Plug Power ‘s ( PLUG 2.11% ) Hydrogen fuel cell technologies have the potential to introduce a fresh, eco-friendly, and sustainable energy source. Some predictions suggest that the green hydrogen energy sector might expand to reach $30 billion by 2030, indicating a significant long-term opportunity for Plug Power.

Despite being a prominent player in the hydrogen energy sector, the company has faced significant challenges in recent years. In 2021, the stock reached a high of approximately $75 per share, but it has since dropped by 97%.

Plug Power, with a share price below $2.50, might seem like a bargain, but there are a few important details to consider before investing in this energy company.

Contents

The long-term potential of green hydrogen is enormous.

Plug Power is a leading company in the hydrogen the energy sector and was among the pioneers in establishing a commercially successful market for its hydrogen fuel cell technology. This technology generates electricity by combining hydrogen and oxygen, eliminating the need for combustion. It is utilized in equipment such as material-handling vehicles (like forklifts), stationary power stations (such as generators), and electric delivery vans. Some of its major clients include Amazon and Walmart .

The company is striving to create a comprehensive hydrogen ecosystem that encompasses the production, storage, transportation, and distribution of liquid green hydrogen. Earlier this year, it started producing liquid hydrogen at its facility in Georgia.

Plug Power aims to take advantage of a significant long-term growth potential. According to a recent report from Markets and Markets Research, the green hydrogen market could reach a value of $30.6 billion by 2030. This implies an impressive compound annual growth rate of 61% in the coming years.

Plug Power is still losing money.

Despite the enormous long-term market potential for green hydrogen, Plug Power faces substantial financial challenges, consistently experiencing annual losses. Even after being publicly traded for 25 years, the company has yet to achieve a full-year net profit.

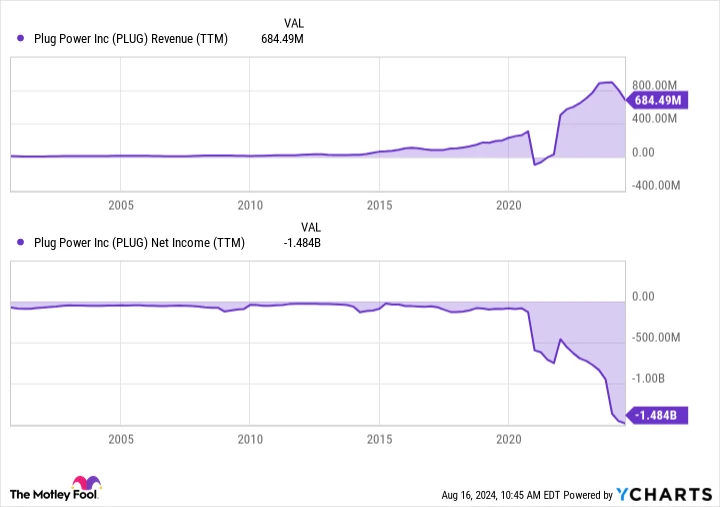

PLUG’s Revenue (Trailing Twelve Months) data by YCharts.

Moreover, even though the company has seen an increase in revenue, its losses have also expanded. In the last year, Plug Power generated $684 million in revenue but suffered a massive loss of $1.5 billion.

This raises another question for investors: If Plug Power isn’t profitable, how is it managing to stay operational? The main reason is through reduction in ownership percentage for shareholders Plug Power has regularly relied on equity markets to secure funding for its operations.

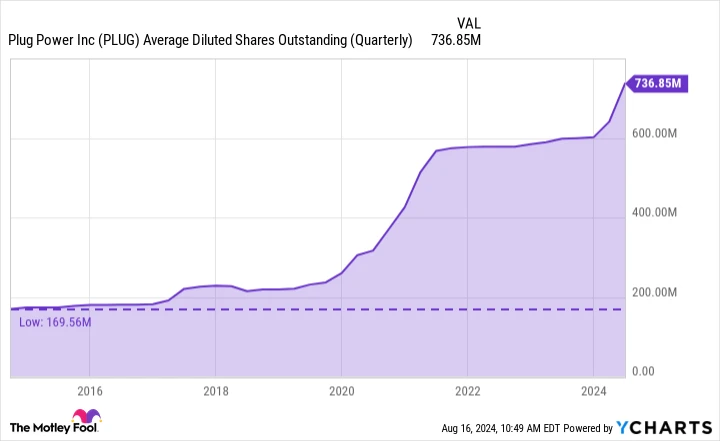

Over the past ten years, the average number of diluted shares for Plug Power has increased from 170 million to 737 million. This means that due to dilution, each share now represents less than a quarter of its initial value.

PLUG Quarterly Average of Diluted Shares Outstanding data by YCharts.

What are the future plans for Plug Power?

To make Plug Power a more attractive investment option, the company needs to become profitable. Unfortunately, its recent earnings report doesn’t indicate an imminent recovery. In the second quarter, the company’s revenue was $143 million, significantly lower than the $185 million analysts had anticipated.

Additionally, the company forecasts its 2024 revenue to be between $825 million and $925 million, with the middle point of this range falling short of the consensus estimate of $908 million.

The company is implementing measures to decrease its cash outflow, enhance its profit margins, and strengthen its financial standing. In the second quarter, the company cut down its net cash spent on operations and capital expenditures by 30% and plans to keep reducing expenses in the latter half of the year.

The company has appointed Dean Fullerton as its new Chief Operating Officer (COO) to assist with these projects. Fullerton previously worked at Amazon, managing engineering services for the e-commerce leader throughout North America, Europe, and developing businesses. Plug Power is optimistic that Fullerton’s experience will be beneficial to its efforts. enhance its operational effectiveness throughout its entire supply network.

Is it a buy?

Plug Power has a strategy set, and investors should closely monitor its earnings and the advice from management in the upcoming quarters. Although the company is still spending a lot of cash, it is making promising statements about improving efficiency, reducing cash expenditure, and focusing on increasing the profitability of its operations.

Despite its potential in the green hydrogen sector, this company has never been profitable and has considerably diluted its shareholders. Therefore, although the long-term prospects for green hydrogen are immense, I would like to see Plug Power improve its margins and financial performance significantly before I contemplate investing in this green energy firm.