With a wide variety of over 90 snacking and restaurant brands that cover quick-service, fast-casual, and traditional dining sectors, MTY Food Group ( MTYF.F 0.55% ) This company is likely to be familiar to you, even though you may not recognize it by its name. Some of its well-known brands include Papa Murphy’s, Cold Stone Creamery, Famous Dave’s, Village Inn, Wetzel’s Pretzels, Thai Express, and TacoTime.

MTY Food Group runs most of its 7,100 locations through a wide network of shops. business model where a company grants individuals or groups the right to sell its products or services under the company’s name and business model , providing the company with a low-asset, high-profit profile. Creating favorable Cash flow that is available after operating expenses and capital expenditures have been deducted. Each year since the beginning of the 21st century, the stock has displayed a similar pattern. provided overall earnings an increase of 3,600% during that period — equivalent to seven times the original amount S&P 500 index’s return.

In spite of this history of achievements, as well as profits before interest, taxes, depreciation, and amortization (EBITDA) EBITDA Despite experiencing FCF growth of 81% and 73% in the past five years, the stock price of MTY, which is traded over the counter in the U.S., has decreased by 40% from its peak.

Here is the reason why this decrease could present a rare investment opportunity for investors that only occurs once every ten years.

MTY Food Group is known for its pattern of frequently acquiring other companies.

MTY Food Group has acquired 50 companies since 1999, with 27 of them being in the past ten years. Unlike companies that depend on large mergers or occasional significant acquisitions for growth, MTY, as a frequent acquirer, tends to show better performance.

A recent report by McKinsey examining companies between 2013 and 2022 revealed that equities with mergers and acquisitions (M&A) initiative MTY has outperformed the overall market by 1.8 percentage points. While the timeframe is shorter than preferred, some companies have demonstrated the ability to reinvest their free cash flow into mergers and acquisitions (M&A) successfully, and MTY is one of them.

MTY has maintained an average over the past ten years. Return on invested capital (ROIC) is a financial metric that measures the profitability of a company by evaluating how efficiently it generates profits from its capital investments. By achieving a 15% return on investment, the company is able to produce significant free cash flow in comparison to the financial resources it uses for its mergers and acquisitions. This results in the company generating value for its investors consistently, surpassing its average cost of capital of 7%.

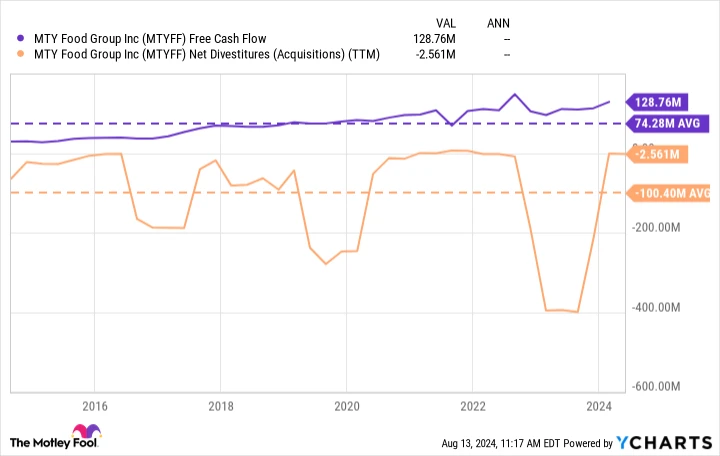

The company is directing its free cash flow towards acquiring new assets, with a clear focus on expanding its empire of food brands.

MTYFF’s free cash flow and earnings before interest, taxes, depreciation, and amortization (EBITDA). data by YCharts

Following the acquisition of Wetzel’s Pretzels and BBQ Holdings (Famous Dave’s) in 2022 for a total of $400 million, the company has decided to temporarily halt any further mergers and acquisitions. The focus now shifts towards integrating the newly acquired businesses, while also concentrating on reducing the company’s net debt balance of $686 million.

While the $686 million debt amount may seem concerning, the company’s debt-to-adjusted EBITDA ratio stands at 2.6, which aligns with its typical levels and is considered suitable for a stable cash flow generating company such as MTY.

Credit: Getty Images.

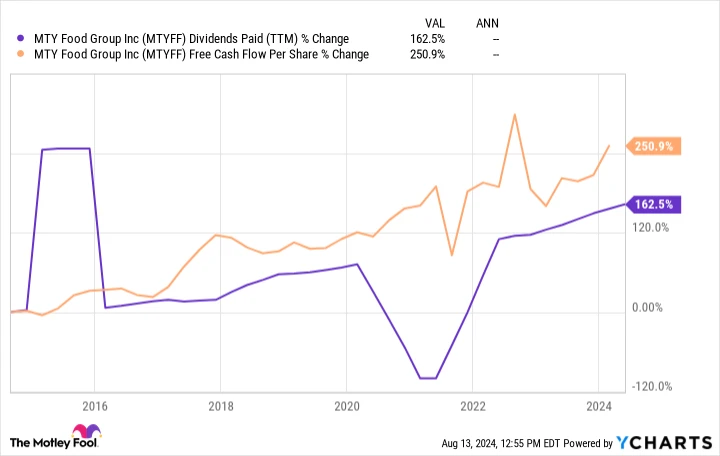

A growing dividend is supported by a consistent flow of free cash.

Over the past ten years, MTY Food Group has increased its free cash flow per share by 251%, leading to significant dividend growth during that period.

Dividends distributed and Free Cash Flow over the past twelve months. data by YCharts

If the company had not decided to stop paying dividends in the initial stages of the pandemic as a precautionary measure, it would probably have continued to increase its dividends annually since 2010. Despite the consistent growth in dividends, MTY’s cash flow was impacted. The dividend payout ratio is a financial metric that indicates the percentage of earnings a company distributes to its shareholders in the form of dividends. With only a modest 14% increase, there is a significant opportunity for further growth in the future. offers a decent return in the form of dividends Investing in MTY has the potential to generate a significant amount of passive income at a rate of 2.5%.

Along with the attractive dividend, the management has been repurchasing company shares for the past five years, leading to a 1% decrease in the total number of shares annually. Moreover, investors can benefit from the fact that the board and management collectively own 16% of MTY’s shares, giving them strong motivation to sustain these beneficial cash distributions to shareholders.

MTY’s valuation that occurs once every ten years

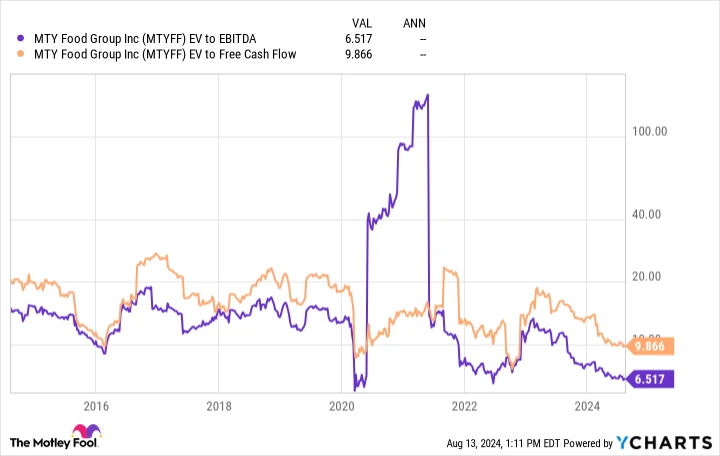

Despite the promising portfolio of brands, growth in free cash flow, and strategy of acquiring companies consistently, what may be even more fascinating is MTY’s current valuation, which occurs once in a decade.

Currently, the company’s enterprise-value-to-EBITDA and enterprise-value-to-FCF ratios are near their lowest levels in 10 years, except for the decrease experienced in March 2020.

Convert market value of equity to earnings before interest, taxes, depreciation, and amortization and market value of equity to free cash flow. data by YCharts

Besides these assessments, MTY’s dividend yield of 2.5% is significantly higher than its average of 1.5% over the past 10 years. This is the highest yield recorded, except for in 2015 when the company issued a special dividend, and during the pandemic-induced market downturn.

In the end, MTY Food Group may not experience explosive growth rates. Nevertheless, the company’s history of making multiple acquisitions, its strong free cash flow generation, and its consistent distribution of cash to shareholders make it an excellent choice as a dividend stock to purchase, especially given its current rare valuation opportunity.