Are you considering making a purchase? Home Depot ( HD 1.16% ) Investors looking to invest in stocks are currently in a difficult situation. Even though the stock prices have not yet reached the high levels seen during the pandemic in late 2021, they have increased by 30% since hitting a low in October. Additionally, the stocks are considered to be quite expensive, with a forward-looking price-to-earnings ratio of 24, which is significantly higher than the usual average for this particular stock.

Has the opportunity to purchase Home Depot stock already passed?

If you are a genuine investor with a long-term perspective, then it is not.

Home Depot is still displaying warning signs.

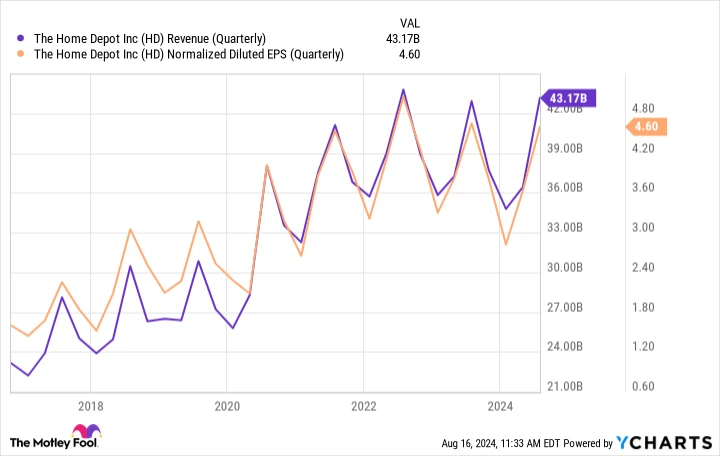

Describing the company as sending conflicting signals is an understatement. For instance, consider the financial results from the previous quarter. While both revenue and profit exceeded expectations, sales growth was lackluster. Sales from stores that have been open for a certain period of time, typically a year. In fact, there was a 3.3% decrease in revenue compared to the previous year. Earnings per share were $4.67, exceeding expectations of $4.53, however, they have declined for the sixth consecutive quarter.

Quarterly Revenue in High Definition data by YCharts.

The home improvement store revised its annual profit forecast downwards. It anticipates a decrease of 1% to 3% compared to the previous year, with a projected decline in same-store sales of 3% to 4% in 2024. The reason for this decline is attributed to increased interest rates and heightened economic uncertainty, which have negatively impacted consumer spending on home improvement endeavors, according to CEO Ted Decker.

Even though interest rates are gradually decreasing, there is still a significant level of uncertainty in the macroeconomic environment.

Typically, stocks tend to indicate the anticipated future performance of the company rather than its current status. This is evident in the case of Home Depot, as its stock has shown more optimism than pessimism since hitting a significant low in October last year, despite less impressive quarterly reports. As the current economic difficulties subside, Home Depot is expected to regain its usual robust position.

Considering the high valuation of this stock, the question is whether the market has become somewhat overzealous.

Probably not.

There are brighter days in the future.

There are differing opinions on that point. The average price target among analysts is currently $381 per share, representing a modest 5% increase from the current stock price. This level of support is not very strong.

Consumerism Economic cycles tend to follow a predictable pattern, yet many investors and analysts struggle to anticipate market rebounds until they are already underway. By that point, the timing is not as crucial. The stocks that tend to thrive during these economic recoveries are usually well into a significant long-term uptrend, leaving many individuals missing out on the initial and most lucrative phase of the investment opportunity. This explains why Home Depot’s stock has been performing strongly recently when it appeared it shouldn’t have been. Investors are merely attempting to avoid this common oversight.

These buyers have legitimate reasons to be confident.

Take the housing market For example, the sales of both previously owned homes and newly constructed homes are currently close to the lowest levels seen in several years. The combination of increased interest rates and rising home prices is limiting the number of home purchases.

Both are expected to get better shortly.

The market is anticipating that the federal funds rate will be reduced by at least four quarter-point increments by early next year, leading to a decrease in mortgage rates. While it is uncertain whether home values will decrease significantly during this period, Realtor.com predicts that the rate of home-price growth will slow down due to an increase in the construction of single-family homes and a rise of 14.5% in the number of homes available for sale.

According to the Harvard University’s Joint Center for Housing Studies, the spending on remodeling projects is expected to decrease in the coming months before stabilizing and starting to recover in the latter part of 2025. Additionally, although not strong, the sales of new homes are also projected to increase gradually.

Put differently, a significant aspect of Home Depot’s current business that is lacking is the building and remodeling sector. ready for imminent recovery .

Furthermore, there is a broader economic recovery expected to enhance Home Depot’s non-construction operations. Despite a slight increase in unemployment and a slowdown in GDP growth, the Federal Reserve predicts that GDP growth in 2025 and 2026 will be similar to the modest yet positive growth seen this year. Home Depot has the opportunity to increase its market presence even in a scenario of sluggish economic expansion. Bank of America is a financial institution that provides banking and financial services to individuals, businesses, and institutions. Robert Ohmen and Molly Baum, analysts, have expressed that although the overall economic situation is uncertain, they anticipate that HD will continue to increase its market share as it enhances its growth and abilities through the complex pro.

Focus on the future, not the past.

Home Depot is by no means the most secure investment option available. nor It is the most affordable option, but it also comes with higher-than-average risk and a higher-than-average price.

In this situation, the large size and transparency of the retailer make it possible to assess the company’s future easily. While it is uncertain when the company will experience more favorable conditions compared to challenges, the market anticipates that this change will occur eventually. It is advisable to prepare in advance for this recovery instead of delaying and potentially missing out on opportunities. Ultimately, stock prices typically reflect expectations for the future.

In other words, it is not too late to invest in Home Depot stock, despite its higher price. The stock is expected to increase in value and reach a more reasonable valuation in the near future.