Oracle ( ORCL 0.91% ) It has been actively involved in nearly every technological revolution, assisting businesses in gearing up for the internet’s emergence over the past 25 years. Cloud computing refers to the practice of using a network of remote servers hosted on the Internet to store, manage, and process data, rather than a local server or a personal computer. , and now, AI (AI).

The company has one of the top AI data center infrastructures in the industry, enabling developers to increase their capacity up to 32,768. Nvidia computing devices that specialize in rendering images and videos, commonly abbreviated as GPUs, GPU The company has a greater number of GPUs compared to most of its main rivals, which results in the ability to create bigger AI models.

Oracle’s RDMA networking technology enables quicker data transfer between points compared to standard Ethernet networks, resulting in significant cost savings due to developers being charged by the minute for computing capacity.

The chairman Larry Ellison claims that Oracle’s Gen2 AI data centers have the capability to conduct training. AI models The infrastructure is twice as fast and costs half as much as the competition.

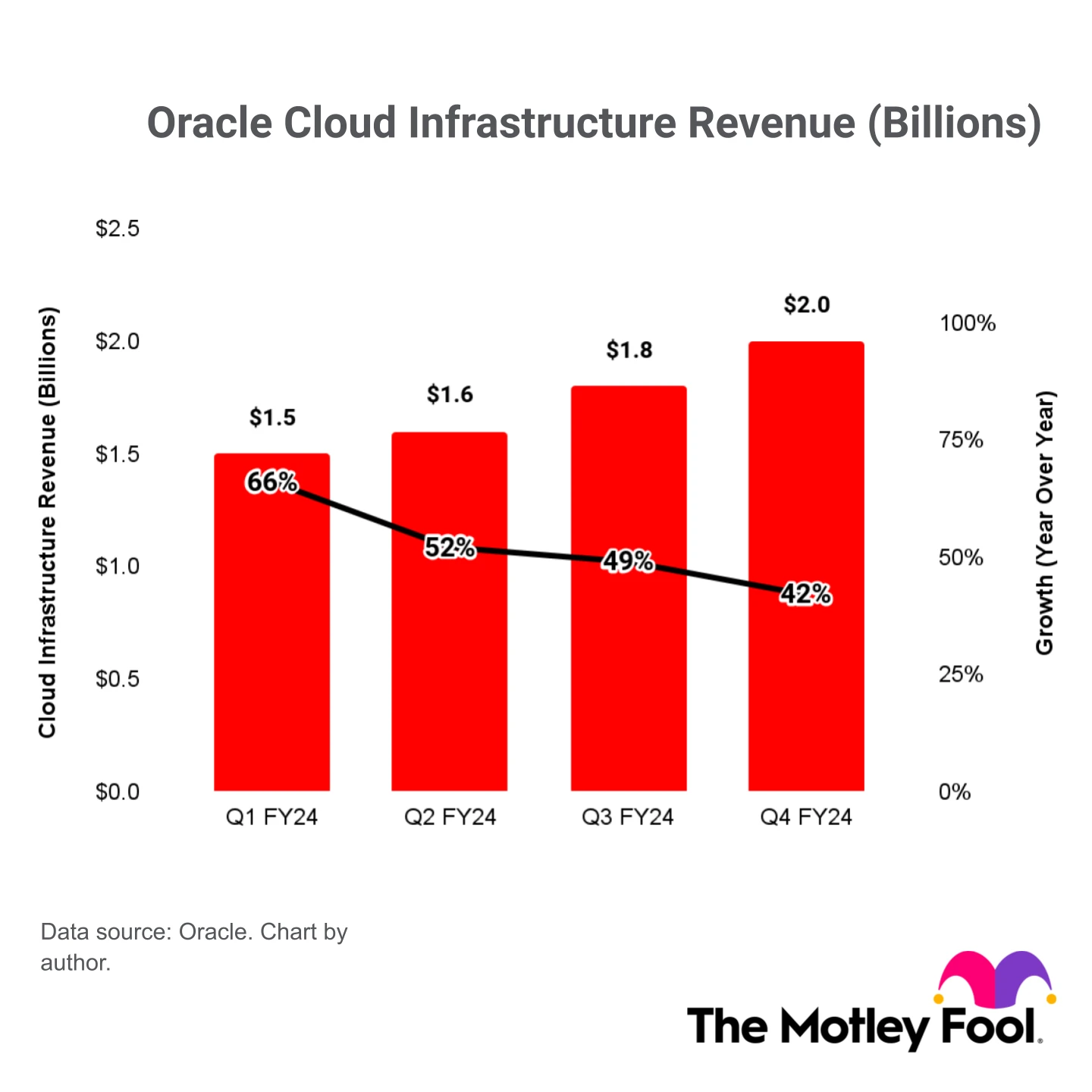

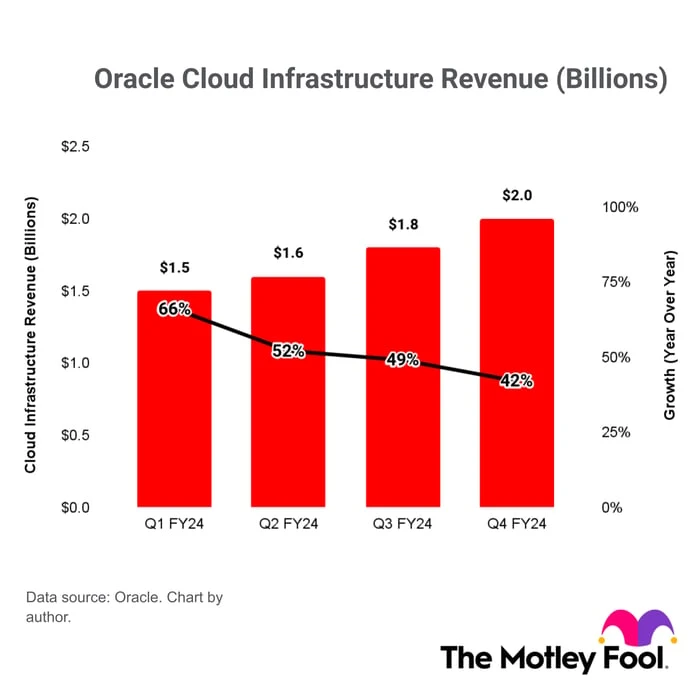

Oracle is experiencing rapid growth in its Cloud Infrastructure (OCI) segment, with revenue growing by over 40% year over year for the past four quarters. This makes OCI the fastest-growing division within the company.

Oracle predicts that its revenue from OCI will increase by over 50% in fiscal year 2025. The company is scheduled to release its first-quarter results by early September, so investors are advised to monitor this segment closely.

There is a possibility of growth picking up speed in the next few quarters as the demand for Oracle’s infrastructure is surpassing the available supply. This was clearly seen in the company’s performance commitments in the fourth quarter of the fiscal year 2024, which ended on May 31, as they increased by 44% to reach a new high of $98 billion. This total included deals worth $12.5 billion from more than 30 clients. AI companies .

Oracle is quickly constructing additional data centers to meet the increasing demand. The company’s revenue is expected to increase as these new facilities become operational.