Contents

Unstoppable Stocks: A Closer Look at Four Dominant Companies

In the world of investing, the concept of a “bulletproof” stock is largely a myth. However, there are a handful of companies that appear remarkably resilient. These businesses boast impressive historical total returns, strong returns on invested capital (ROIC), and consistently increasing dividends, making them seem almost impervious to the test of time.

Among these standout companies are Costco Wholesale, Cintas, Rollins, and Badger Meter. Since 2000, these stocks have delivered total returns ranging from 2,810% to 12,100%, showcasing their formidable resilience. Given their successful track record and robust business models, each of these stocks commands a price-to-earnings (P/E) ratio between 53 and 56, which is double the average of the S&P 500.

Here’s why these four stocks are worth watching, especially during a market sell-off or for strategic purchasing through dollar-cost averaging (DCA) over time.

Costco Wholesale

Imagine if you had invested $100 in Costco shares during its initial public offering (IPO) in 1985 and held onto them until today; you’d be sitting on over $150,000. Costco has rapidly ascended to become the world’s third-largest retailer, with 876 warehouses and approximately 134 million cardholding members.

Costco’s business model is focused on efficient operations, offering products and services at the lowest possible cost. This strategy generates over $4.4 billion annually in membership fees from cost-conscious consumers. By leveraging its membership model and carefully curated bulk product offerings, Costco has established a strong cost advantage, creating a protective moat around its operations.

Beyond its cost advantage, Costco enjoys a brand loyalty moat. Customers willingly pay a $65 annual fee just to shop there. This loyalty is evident in the 93% renewal rate among U.S. and Canadian members, and 90% internationally, underscoring a highly devoted customer base.

From a stock perspective, Costco’s rising ROIC of 24% suggests continued potential for outperformance. Management plans to grow its warehouse count by 3% to 4% annually for the foreseeable future. With sales, net income, and dividends increasing by 9%, 12%, and 13% annually over the past decade, Costco is expected to deliver strong earnings, as usual, on September 26. But if any shortfall occurs, it may present an opportunity to invest further.

Cintas

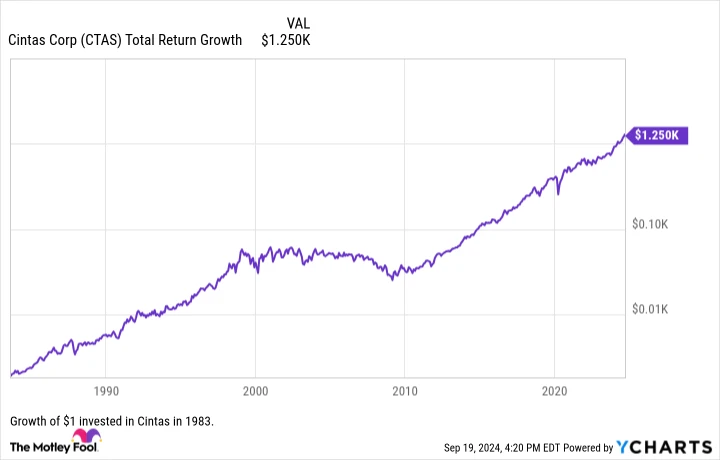

Cintas may not offer the most thrilling business operations, but its growth story is nothing short of remarkable. The company provides essential services such as uniforms, restroom supplies, floor care, first aid equipment, fire extinguishers, and safety training. Since its 1983 IPO, Cintas has become a 1,250-bagger.

Cintas has achieved sales and adjusted earnings per share (EPS) growth in 52 of the last 54 years, demonstrating its resilience. The company generates 70% of its sales from service sectors like healthcare, hospitality, and dining, and 30% from industrial sectors such as manufacturing and construction. Serving over 1 million customers, Cintas maintains a diversified customer base.

Despite its growth, Cintas believes there are still over 15 million businesses in North America that have yet to adopt its products. This leaves ample room for expansion in the fragmented industry it serves.

Over the past decade, Cintas has delivered sales, net income, and dividend growth of 9%, 19%, and 27% annually. With an ROIC of 24%, the company shows no signs of slowing down, making future dividend increases highly likely.

Rollins

Rollins may not match the astronomical figures of Cintas and Costco, but it has still outperformed the S&P 500 by more than fourfold since 1989. As North America’s largest pest control business, Rollins has proven its resilience through various economic challenges.

During the 2008 financial crisis, the industrial slowdown in 2015, and the 2020 pandemic, Rollins consistently delivered sales growth of 6%, 6%, and 12%. One reason for its success is its strategic approach to mergers and acquisitions, acquiring smaller peers in the fragmented pest control industry during tough times.

Rollins’ expertise as an integrator is evident in its impressive 30% ROIC, indicating its mastery in leveraging acquisitions for growth. Over the last 10 years, Rollins has achieved sales, net income, and dividend growth of 9%, 14%, and 15% annually, making it an attractive investment for those looking for potential price dips or DCA opportunities.

Badger Meter

Badger Meter, a leading water solutions provider, has delivered total returns exceeding 43,000% since 1972. With its innovative BlueEdge suite of solutions, Badger Meter is a key player in the $20 billion smart water industry.

While offering basic instrumentation like meters, valves, and sensors, Badger Meter’s advanced metering infrastructure is set to drive future stock performance. By providing connectivity and communication solutions to water utilities, the company is modernizing the outdated industry, enabling real-time insights and prompt action.

This real-time analysis is becoming indispensable for Badger Meter’s customers due to stricter compliance standards and a growing focus on water conservation. The burgeoning smart water industry has not only boosted the company’s sales growth but also improved profitability and ROIC, thanks to its high-margin tech-driven solutions.

In the first half of 2024, Badger Meter reported sales and EPS growth of 23% and 49%, respectively. This reinvigorated growth story offers optimism for the company’s trajectory toward becoming a Dividend King by 2043.

Investment Opportunity: A Second Chance to Double Down

The Motley Fool Stock Advisor has achieved a total average return of 762%, significantly outperforming the S&P 500’s 167% since its inception in 2002. The analyst team has a keen sense of when to double down, having re-recommended a select few stocks that later delivered remarkable returns.

Consider Nvidia: if you invested $1,000 when the team doubled down in 2009, your investment would be worth $301,443 today. Similarly, a $1,000 investment in Netflix in 2004 would have grown to $380,400, and a $1,000 investment in Apple in 2008 would now be valued at $42,842.

Currently, the team is issuing “Double Down” alerts for three exceptional companies, presenting a rare opportunity that may not come again soon.

See the stocks ›

*Stock Advisor returns as of 09/25/2024