If you are seeking to earn passive income from your investments, Annaly Capital ( NLY 0.75% ) One stock that may have caught your attention is probably the one offering a 13% dividend yield.

Investors can participate in the U.S. housing market through the mortgage real estate investment trust (mREIT), which is a potential avenue to capitalize on the current higher mortgage rates. Nonetheless, the stock is highly impacted by interest rate fluctuations, which have adversely affected the company’s performance in recent years. Before deciding to invest in Annaly Capital for its attractive dividend yield, it is advisable to carefully consider the following factors.

The method by which Annaly generates revenue

Annaly makes investments. securities that are backed by mortgages , collections of home loans that are packaged together and then sold to individuals looking to invest. These packages are often supported by government-backed organizations like Fannie Mae Fannie Mae and the mentioned entity Freddie Mac Freddie Mac provides a guarantee for the principal and interest payments on these mortgage investments, which can assist in reducing risk to some extent.

Nevertheless, the company operates in a market where products are relatively similar, competing with other companies for the same mortgage-backed securities, which poses a challenge in differentiating itself. In addition, due to the relatively low mortgage yield, the mREIT employs leverage to increase the return on its investment portfolio.

Annaly utilizes repurchase agreements (repo) and various financial tools to increase gains through leverage. The company’s objective is to maintain an economic leverage ratio of less than 10:1, which is calculated by dividing the sum of its debt and derivative instruments by its total equity.

Annaly utilizes a combination of its own capital and funds borrowed from external sources to invest in Mortgage-Backed Securities (MBS). make a profit The company’s profitability depends on the difference between the return on its investments and the expenses incurred from borrowing money. Due to the company borrowing money for a short period and investing in Mortgage-Backed Securities for a longer period, it is affected by fluctuations in the yield curve, which indicates the connection between interest rates and the duration until an investment matures.

Credit: Getty Images.

In recent years, interest rates have increased at all points on the yield curve. Annaly’s interest-earning assets had an average yield of 4.33% last year due to its focus on investments in the higher mortgage rate market. Meanwhile, the average cost of its debts rose to 3.01% from 0.79% two years ago. Consequently, the net interest spread decreased to 1.32% from 1.89% in 2021.

Annaly experiences the effects of higher interest rates in a different manner as well. book value Annaly’s portfolio includes debt-related securities, which are affected by fluctuations in interest rates. When interest rates increase, the value of these securities decreases. Annaly’s book value per share dropped by 39% in the past two years.

Unimpressive performance for investors

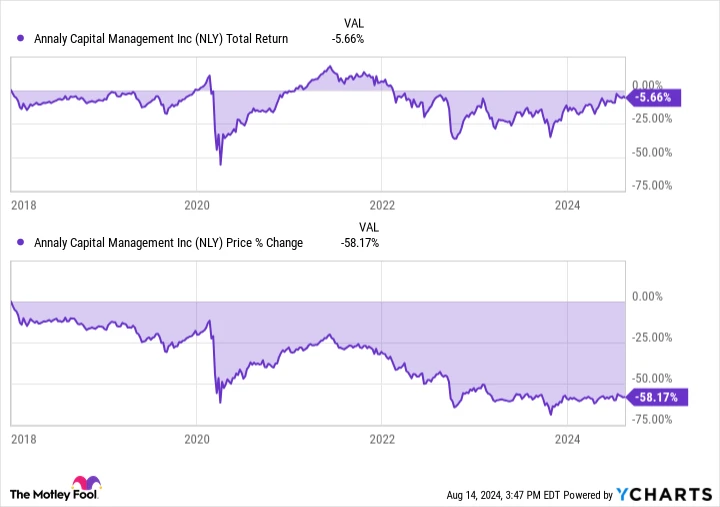

Annaly’s susceptibility to interest rate fluctuations exposes it to shifts in economic and market trends. In recent years, the company has not met investors’ expectations. From 2018 onwards, Annaly’s overall return (accounting for reinvested dividends) stands at -5.6%. Despite receiving a high double-digit dividend yield, investors have experienced a significant 58% drop in the stock’s value, resulting in an overall negative return.

NLY Total Return Level can be expressed as… data by YCharts .

Long-term underlying factors may lead to an increase in interest rates compared to the period before the pandemic.

For example, JPMorgan Chase CEO Jamie Dimon issued a warning The potential for increased fiscal deficits, changes in global trade dynamics, rising government commitments, and geopolitical instability may lead to a more turbulent decade ahead compared to the previous one. Consequently, I find Annaly less attractive as a long-term investment (five years or more) due to the likelihood of higher interest rates.

Is Annaly the right choice for you?

In my opinion, Annaly might perform positively if the Federal Reserve starts to decrease interest rates. CME Group According to the FedWatch tool, investors are anticipating up to six interest rate reductions of 0.25% each within the coming year.

Annaly has enhanced its portfolio yield, and it stands to gain from a decrease in interest rates as this would lower its funding expenses in the short term. Additionally, the decline in interest rates would lead to an increase in its book value, following a period of consecutive decreases over the years.

Although Annaly could perform strongly in the short term if interest rates decrease, long-term structural issues may cause interest rates to remain high for the next ten years. Due to Annaly’s vulnerability to interest rate changes, reliance on leverage, and lack of a strong competitive edge, I would recommend exploring alternative options for generating returns.