If you have been involved in investing for a significant amount of time, it is highly likely that you have thought about acquiring a share in. Amazon ( AMZN 0.37% ) It is highly regarded by Wall Street analysts and Amazon stock has proven to be a reliable investment option that continues to receive positive recommendations.

Looking at the balance between risk and reward, Amazon no longer offers the same level of opportunity as it did when it was a young company. Due to its significant size, it is challenging for Amazon to sustain rapid growth. Moreover, other e-commerce rivals are improving their strategies. Additionally, it can be said that Amazon’s stock is currently valued close to its maximum potential. It may be advisable to consider prioritizing other companies over Amazon in your investment watch list.

Here are three improved options to consider purchasing at this time.

Contents

DraftKings

Shareholders of the sports betting technology company have faced a challenging period in the last few months. DraftKings ( DKNG 1.13% ) Due to a decrease in revenue and a potential additional charge for customers’ bets, the stock has dropped by over 30% since reaching its peak in March. It is currently close to the lowest point it has reached in the past few weeks. Investors are reacting to these developments. reacting to news titles .

However, these concerns overshadow the reality that DraftKings is experiencing significant growth and steadily moving closer to achieving long-term profitability.

For instance, consider the financial results for the second quarter. Although the revenue of slightly over $1.1 billion was slightly below the expected amount of just over $1.11 billion, there was still a 26% increase in sales compared to the previous year. The adjusted earnings per share of $0.22 not only exceeded the anticipated loss of $0.01, but also nearly doubled the $0.14 from the second quarter of the previous year. These results in revenue and earnings for the second quarter also continued longstanding patterns that are forecasted to continue into the foreseeable future.

These high hopes are not unreasonable. Even though the federal prohibition on sports betting was lifted in 2018, states have been gradual in legalizing it. As of the most recent update approximately 66.67% A number of states in the U.S. have legalized various forms of sports betting, while others are contemplating enacting laws to permit it, potentially allowing DraftKings to enter those markets. According to Technavio, a research firm, the global sports betting market is projected to expand at a rate of 12% per year until 2030, with the U.S. playing a significant role in driving this growth.

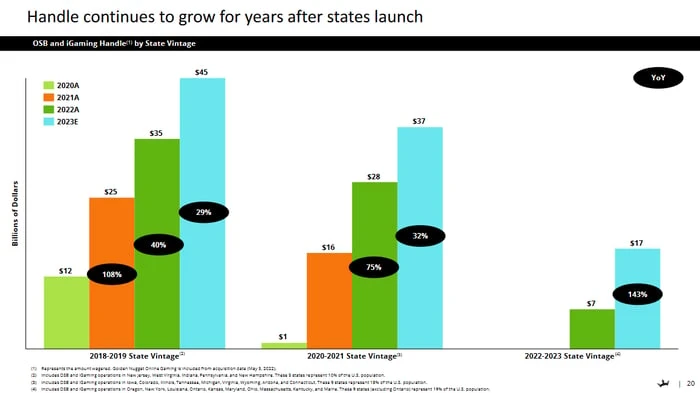

One factor contributing to the growth of DraftKings is the sustained expansion of its customer base. After establishing a presence in a new market, the number of paying customers continues to increase over an extended period as more people become aware of its products and are influenced by marketing campaigns. Data indicates that betting activities also continue to rise even after DraftKings has been operating in a state for four years. This trend suggests that the company is likely to experience further growth beyond the fourth year as it accumulates more data.

This information was obtained from the investor day presentation of DraftKings in November 2023.

Interpretation: Despite the potential for ongoing expansion, the stock price does not currently reflect this. This could be due to temporary setbacks that stocks sometimes face. Nevertheless, for strong companies like DraftKings, these short-term challenges present chances for long-term investment.

Shopify

Similar to DraftKings, Shopify ( SHOP -0.39% ) Recently, the stock market has been challenging for investors. The value of the shares has dropped by almost 20% since reaching a high in February, even though there was a positive increase in earnings earlier this month. The company’s recent profit forecast did not meet the market’s expectations. Similar to DraftKings, it could be said that investors are focused on finding negative information about this company, rather than considering the overall positive outlook.

Shopify assists businesses in creating and controlling an online store for selling products and services. Many small and large businesses use Shopify’s technology to conduct their online sales. It is different from Amazon in that it provides merchants with an alternative to a large online marketplace where sellers compete with each other.

Sure, the e-commerce Although the market may be saturated and well-established, that doesn’t imply that there is no potential for growth. According to the Census Bureau, only approximately 16% of retail sales in the United States are conducted online, leaving a significant portion of the market untapped. never With the possibility of conducting transactions through the internet, a significant portion of that market is available for the taking by the e-commerce sector.

According to Mordor Intelligence, the e-commerce market in the United States is expected to expand at a rate of 14.7% annually until 2029. This company is also beginning to establish a foothold in international markets where a comparable trend is observed.

The predictions align with the overall industry forecast. Shopify’s revenue projection for 2024 is in accordance with this. anticipated to get better Revenue increased by more than 23% compared to the previous year, and it is expected to continue growing at a similar rate in the coming years. Earnings are projected to increase at an even faster rate.

The company is currently facing a profit margin challenge that is expected to continue for a few more quarters. However, this is not a critical issue as the growth in direct-to-consumer shopping is likely to support Shopify’s performance.

Microsoft

Finally, add Microsoft ( MSFT 0.78% ) Add Microsoft to your list of top-performing stocks to invest in as an alternative to Amazon. Microsoft, a familiar name in the tech industry, has been a key player in the personal computer market since the 1990s and has expanded its offerings to include cloud computing and business services. AI , and even video games are all within its range now.

The main reason to consider owning a share of this software giant is not primarily for diversification, but for the way the business is evolving and operating.

There is a declining trend in the outright purchase of software as more people are opting to rent it instead. versions that are stored and accessed over the internet Microsoft generates consistent and profitable revenue through their productivity tools such as Word and Excel. This approach also applies to their cloud computing services, enabling the company to concentrate on acquiring new clients who pay for their services.

It is accomplishing this extremely well. very The revenue for the previous quarter reached $64.7 billion, showing a 16% increase compared to the previous year. This growth trend has been consistent and is anticipated to persist in the future. Earnings have also followed a similar pattern. The company, especially its widely used Windows operating system, is so crucial that it is challenging to think about switching to other platforms.

The continuous increase in the stock’s value might seem daunting for potential buyers. However, do not let it discourage you from making a purchase. Despite the price-to-earnings ratio standing at around 31, which may seem high, it is actually considered affordable considering the consistent revenue growth rate in the mid-teens. Moreover, analysts have set a consensus price target of almost $500, which is 19% higher than the current stock price.

Out of the 60 analysts who track Microsoft’s stock, 49 of them recommend it as a strong buy, not just a regular buy.

The Foolish Person Stock Advisor The team of analysts has recently pinpointed what they consider to be the… 10 best stocks for investors to purchase at this time… DraftKings One of them was omitted. The 10 selected stocks have the potential to generate significant profits in the future.

Consider when Nvidia compiled this listOn April 15, 2005, if you had put in $1,000 based on our suggestion, You would possess a total of $796,586. !*

It is important to mention Stock Advisor the overall average gain764% – an outstanding performance exceeding the market average 164% Ensure you stay updated with the most recent top 10 list for the S&P 500.

Stock Advisor performance up to August 12, 2024.