AMD (Advanced Micro Devices) ( AMD 1.18% ) has not experienced the rapid growth that chip stocks such as Nvidia have; however, that doesn’t imply it hasn’t participated in the AI surge. The stock of this multifaceted chip expert, primarily recognized for its PC CPUs, has increased by 141% since the beginning of 2023.

In the past few weeks, several positive news stories have emerged for AMD, such as an impressive earnings report for the second quarter. Additionally, another supporter from Wall Street is now backing the stock.

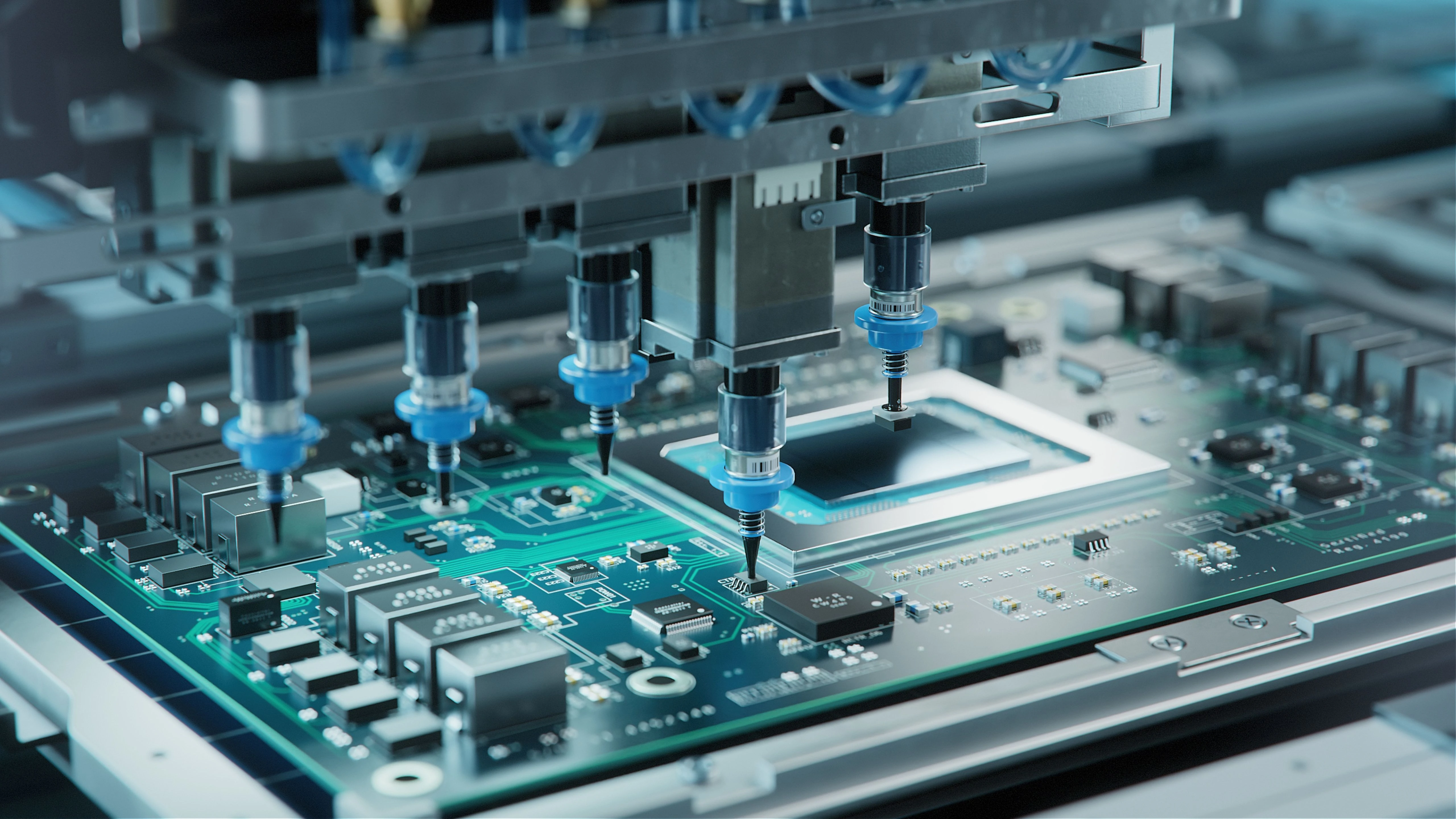

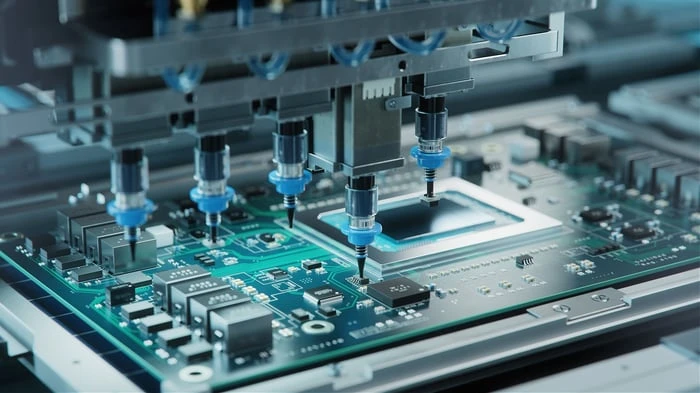

Photo credit: Getty Images.

Edward Jones recommends purchasing AMD stock.

Edward Jones, a financial services company, released a report starting their examination of AMD by giving it a buy rating. They also added AMD shares to their “focus list,” signifying a top-tier status.

Edward Jones anticipated that AMD would achieve “exceptional growth” in the data center infrastructure sector, following a quarter where sales in this segment more than doubled. This prediction is supported by the strong demand, as evidenced by Nvidia’s impressive results.

Following its acquisition of Xilinx in 2022, it also has the chance to offer new products to the embedded segment as cross-sell opportunities.

Is purchasing AMD shares at $155 a good decision?

Alongside its impressive earnings report released at the end of July, AMD has gained an advantage from the downfall of a competitor. Intel Nvidia’s postponement of its latest Blackwell platform, combined with the recent $4.9 billion purchase of ZT System, a company that specializes in creating and producing systems for AI infrastructure.

AMD is rapidly taking steps to seize the AI opportunities available, gaining increasing support in the process. Wall Street Although it may take a while for profits to increase significantly, the stock has considerable potential for growth, particularly due to its progress in the data center sector. In my opinion, it’s a good purchase at the moment.