Semiconductor stocks have emerged as a successful trend in the surge of artificial intelligence (AI) stocks. Leading chip manufacturers Nvidia ( NVDA 1.42% ) and Broadcom ( AVGO -0.14% ) did so well that management decided to split their stocks in order to make it more accessible for investors and company employees to buy or sell shares.

Keep in mind that stock splits reduce the price of individual shares, but this is balanced out by an increase in the total number of shares available. stock splits do not fundamentally alter a stock’s value. Nevertheless, a sell-off, similar to the one investors recently observed in the Nasdaq , can.

Although the market has recovered, these two (AI) the successful stocks are still below their peak values. If the Nasdaq keeps declining, these stocks could be great purchases for long-term investors. Here’s the reason.

A sell-off provides a crucial cushion for Nvidia stock.

Nvidia has experienced unparalleled success in the realm of AI, largely due to its graphics processing units (GPUs) becoming the top preference for data centers that operate intricate AI models. Its exclusive CUDA software enables customers to fully utilize the potential of its GPU chips, making them ideal for AI applications.

Leading figures in the technology sector are competing to develop the computational infrastructure necessary for the advancement of AI. This intense demand propelled Nvidia’s revenue to unprecedented levels beginning in 2023.

The major players in AI and cloud computing plan to continue their investments. Microsoft said in its most recent financial results discussion the demand for AI exceeded the computing resources that were available. Meta Platforms In a recent “fireside chat” with Nvidia CEO Jensen Huang, Mark Zuckerberg revealed that his company has acquired close to 600,000 of Nvidia’s H100 chips and plans to invest further in the coming year to enhance AI capabilities.

The head of a company that competes with Nvidia AMD (Advanced Micro Devices) predicts that the overall AI chip industry will expand to $400 billion in the coming years. Currently, Nvidia, which is the leading company in this sector, only accounts for a small portion of that amount. Indications suggest continuous demand, and Nvidia aims to safeguard its market position by regularly launching state-of-the-art processors to stay up-to-date with advancements.

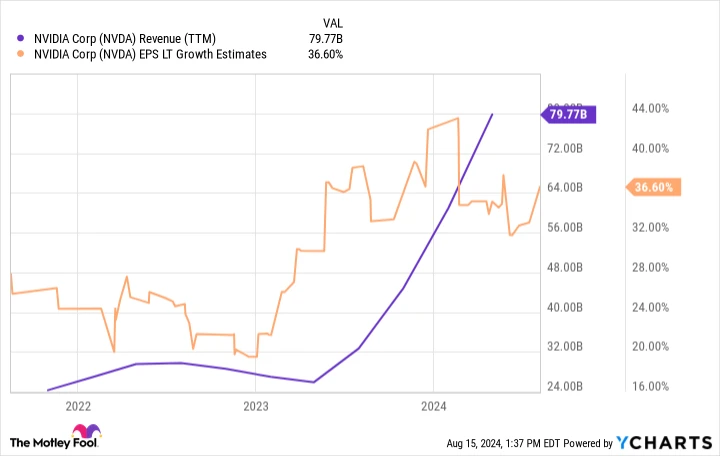

It’s unlikely that revenue will keep increasing at a triple-digit rate, but experts predict that Nvidia’s earnings will increase by 36% each year over the long run.

NVDA’s revenue over the trailing twelve months (TTM) data by YCharts; TTM stands for the past 12 months; EPS refers to earnings per share.

If Nvidia meets its predicted performance, the stock appears to be a good deal right now at a anticipated price-to-earnings ratio (P/E) With a ratio of 44, which is appealing for a rapidly expanding company, the business is likely to encounter competition from other semiconductor manufacturers and major technology clients who might attempt to develop their own chips.

While the stock might seem inexpensive in retrospect if everything goes smoothly, investors should embrace any downturn that contributes to a buffer zone to consider the uncertainties.

A volatile market presents Broadcom as a chance to purchase during a price drop.

Broadcom has proven to be a great choice for AI investors seeking to diversify their portfolios. The company focuses on semiconductors for networking and communications and also operates a business unit that offers infrastructure software to businesses. Approximately two-thirds of its total revenue comes from semiconductor solutions, while the remaining one-third is generated from its infrastructure software division.

Stocks in the semiconductor industry tend to follow a cyclical pattern. AI has led to a surge in spending on chips, though this is expected to decelerate eventually as AI capabilities begin to meet the current demand. While Broadcom isn’t expanding at the same pace as Nvidia, its software division produces recurring revenue, which could potentially make the company more stable in the long run.

Broadcom is experiencing significant momentum from AI advancements; while AI models demand high-performance processing chips, they also generate substantial networking loads that necessitate AI-specific hardware. Initially, the company predicted that AI would account for 25% of its semiconductor solutions revenue in 2024 but revised this estimate to 35% during the second quarter.

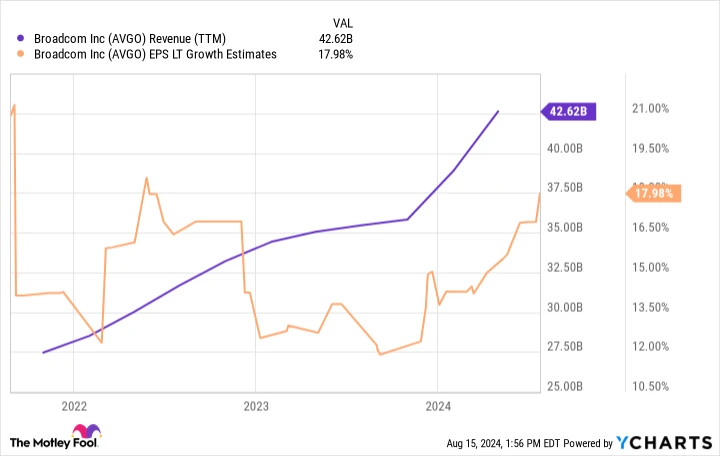

Meanwhile, incorporating VMware into the software industry contributed to a 43% increase in Broadcom’s total revenue compared to the previous year in the second quarter. Even without considering the acquisition, organic revenue growth was 12%. While this isn’t extremely rapid, analysts predict that the company will achieve an 18% annual growth in earnings over the long term, which is quite significant.

Trailing twelve months (TTM) revenue for AVGO data by YCharts.

Broadcom stands out as a great dividend stock, distinguishing itself from the majority of AI investments. While the initial yield is modest at 1.3%, the company has impressively increased its dividend by an average of 19% each year over the last five years.

The stock provides investors with a variety of benefits, including potential gains from AI, dividends, and a diversified business model that might perform well during a market downturn. Currently, shares are trading at a forward P/E ratio of 33, which is neither alarmingly high nor particularly low. Investors can feel secure in purchasing and retaining Broadcom shares even if the Nasdaq experiences a sell-off and brings the stock price down.

Think about this before purchasing Nvidia stock:

The Jester of Finance Stock Advisor team of analysts has just pinpointed what they consider to be the 10 best stocks for investors to purchase at the moment… and Nvidia wasn’t included. The ten stocks that were selected have the potential to yield substantial returns in the upcoming years.

Consider when Nvidia created this list onOn April 15, 2005, if you had put $1,000 into the investment we suggested, you would possess $779,735 !*

It’s important to mention Stock Advisor the overall average yield is762% — an exceptional market outperformance when compared to 164% for the S&P 500. Make sure to catch the newest top 10 list.

*Performance of Stock Advisor as of August 12, 2024