It is impossible to go a day without coming across information regarding Nvidia The AI company leading the technological revolution currently holds the third-highest market capitalization globally, exceeding $2.8 trillion. Investors are making substantial investments in its anticipated expansion, resulting in the stock being valued at a premium price-to-earnings ratio. P/E Currently, I am 63 years old.

I am feeling optimistic, but I believe it is a good opportunity to take a different approach compared to others. I have identified two stocks with smaller market capitalizations than Nvidia that I predict will outperform it by the year 2030.

Could Alphabet be considered the ultimate winner in the field of artificial intelligence?

Alphabet ( GOOG 0.96% ) ( GOOGL 1.03% ) Ranked as the fourth largest company globally based on market capitalization, trailing just behind Nvidia, is Google. Throughout the 21st century, Google has been a dominant force in the consumer internet industry with its popular services such as Google Search, YouTube, and Google Cloud. The company holds a strong presence in the digital advertising sector, as billions of users worldwide frequently interact with Google and YouTube.

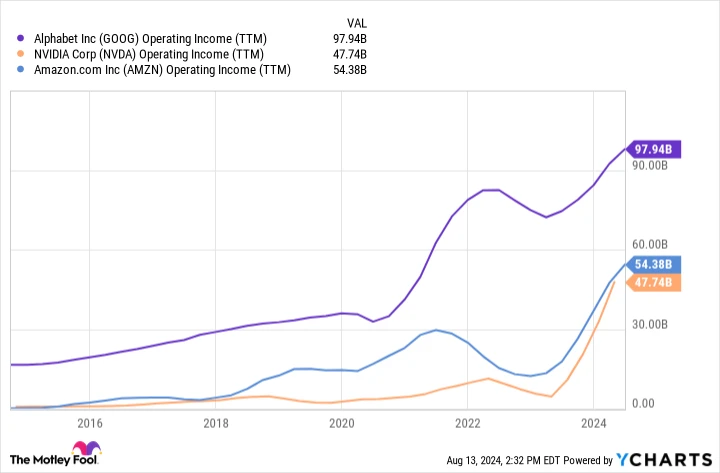

In the previous quarter, Google saw a 14% increase in revenue from its search services compared to the previous year, while YouTube’s advertising revenue went up by 13% and Google Cloud revenue increased by 29%. This strong growth in all areas resulted in the company achieving a record operating income of $98 billion in the past year. To put this into perspective, Google’s operating earnings surpassed Nvidia’s, which amounted to less than $50 billion.

Investors may have hesitated to invest in Alphabet because of concerns that it was lagging behind in the field of artificial intelligence. Towards the end of 2022, OpenAI introduced ChatGPT to the general public and subsequently secured a significant investment. Microsoft Alphabet briefly appeared to be falling behind in the competition for new conversational and creative AI tools.

Recently, Google and Alphabet have demonstrated the capability to replicate and even exceed all advancements made by OpenAI, which is likely to reassure investors. It appears that Google and Alphabet are now at the forefront of artificial intelligence.

With the increasing global internet usage and growing popularity of cloud computing, there is significant potential for expansion. Additionally, the integration of artificial intelligence tools in new devices such as Pixel phones presents opportunities. Given the current high earnings and ample scope for growth, it is predicted that the company may surpass Nvidia in market capitalization by 2030.

GOOG’s trailing twelve months operating income , data by YCharts defines TTM as the past 12 months of data.

Amazon: Continuing with the familiar

Amazon ( AMZN -0.30% ) Ranked sixth globally, the company holds a market capitalization of $1.8 trillion, making it one of the largest companies in the world. e-commerce and Cloud computing refers to the delivery of computing services – including servers, storage, databases, networking, software, analytics, and intelligence – over the internet to offer faster innovation, flexible resources, and economies of scale. It has enabled the growth to continue even at a significant scale.

In the past year, the revenue has reached $600 billion, which is a significant increase from approximately $100 billion a decade ago. The growth in revenue continues to be strong, with a 10% increase compared to the same quarter last year.

Amazon has historically faced challenges regarding its profitability, but the company’s new CEO, Andy Jassy, has alleviated these concerns. The operating margin has increased significantly to 9% in the past year and 10% in the last quarter, reaching a record high. The company is expected to experience further growth in profit margins due to the expansion of higher-margin services such as advertising, subscriptions, and third-party e-commerce.

In contrast to Nvidia, which already has very high profits, Amazon has the potential to significantly boost its earnings by increasing its base profit margin and expanding its sales.

Amazon currently earns more in operating income than Nvidia. If Amazon reaches $1 trillion in revenue by 2030 with 15% operating margins, its operating income will increase to $150 billion by the end of the decade. In that case, I believe Amazon’s market capitalization will exceed that of Nvidia in 2030.