’s Prime Video, Disney’s Hulu, and Disney+ lag behind, none exceeding 3.1% usage.

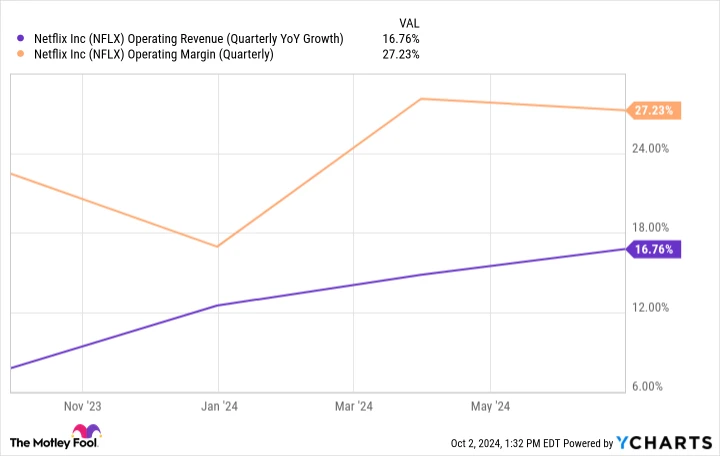

Netflix’s strategic positioning has fortified its competitive edge, as streaming continues to capture viewership from traditional TV. This shift has bolstered Netflix’s fundamentals, reflected in its latest quarterly report, which showed a 17% year-over-year revenue increase and a 27% operating margin.

Netflix has emerged stronger from the streaming wars, poised for continued success. As the company expands its ad-tier business, 2025 could be a landmark year. Investors should consider Netflix now, anticipating a potentially stellar period.

Will Healy on Sea Limited

After a steep decline during the 2022 bear market, Sea Limited presents a compelling case for a comeback. The Singaporean conglomerate thrived during the pandemic with its retail, gaming, and fintech divisions. However, the post-lockdown era posed challenges, including a decline in popularity for its top game, Free Fire, and an unsuccessful expansion into non-Asian markets by its retail arm, Shopee.

Despite these setbacks, Sea Limited has made strategic adjustments. Shopee has refocused on its core Asian markets, investing in logistics, while Free Fire has regained popularity. Additionally, Sea Money, its fintech arm, continues to thrive, contributing to a 23% year-over-year revenue increase to over $7.5 billion in the first half of 2024.

While an increase in sales and marketing expenses affected net income, these investments are expected to drive long-term revenue and profit growth. Investors have responded positively to the company’s strategy, with the stock rising over 115% in the past year. With its price-to-sales ratio close to that of Amazon, Sea Limited is well-positioned for significant gains in 2025, still trading 75% below its 2021 high.

A Second Chance to Double Down on Winning Stocks

The Motley Fool Stock Advisor has delivered an outstanding average return of 781%, vastly outperforming the S&P 500’s 168% since its inception in 2002. The analyst team is adept at identifying when to double down on stocks, yielding extraordinary returns.

For example, a $1,000 investment in Nvidia in 2009 would now be worth $323,897. Similarly, investing $1,000 in Netflix in 2004 would have grown to $388,128, and $1,000 in Apple in 2008 would now be $42,905.

Currently, we’re issuing “Double Down” alerts for three exceptional companies, with opportunities like this rarely available. Don’t miss out on this chance to capitalize on these promising stocks.

See the stocks ›

Stock Advisor returns as of 10/08/2024