Chevron ( CVX 0.19% ) Chevron is quite appealing as an energy investment, particularly due to its dividend, which has been raised every year for the past 37 years and currently offers a substantial 4.4% yield. With the stock trading over 20% below its recent peak, is it a good time to invest in Chevron? Consider these key points before deciding.

Chevron is involved in various aspects of the energy sector. They explore for and produce oil and natural gas, refine these resources into usable fuels and products, and distribute and market them to consumers. Additionally, they invest in renewable energy technologies and work on initiatives to improve energy efficiency and reduce emissions.

The headline is misleading because Chevron essentially does. everything and this is the reason it is considered an integrated energy The company is involved in various areas of the energy industry. Specifically, it engages in upstream activities, which involve energy production. It also operates in the midstream sector, focusing on pipelines, transportation, and storage infrastructure. Additionally, the company has a presence in the downstream sector, dealing with chemicals and refining processes. Each of these segments functions uniquely and experiences distinct market dynamics.

Combining upstream, midstream, and downstream operations within a single company not only results in a diversified entity but also benefits from Chevron’s international presence, which can help mitigate the fluctuations of the energy cycle. While commodity prices significantly influence Chevron’s financial performance, the impact of these inherent fluctuations is less severe than if the company were only concentrated on upstream activities.

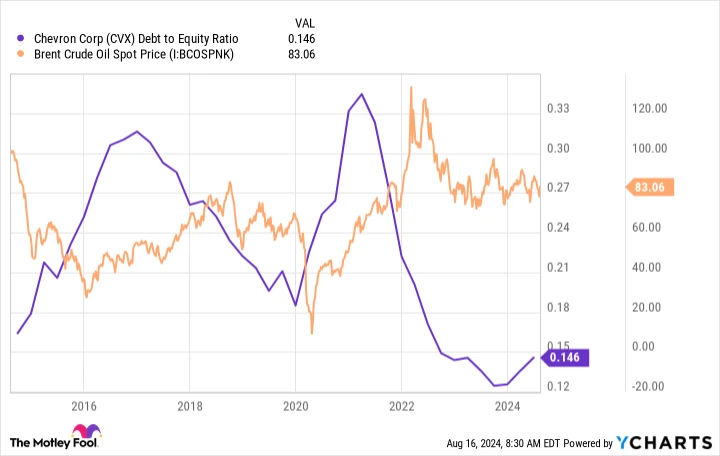

Chevron is highly concentrated on the robustness of its balance sheet Chevron’s debt-to-equity ratio currently stands at a very small 0.15. This is considered low for any company, and it’s the lowest when compared to Chevron’s nearest competitors. This low ratio allows Chevron more flexibility to increase its borrowing to sustain its operations and dividends during the unavoidable downturns in the oil market. In essence, investing in Chevron is a cautious approach to participating in the energy industry.

The Debt to Equity Ratio for CVX data by YCharts

Should you consider buying Chevron if its price drops below $150?

Chevron’s stock has fallen to below $150 today, marking a decrease of about 20% from its recent high of approximately $188 per share in late 2022. This drop might be considered a good opportunity for investors who focus on dividend-paying stocks for those looking to incorporate energy investments into their portfolios, highlighting the appealing 4.4% yield of the stock. Ultimately, the S&P 500 index is generating a return of approximately 1.2%, while the typical energy stock, employing The Energy Select Sector SPDR Exchange Traded Fund serving as a stand-in, is producing approximately 3.1%.

Considering Chevron’s solid financial standing, diverse business operations, and extensive history of enduring energy market declines while consistently rewarding investors with regular dividend hikes, it’s clear that a cautious investor would be making a prudent decision by purchasing the stock if they are currently seeking an energy investment.

However, there’s an issue: Oil prices are currently quite elevated. While they have reached higher levels in the past, they have also dropped significantly lower. Considering the characteristics of the oil industry, it is very probable that Chevron will face significantly reduced energy prices sometime soon.

Chevron is prepared, highlighting its minimal debt-to-equity ratio, but this doesn’t alter the reality that revenue and earnings decrease when energy prices drop. Consequently, this will prompt investors to sell the stock.

In the last ten years, Chevron’s stock price has fallen below $80 per share on three occasions. During this time, the dividend yield has climbed to as high as 9% at one stage, which was an unusual spike linked to the coronavirus pandemic. However, a 6% yield is not unusual, as it has also been achieved three times.

It wouldn’t be surprising to witness a significant decline in oil prices that results in a substantial drop in Chevron’s stock value, subsequently increasing the yield to more appealing levels. In other words, if you’re aiming to purchase Chevron at a discounted rate, it’s wise to hold off until the next major dip in the oil market.

Chevron is a reputable company.

For investors who prioritize income and are looking at the long term, Chevron might be a smart option at the moment. While you might not be purchasing it at the lowest price available, acquiring the stock for under $150 is likely a reasonable decision.

If you’re patient and observant, it’s likely that you’ll be able to purchase it at a more favorable price later on, considering the natural fluctuations within the energy sector. The important thing is to familiarize yourself with the company now and develop a solid strategy for when you plan to make the purchase, such as when the yield reaches 6%.

The ideal moment to purchase Chevron is probably when the apprehension about holding its stock is at its peak. Without careful planning, this fear could cause you to overlook the chance.