The The Disney Corporation ( DIS 0.54% ) The company was established in 1923 but remained private until 1957 when it was listed on the New York Stock Exchange with an initial share price of $13.88. Since that time, its stock has increased by 4,500%, driven by steady growth in earnings.

In recent years, the entertainment giant has faced a series of challenges.

Data by YCharts.

The chart above illustrates Disney’s stock generally rising steadily until the pandemic struck in 2020, leading to the closure of parks and theaters, which significantly impacted its operations. The company experienced a brief surge in 2021 as investors supported its newly launched streaming service expansion. Nonetheless, Disney’s share price has dropped by 50% since its peak in the spring of 2021.

The challenges of the pandemic, along with costly efforts to enter the streaming market, caused investors to retreat, a setback that took Disney years to recover from. However, recent financial results indicate that there is finally hope on the horizon and a recovery is in progress.

Consequently, following significant drops, Disney’s stock seems to be undervalued. Therefore, it has turned into a growth stock, currently reduced by 50%, making it a good purchase opportunity.

Following a more consistent and reliable growth path compared to its competitors

On August 7, Disney released its earnings report for the third quarter of 2024. The company saw a 4% increase in revenue compared to the previous year, reaching $23 billion, which surpassed Wall Street expectations by $70 million. Additionally, earnings per share were $1.39, exceeding predictions by $0.20. The quarter also showed notable growth in operating income, which climbed 19% from the previous year to exceed $4 billion.

The increase in profits was primarily attributed to the expansion of Disney’s entertainment division, where operating income almost tripled following a significant succeed in streaming In the third quarter of 2024, the company’s streaming division, which encompasses revenue from Disney+, ESPN+, and Hulu, achieved profitability for the first time, reaching this milestone a quarter earlier than anticipated.

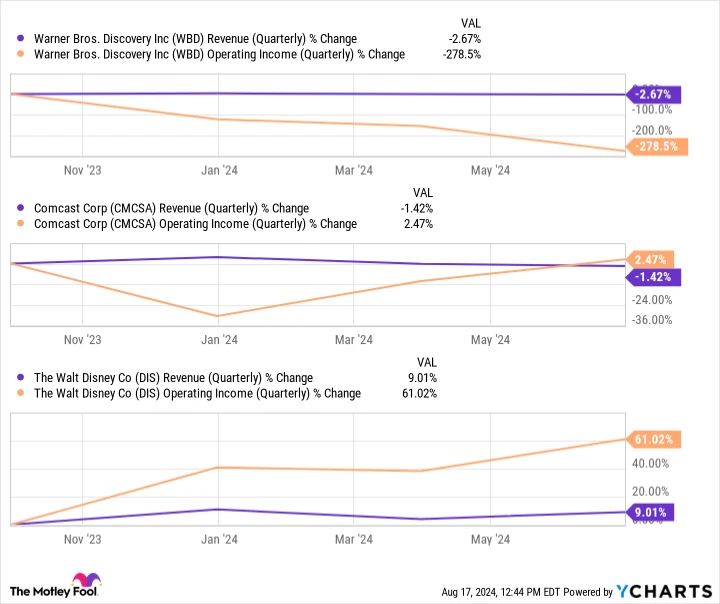

Data by YCharts.

Entering the streaming industry is known to be both difficult and expensive. The chart above illustrates the revenue growth of several of the leading entertainment corporations . Warner Bros. Discovery is a media and entertainment company. and Comcast have shown considerably less financial growth over the past year compared to Disney. Although numerous factors contribute to this, it is fairly well-known that these companies have encountered ongoing challenges in their efforts to expand into streaming.

At the same time, Disney’s strong rebound after the global pandemic and the following economic slump demonstrates its resilience and capability to effectively handle challenging market situations. A recent achievement in the streaming sector further highlights the strength of the Disney brand, as it has managed to keep its subscriber base intact.

Disney’s stock is a good deal considering its potential.

Disney has had numerous successes this year. Besides achieving profitability in their streaming services, they are the sole film studio to surpass $1 billion in box office earnings in 2024. Remarkably, Disney has reached this milestone twice, with Inside Out 2 which came out in June, and Deadpool and Wolverine , which was first introduced in July.

The achievements of this year’s Deadpool third installment has renewed interest in Disney’s Marvel Cinematic Universe, which had previously waned among audiences due to several underwhelming releases. Nonetheless, the successful box-office hit has generated excitement for the upcoming Marvel films set for release in 2025, such as the Daredevil: Reborn a show for Disney+ and The Fantastic 4: Initial Steps movie, set to premiere in July of next year.

Disney’s recent quarterly earnings and an impressive content plan have positioned the company on a promising trajectory for growth. In the third quarter of 2024, there was a slight decrease in the parks division, with operating income from experiences totaling $2 billion, a 3% decline compared to the previous year.

Park revenues frequently fluctuate in response to the state of the economy and consumer spending capacity, which has been unpredictable in recent years. On the other hand, the expansion of streaming services continues to be a strong incentive to invest in Disney, as it diversifies the company’s operations and reduces its reliance on theme parks.

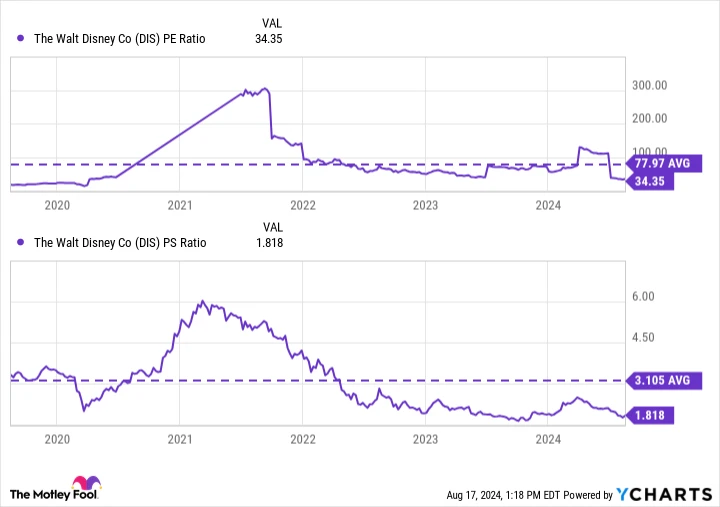

Data by YCharts.

Additionally, this chart indicates that Disney’s stock might currently be trading at one of its most favorable values in recent years, with its The ratio of a company’s current share price to its earnings per share (EPS) and The ratio of price to sales (P/S) beneath their averages for the past five years.

Disney’s business has faced multiple challenges since 2019, which occasionally increased its P/E and P/S ratios. Despite this, recent strong quarterly performances and a market sell-off in the past few years have made Disney’s current valuation appear attractive relative to its potential. As the company is now in recovery mode, this could be an ideal opportunity to invest in the dip. this popular high-growth stock .

Before purchasing Walt Disney stock, think about the following:

The Motley Fool is a company that provides financial advice and investment services. Stock Advisor The analyst team has just pinpointed what they consider to be the 10 best stocks for investors to purchase at this moment… and Walt Disney wasn’t part of that group. The 10 selected stocks have the potential to generate significant returns in the upcoming years.

Consider when Nvidia created this list onOn April 15, 2005, if you had put $1,000 into the investment we suggested, you would possess $779,735 !*

It’s important to mention Stock Advisor the overall average return is762% — a performance that significantly surpasses the market in comparison to 164% for the S&P 500. Be sure to check out the most recent list of the top 10.

*Stock Advisor performance as of August 12, 2024