Contents

The Critical Role of Social Security in American Retirement

For many Americans, Social Security is indispensable for financial security during retirement. Over the past 23 years, Gallup’s annual surveys have consistently demonstrated that 80% to 90% of retirees rely on Social Security as a significant income source. In 2024, a striking 88% of respondents affirmed this reliance, underscoring the program’s importance in covering essential expenses.

Given its critical role, retirees eagerly anticipate the announcement of Social Security’s annual cost-of-living adjustment (COLA). As of October 10, this much-anticipated announcement is just weeks away. However, expectations for a record-setting COLA in 2025 are dwindling.

Understanding Social Security’s Cost-of-Living Adjustment (COLA)

What is COLA and Why is it Important?

In an ideal scenario, prices would remain stable over time. However, the real world sees constant fluctuations, often with rising costs. The Social Security Administration (SSA) uses COLA to help retirees maintain their purchasing power despite these changes. For example, if the cost of goods and services increases by 4% over a year, Social Security payments ideally should rise by the same percentage to help beneficiaries keep up with inflation.

For the first 35 years after the Social Security program began, there was no standardized method for adjusting benefits to inflation. Instead, Congress sporadically approved adjustments, resulting in 11 changes between 1940 and 1974, with no adjustments at all during the 1940s.

In 1975, the process was modernized with the introduction of the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) as the basis for COLA calculations. The CPI-W covers eight major spending categories, each with various subcategories and specific weightings, allowing it to be expressed as a single figure. This simplifies the year-over-year comparison needed to determine inflation or deflation.

The Bureau of Labor Statistics (BLS) releases monthly CPI-W data, but only the trailing 12-month (TTM) readings for the third quarter (July through September) are used to calculate Social Security’s annual COLA. A higher average CPI-W reading in the current year compared to the previous year indicates inflation, which leads to increased benefits.

How COLA is Calculated

Calculating the COLA is straightforward. The percentage difference in the average third-quarter CPI-W readings from one year to the next, rounded to the nearest tenth of a percent, determines the following year’s COLA.

The Impact of Inflation on Recent COLAs

Expectation vs. Reality for 2025 COLA

Since 2010, COLAs have generally been modest. In fact, there were three years (2010, 2011, and 2016) when deflation resulted in no COLA, and the smallest positive adjustment on record was just 0.3% in 2017.

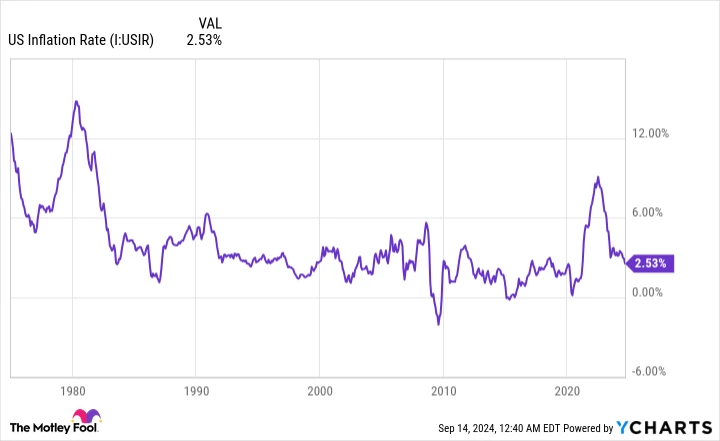

However, starting in 2022, the trend shifted. Due to a significant increase in the U.S. money supply during the pandemic, inflation soared, and so did the COLA. Beneficiaries saw increases of 5.9% in 2022, 8.7% in 2023, and 3.2% in 2024. The 8.7% adjustment in 2023 was the largest in four decades.

Hopes were high for another historic COLA in 2025. It’s been over three decades since four consecutive COLAs exceeded 2.7%, and nearly three decades since they surpassed 2.6% consecutively. Following the July inflation report, predictions indicated a 2.57% COLA for 2025, which would round up to 2.6%.

Yet, the August inflation report brought a different reality. With inflation cooling, both The Senior Citizens League and independent analyst Mary Johnson revised their 2025 COLA forecasts downward to 2.5%. This would be the smallest adjustment in four years and slightly below the two-decade average of 2.6%.

Financial Implications of a 2.5% COLA

For approximately 51.3 million beneficiaries, a 2.5% COLA would mean an average monthly increase of $48.01. For the nearly 7.3 million workers with disabilities and approximately 5.8 million survivor beneficiaries, average monthly checks would rise by $38.50 and $37.73, respectively.

Challenges Await Retirees in 2025

The Double-Whammy of Inflation and Healthcare Costs

Retirees may face more than just a modest COLA in 2025. The CPI-W, while tracking a broad range of goods and services, does not accurately reflect the spending habits of seniors. Retirees typically allocate a larger portion of their budget to shelter and medical care than working-age Americans, which the CPI-W does not fully account for.

In August, the inflation rates for shelter and medical care were 5.2% and 3.2%, respectively, highlighting a mismatch between expected COLA and actual cost increases. This discrepancy suggests a continued decline in the purchasing power of Social Security dollars.

Exacerbating the situation, the Medicare Trustees Report forecasts a 5.9% increase in monthly Part B premiums to $185 next year. This hike could offset the modest COLA for many beneficiaries, particularly those 65 and older, as these premiums are often deducted from Social Security checks.

While the situation may change slightly in the coming weeks, it appears that retirees will face a challenging financial landscape in 2025, with reduced buying power and rising healthcare costs.

Maximizing Social Security Benefits

With many Americans behind on retirement savings, understanding strategies to maximize Social Security benefits can be crucial. For instance, certain lesser-known tactics could significantly boost retirement income. Learning how to optimize these benefits could lead to a more secure and confident retirement.

Discover these “Social Security secrets” ›