Contents

Ally Financial: The All-Digital Bank on Investors’ Radar

Ally Financial, a prominent name in the all-digital banking sector, has carved out a niche for itself with its competitive fees and attractive savings rates. As a part of Warren Buffett’s portfolio, it naturally draws the attention of investors. However, recent events have sparked debate: Is the current downturn a signal to steer clear, or a chance to invest at a lower price?

The Evolution of Ally

Ally’s journey began in auto lending as General Motors’ financial arm. It transitioned to an independent entity in 2009 and went public in 2014. While auto loans remain a cornerstone of its operations, solidifying its status as a leading prime lender, Ally has diversified into consumer lending. Despite a challenging economic landscape, it maintains a strong application volume. The company has proactively increased its loss provisions and tightened underwriting to navigate potential risks and delinquencies.

Banking, inherently cyclical, faces challenges during periods of high interest rates. These conditions can spur defaults, reduce lending activity, and increase deposit costs. Despite these hurdles, Ally’s stock had been on an upward trend, reflecting its adaptability and consumer appeal. It combines a century-old legacy with a modern digital platform—a combination that caught Buffett’s eye in early 2022 when the stock was undervalued. Since then, its valuation has climbed, yet recent developments have impacted its trajectory.

Short-term Setback or Enduring Issue?

Ally’s recent financial update was less than encouraging. During a presentation at the Barclays conference, CFO Russ Hutchinson highlighted unexpected challenges, including a rise in auto delinquencies in July and August. Charge-off rates exceeded expectations, with potential for further expansion as inflation continues to strain customers. Despite credit card rates aligning with forecasts, the news led to a 17% drop in Ally’s stock price.

The high interest rate environment and increased default rates are straining banks, but Ally’s inability to foresee these issues raises concerns about its credit assessment processes. While other major banks have yet to report their third-quarter earnings, Ally’s situation could hint at broader industry trends.

Attractive Valuation and Dividend Potential

Warren Buffett is typically selective, favoring companies with strong fundamentals. While not infallible, his investment choices often hinge on effective management—a crucial element of his strategy. Ally recently appointed Michael Rhodes as CEO, a leader initially set to helm Discover Financial Services. Such changes are noteworthy, though they rarely unsettle established banks.

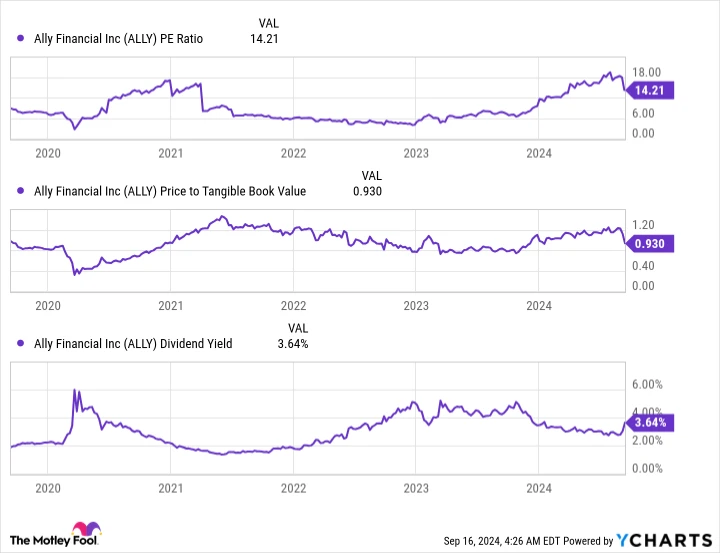

Despite the leadership transition, Ally retains the qualities Buffett values: a strong consumer presence, economic relevance, affordability, and a growing dividend. Its valuation, once dirt cheap, had risen to reasonable levels but is now attractively low again. The dividend yield, too, has climbed, making the stock appealing to long-term investors seeking dividend income.

A Second Chance for Investors

Have you ever felt you missed out on investing in top-performing stocks? There are rare moments when our expert analysts issue a “Double Down” recommendation for stocks they predict will soar. If you fear you’ve missed the chance, now might be the perfect time to invest before opportunities slip away. Consider these past successes:

– Nvidia: A $1,000 investment in 2009 when we doubled down would now be worth $293,950!*

– Apple: A $1,000 investment in 2008 during our recommendation would now be $41,749!*

– Netflix: A $1,000 investment in 2004 at our advice would now be $372,365!*

Currently, we’re releasing “Double Down” alerts for three exceptional companies. Opportunities like this are rare, so don’t let them pass you by.

Explore 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/19/2024