Contents

The Rise and Fall of Vaccine Giants: Pfizer and Moderna

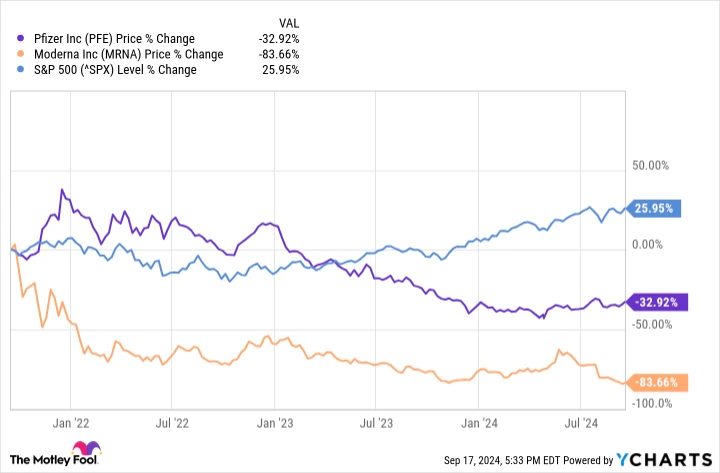

A few years ago, Pfizer and Moderna were the darlings of the stock market, thanks to their groundbreaking coronavirus vaccines. These pharmaceutical powerhouses reaped financial and stock market rewards. However, as the pandemic waned, their allure diminished for many investors, leading to underperformance in recent years. The question now is whether Pfizer and Moderna can make a comeback. The answer is a resounding yes, with the potential to deliver impressive returns to patient investors over the next decade.

Pfizer: Strategic Moves and a Promising Pipeline

Pfizer’s recent stock performance has been lackluster, yet it’s crucial to acknowledge the strategic decisions that have kept the company afloat. A significant move was spinning off its off-patent drug unit, Upjohn, which had been dragging down profits. Additionally, Pfizer’s partnership with BioNTech to develop a COVID-19 vaccine was a pivotal decision.

While Xeljanz, a key growth driver, saw reduced impact due to safety concerns, Pfizer’s coronavirus portfolio and the Upjohn spin-off provided much-needed revenue. These strategic moves are expected to continue paying dividends. In the second quarter, Pfizer’s revenue rose by 2% year over year to $13.3 billion, marking a positive shift after a period of stagnation.

Pfizer has secured several significant approvals recently and continues to develop important medications. Notably, its investigational GLP-1 weight loss drug, danuglipron, showed promising results in a mid-stage study. Additionally, positive phase 2 results for ponsegromab, a potential treatment for cancer cachexia, were reported. Cachexia, a life-threatening condition affecting millions worldwide, currently lacks FDA-approved treatments. Ponsegromab demonstrated significant increases in weight and muscle mass in patients with various cancers, with a reasonable safety profile.

With an exciting pipeline featuring 113 programs, Pfizer is poised for more approvals and label expansions in the coming years. As the negative impact of its COVID-19 lineup diminishes, Pfizer’s financial results are expected to improve, potentially delivering solid returns through 2034.

While Moderna experienced a strong start to the year, its shares recently dipped following two announcements. First, the company adjusted its break-even projection to 2028, after previously targeting 2026. Second, a reduction in R&D expenses by approximately $1.1 billion by 2027 was unveiled. The market perceived this R&D budget cut as concerning, given that robust R&D spending is crucial for vaccine developers.

Despite these challenges, Moderna has made substantial strides over the past few years. It gained approval for mRESVIA, a vaccine targeting the respiratory syncytial virus. Positive phase 3 results for a combination coronavirus/influenza vaccine were reported, a domain where Pfizer’s candidate fell short. Additionally, Moderna’s stand-alone flu vaccine for seniors excelled in a late-stage study.

Moderna remains a leader in the COVID-19 vaccine market. In the second quarter, it reported $241 million in revenue, albeit a decline of $344 million from the previous year. With the fall and winter seasons approaching, Moderna anticipates increased revenue, projecting net product sales between $3 billion and $3.5 billion for the year.

Beyond recent successes, Moderna has promising products in phase 3 studies that could earn approval within three years, including a personalized cancer vaccine and a potential cytomegalovirus vaccine. These developments demonstrate that Moderna’s success in developing a coronavirus vaccine was not a one-time feat. The stock remains attractive for long-term biotech investors.

Seize the Opportunity: A Second Chance for Lucrative Returns

Have you ever felt like you missed the chance to invest in the most successful stocks? If so, here’s your opportunity. Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies on the verge of significant growth. If you’re concerned you’ve missed your chance, now is the ideal time to invest before it’s too late. The results speak for themselves:

– Nvidia: A $1,000 investment during our 2009 recommendation would now be worth $301,443!*

– Apple: A $1,000 investment in 2008 would have grown to $42,842!*

– Netflix: A $1,000 investment in 2004 would now be valued at $380,400!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, and opportunities like these don’t come around often.

Explore 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/25/2024