Shares of TI ( TXN 3.42% ) A manufacturer of analog and embedded chips saw its stock rise by up to 4.1% on Wednesday, though it later decreased to a 3% gain by 12:18 p.m. ET. Despite this pullback, the gain remained significantly higher than that of the overall semiconductor industry, where the iShares Semiconductor Exchange-Traded Fund ( SOXX 1.45% ) increased by just 0.7% at that point.

On Tuesday, Texas Instruments provided a midyear update regarding its long-term investment plans, an event that typically occurs just once annually. However, due to the analog chip industry experiencing one of its most severe downturns ever, the company adjusted its strategy by decreasing the lower limit of its previously announced spending plan from 2022.

A heightened period of investment occurring at the most inopportune moment

Following the supply chain shortages of 2021, Texas Instruments initiated a long-term investment strategy aimed at boosting its capital investments over a period of four years, reaching approximately $5 billion annually from 2023 to 2026. The plan aimed to invest in U.S. facilities for essential semiconductors used in various industrial and automotive applications, with the goal of reducing the cost per chip.

The company has strategically decided to focus on industrial and automotive applications, which made up 75% of its revenue in 2023, compared to only 40% in 2014.

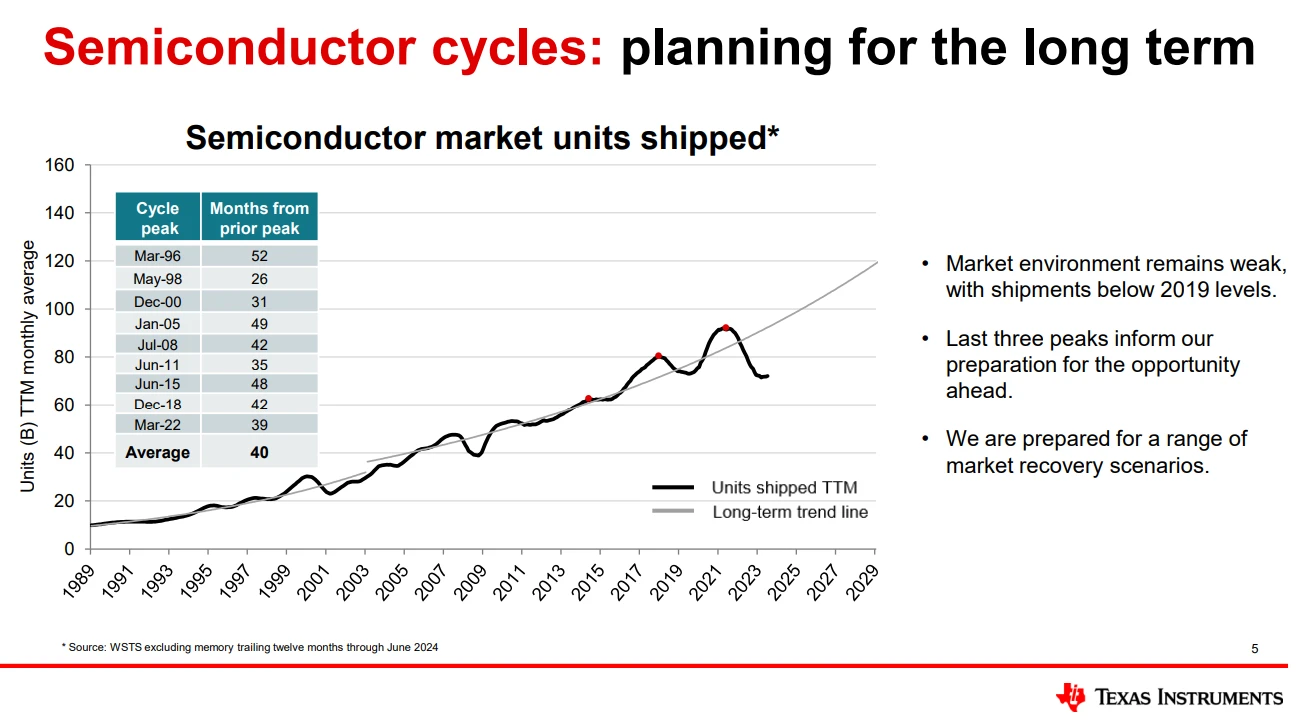

The issue is that Texas Instruments developed these long-term strategies during a period in 2022 when the demand for industrial and automotive chips was soaring due to shortages. However, currently, these markets are experiencing one of their most severe downturns in history.

The company actually mentioned that current demand for units is even weaker than it was in 2019, which marked the last downturn. It’s unusual for a cyclical low point in the chip industry to dip below the previous one.

Image credit: Texas Instruments.

The company’s position has been affected by low demand coupled with excessive expenditures. free cash flow currently almost at zero, a stark difference from the billions in cash flow that investors are accustomed to witnessing each quarter.

Management appeared to finally recognize that its markets might not be as strong as previously believed. In an unusual midyear update to its long-term planning, typically conducted only once annually, management kept its spending plans for 2024 and 2025 the same. However, they reduced their projected spending for 2026 to between $2 billion and $5 billion, down from $5 billion, contingent on the revenue generated at that time.

It seems that recognizing the state of the market and reducing expenditures is boosting investor confidence today.

Texas Instruments has unexpectedly reached its highest levels ever.

The company has fallen behind in the semiconductor market because it hasn’t kept up with AI trends, yet its stock is close to reaching its highest value ever.

This might appear to contradict common sense, considering the significant recession we’re currently experiencing. However, chip stocks often interestingly shift in anticipation of cycles, rather than during them.

The company has also revised its projections for free cash flow per share in different recovery scenarios for 2026, estimating it to be between $8 and $12. Texas Instruments has a strong history of increasing cash flow and dividends, which makes it a solid long-term investment. However, with the shares currently priced at $208, which is approximately 20 times the midpoint of the projected 2026 recovery scenario, the stock seems more suitable for holding rather than buying at this time.

Is it a good idea to invest $1,000 in Texas Instruments at this time?

Prior to purchasing shares in TI take this into account:

The Motley Fool is a financial services company that provides investment advice and stock market analysis. Stock Advisor the analyst team has just pinpointed what they consider to be the 10 best stocks for investors to purchase at this time… and TI (Texas Instruments) was not among them. The 10 stocks that were selected have the potential to yield significant returns in the years ahead.

Consider when Nvidia created this list onIf you had invested $1,000 on April 15, 2005, when we suggested it, you would possess $779,735 !*

It’s important to mention Stock Advisor has an overall average return of762% — a performance that significantly surpasses the market when compared to 164% for the S&P 500. Make sure to check out the newest top 10 list.

*Returns from Stock Advisor as of August 12, 2024