Contents

CrowdStrike’s Resilience Amidst Challenges

This summer saw CrowdStrike’s stock take a notable tumble, largely due to a software glitch that disrupted millions of Microsoft-connected systems globally. This incident cast a shadow over the company, raising fears about potential customer losses to eager competitors. However, the first earnings report since this debacle suggests that the company might not be in as dire a situation as initially thought.

Interest Rate Cuts: A Silver Lining

In a move that could favor growth stocks like CrowdStrike, the Federal Reserve has begun reducing the overnight lending rates for banks. This could potentially lead to further interest rate cuts, encouraging higher valuations for such stocks. If you’re not already considering it, now might be an opportune moment to add this AI-driven stock to your portfolio, especially as it trades below its peak value for the year.

Resilience of Core Technology

The CrowdStrike incident was undeniably a setback. However, it’s crucial to recognize that the problem stemmed from a software update issue, not a fundamental flaw in the company’s technology. Unlike traditional antivirus software, CrowdStrike’s cloud-based platform offers real-time protection across all of a client’s devices, leveraging advanced technologies, including artificial intelligence.

Recognized as a leader in endpoint detection and response, CrowdStrike has diversified its offerings into a comprehensive security platform, selling its protection through various modules. Its growth strategy hinges on acquiring new customers and effectively cross-selling its modules, with 65% of its customers utilizing at least five modules. Notably, 48% of customers spending $100,000 or more engage with at least eight modules.

CrowdStrike’s aggressive marketing and customer acquisition strategies are balanced by its successful cross-selling efforts, which have significantly bolstered its profits. The company converts nearly a third of its annual revenue into free cash flow, and it holds a robust financial position with approximately $4 billion in cash and $743 million in debt.

Assessing the Financial Impact

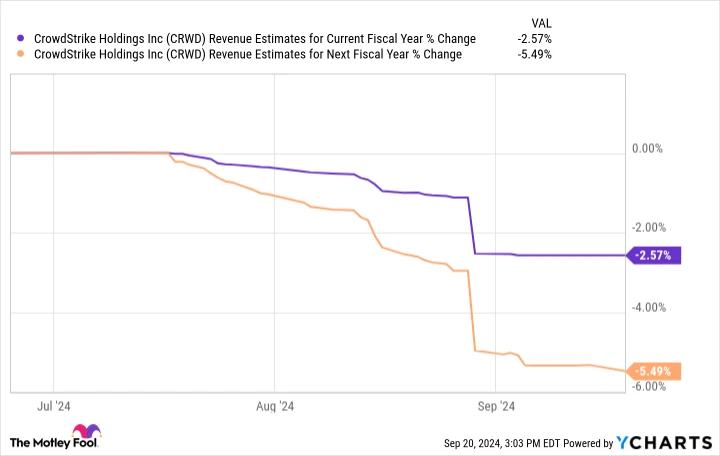

Initially, Wall Street feared a mass exodus of customers following the outage, but this hasn’t materialized as anticipated. The second-quarter earnings report was too soon to reflect any potential fallout, though management did slightly lower its revenue guidance. Analysts’ revenue estimates for the current fiscal year have dipped by only about 2.5%.

CRWD revenue estimates for current fiscal year; data by YCharts.

While software sales cycles can be lengthy, analysts do anticipate some headwinds persisting into 2025, with revenue estimates for next year decreasing by about 5.5%. Notably, SentinelOne, a key competitor, recently secured a deal with Lenovo to include its security software in new devices. This development could prompt questions about CrowdStrike’s competitive standing until it can demonstrate consistent growth post-outage. Monitoring revenue guidance in upcoming quarters will be crucial.

Valuation: A Fair Price for Quality

While future outcomes remain uncertain, current data suggests that CrowdStrike will weather this storm and maintain its status as a premier technology growth stock. Even with revised 2025 revenue projections, the company is poised for a 22% revenue increase next year.

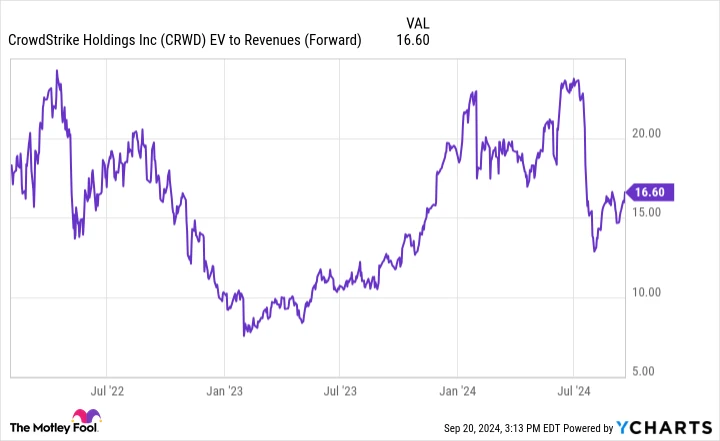

Despite recovering from its post-outage lows, the stock is still 25% below its peak, offering some relief in terms of valuation:

CRWD EV to revenue (forward); data by YCharts. EV = enterprise value.

The perennial question with high-growth, profitable firms like CrowdStrike is: What price is too steep? At the time of the outage, the stock traded at about 24 times its enterprise value to sales, positioning it among the highest-valued companies on Wall Street. While it’s not the market’s priciest stock, it remains valued at a premium compared to peers, though below companies like Nvidia and Palantir.

Given its valuation, market fluctuations or further evidence of outage-related damage could impact the stock. However, with interest rates on a downward trend, growth stocks like CrowdStrike may see a boost in valuations. Consider a dollar-cost averaging approach to investing in CrowdStrike, allowing flexibility to capitalize on potential buying opportunities.

Seizing a Second Chance

Have you ever felt like you missed out on lucrative investment opportunities? If so, pay attention. Occasionally, our team of experts identifies companies poised for significant growth, issuing a “Double Down” recommendation. If you’re worried about missing out, now is an ideal time to invest before it’s too late. The numbers speak for themselves:

– Amazon: Investing $1,000 when we doubled down in 2010 would now be worth $21,836!

– Apple: A $1,000 investment during our 2008 double down would have grown to $42,842!

– Netflix: Investing $1,000 in 2004 would be valued at an astonishing $380,400!

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and opportunities like this don’t come around often.

See 3 “Double Down” stocks

Stock Advisor returns as of 09/25/2024