The The Nasdaq Composite Index ( ^IXIC 1.39% ) It includes nearly all the stocks listed on the Nasdaq market. It experienced significant growth in the first six months of 2024, increasing by 20% with minimal fluctuations.

The situation shifted in July, leading to the index falling by 6.5% from its highest point as investors analyze poor economic data and uncertainties. unexpected change in the value of the Japanese currency .

Historical data indicates that the U.S. stock market typically reaches new peaks over extended periods, making this current decline a potentially advantageous moment for investment. One particular stock that may be worth exploring for investors is Datadog ( DDOG 1.94% ) due to its distinctive contribution to the advancement of artificial intelligence (AI).

Following a decline of 9.5% in the last month due to the Nasdaq market drop, Datadog stock is currently trading 39% lower than its peak in 2021. Despite this, Wall Street analysts remain optimistic about the company. The publication known as the Wall Street Journal Datadog has been given the top buy rating. Let’s explore the reasons behind this evaluation.

Credit: Getty Images.

The technology provided by Datadog is essential for contemporary companies.

Datadog’s expanding collection of software tools is utilized by approximately 28,700 businesses, making the company renowned for its offerings. cloud A monitoring system designed to detect and prevent technical errors that could disrupt digital systems.

Previously, an online retail company may have been unaware that its website was inaccessible to customers in a particular country until a drop in sales was observed. With Datadog, management can now receive immediate alerts, allowing them to address the issue proactively before it impacts the customers.

In the digital economy, having a strong online presence is crucial due to the constant availability of alternatives just a click away. Datadog is widely used not only in e-commerce but also in consumer-focused industries such as financial services, entertainment, gaming, and healthcare.

Datadog introduced a new product last year. AI A new feature, called Bits AI, has been incorporated into their existing products to assist businesses in identifying the main reason behind technical problems more efficiently.

Bits AI is capable of generating incident summaries, which can help managers save a significant amount of time that would typically be used for manual investigations. Furthermore, managers have the option to engage in a conversation with the assistant to obtain more detailed information if needed.

Datadog has further expanded its presence in AI by introducing a new observability tool. big models of language Large language models (LLMs) are essential for AI applications such as chatbots and virtual assistants. This highlights the importance of ensuring that LLMs are precise and free of errors.

The observability tool assists developers in overseeing expenses, identifying problems with their LLMs, and evaluating their effectiveness through monitoring the interactions from the chatbots they support.

The revenue generated by artificial intelligence is increasing quickly.

During the second quarter ending on June 30, Datadog recorded a total revenue of $645.2 million, marking a 27% growth compared to the same period last year. This figure exceeded management’s projected revenue of $622 million.

In June, CEO Olivier Pomel mentioned that 4% of Datadog’s revenue came from customers who primarily use AI technology. Despite seeming low, this percentage has made an impact. doubled There has been a 2% increase in the last year.

Pomel mentioned that approximately 2,500 customers have started utilizing one or more of Datadog’s AI tools, accounting for roughly 8.7% of its overall customer base, indicating a rapid adoption rate.

Additionally, the company is successfully maintaining cost control while experiencing significant growth in both its traditional operations and artificial intelligence ventures. Costs incurred in the regular operations of a business. There was a modest 18.5% increase in profits from the previous year, which was lower than the 31.2% increase seen in the same quarter of the previous year, resulting in higher profitability.

Datadog produced as a consequence net income The company recorded a substantial increase in profit, with a net income of $43.8 million, compared to a net loss of $3.9 million during the same period last year.

Datadog is demonstrating to investors that it can achieve growth without the need to spend a large amount of money, as there is a high natural interest in its range of monitoring and observability tools.

Investors on Wall Street are optimistic.

The publication known as The Wall Street Journal Datadog is being covered by 43 analysts, with 29 giving it a top buy rating. Additionally, seven analysts are bullish on the stock, while the remaining seven suggest holding. None of the analysts advise selling Datadog.

The stock has a target price of $144.89 agreed upon by analysts, which is 27% higher than its current trading price. The highest target set by experts is $160, suggesting a potential increase of 40%.

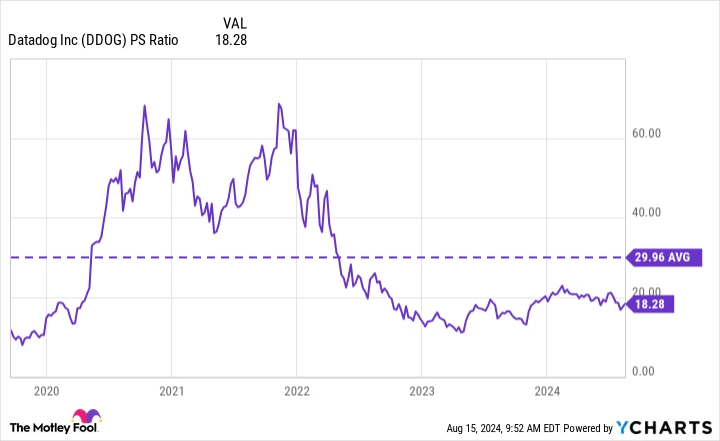

These estimates could be considered cautious as they are significantly below Datadog’s peak value of approximately $193, which was reached during the technology boom in 2021. It should be noted that the stock was greatly inflated in value at that time. The ratio of a company’s stock price to its revenue. over 60.

Afterwards, a drop in the stock value and steady increase in revenue have led to a decrease in the price-to-sales ratio to 17.8, representing a 40% decrease from its historical average of 29.9 since the company’s initial public offering five years ago.

DDOG PS ratio data by YCharts.

If AI is evolving to become more pervasive and accessible, much like the cloud. Given that nearly all businesses worldwide will utilize Datadog’s LLM and AI services to some extent, there will likely be a significant demand for these products. Consequently, it is expected that the company’s AI revenue will exceed 4% of its total revenue in the near future. Investors may want to consider purchasing the stock before this transition occurs.