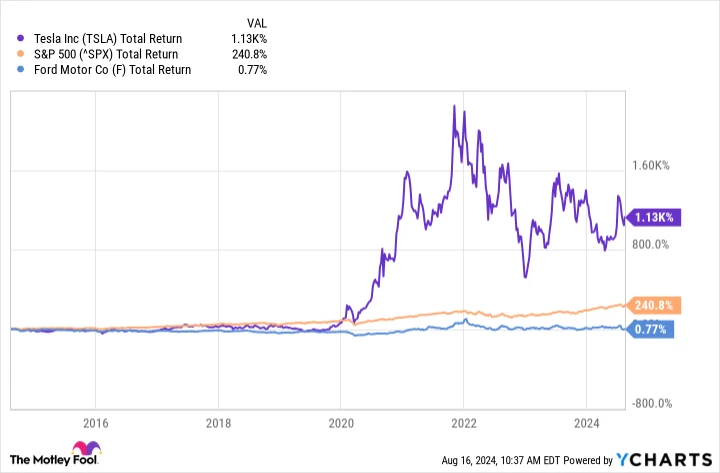

Generating minimal returns in the past decade, with little to no increase in value even with dividends taken into account. The Ford Motor Company is a well-known automobile manufacturer. ( F 0.48% ) It has proven to be a poor choice for a lasting investment. S&P 500 experienced a 241% increase during the same timeframe, while a new car manufacturer Tesla increased by a factor of 11.

TSLA Total Return Index data by YCharts

Although previous results do not guarantee future outcomes, they may offer some indications. Let’s examine what the next ten years may entail. have in establishment for Ford as it looks to streamline and enhance its operations.

The period of growth and popularity of electric vehicles turned into a decline and failure.

Similar to numerous traditional car manufacturers, Ford was swept up during the highly anticipated shift to vehicles powered by electricity Electric vehicles (EVs) were expected to transform the traditional business reliant on slow internal combustion engines into something more dynamic and creative. But Although the company is swiftly embracing the new technology, it has not significantly benefited the financial performance.

Credit: Getty Images.

Ford’s latest electric vehicle line, Model E, faced significant losses of $1.1 billion in the second quarter, equivalent to $46,000 per unit sold. This has contributed to a total loss of $2.5 billion for the segment in the current year, with factors such as an industry-wide price competition and lower demand playing a role.

There are various factors contributing to the market downturn. To begin with, the increase in interest rates is making cars less accessible, as it raises the cost of these significant investments. are generally created Assistance from credit could be beneficial, and the anticipated reductions in the Federal Reserve interest rates may also provide support. But According to analysts at J.P. Morgan, there is a 35% probability of the U.S. economy falling into a recession by the end of the year, which would negatively impact the demand for purchasing cars.

What will the upcoming decade bring?

In the future, there is a high possibility that the demand for electric vehicles will recover and gradually outpace the demand for conventional internal combustion engine vehicles as battery technology advances and necessary infrastructure such as charging stations is developed. Nevertheless, it remains uncertain how this shift will impact Ford and other companies in the industry.

In recent years, there has been a trend showing that producing electric vehicles (EVs) is becoming less financially rewarding. Additionally, the automotive industry’s focus is being redirected to China due to advancements in new technology. This has prompted manufacturers like BYD Due to their vertical integration, they are able to manufacture electric vehicles at surprisingly affordable prices. BYD’s most inexpensive vehicle, the Seagull, is available for purchase. the same as $9,700 within the country of China.

Although Washington’s high tariff on Chinese electric vehicles may prevent extremely competitive products such as the Seagull from entering the American market, Ford might encounter intense price competition in other regions that could harm its profit margins. in the world .

Would it be a good idea to invest in Ford stock for the long term?

One potential positive aspect for investors in Ford stock could be the company’s financial position. Despite the challenges faced by its electric vehicle (EV) sector, Ford managed to produce approximately $2.5 billion in the fourth quarter. profit from normal business operations , which is quite impressive. Additionally, it has a significant $25 billion in cash and similar assets listed on its financial statement.

Ford not only has sufficient financial resources to overcome any upcoming industry obstacles, but There will also be a significant amount remaining to give back to shareholders. The company is recognized for distributing special dividends. as a component of its strategy to allocate between 40% and 50% of its free cash flow to investors. At the current moment, the stocks offer a dividend yield of approximately 5.8%.

However, receiving dividends does not guarantee that a stock is a wise investment, particularly if the stock price stays the same or decreases. S&P 500 Ford is not expected to exceed an annual average return of 10% over the long term, despite its significant dividend payments. The company is encountering numerous challenges that may hinder its performance in the next decade. prolonged and significant obstacles that need to be overcome in order to qualify as a purchase.