Recently, there has been some fluctuation in the stock market, however, it is important to mention that S&P 500 The index has experienced strong growth of 41% since the start of 2023, primarily driven by a robust increase in technology stocks that performed better than the overall market, supported by factors like artificial intelligence (AI).

This clarifies the reason behind the technology-filled. Technology companies listed on the Nasdaq-100 index. Since the start of 2023, the index has shown remarkable performance by exceeding the returns of the S&P 500, with a significant increase of 74%. companies that focus on developing and producing technology The reason why companies in this sector often achieve significant profits is their ability to take advantage of changing trends, such as the internet, smartphones, video streaming, social media, and AI, as time goes on.

This is why it would be advantageous for investors to purchase stocks of Nvidia ( NVDA 1.40% ) and SoundHound AI ( SOUN 0.40% ) By 2024, both companies are utilizing AI advancements in their industries and have the potential to become leading stocks in the future. Nvidia and SoundHound’s stock prices have already increased by 135% this year, indicating a positive outlook for their growth potential in the long term.

The upward trend of Nvidia driven by artificial intelligence is expected to pick up speed.

Despite Nvidia’s strong performance in the stock market this year, it has recently experienced a small decrease. Nevertheless, there is a possibility that this situation may improve at the end of this month when the leading semiconductor company announces its financial results for the second quarter of the fiscal year 2025.

Nvidia is scheduled to announce its upcoming quarterly financial results on August 28. Analysts predict that the company will achieve $28.5 billion in revenue, slightly surpassing Nvidia’s own projection of $28 billion. The earnings per share are anticipated to increase significantly to $0.64, compared to $0.27 in the corresponding quarter of the previous year.

Nvidia is likely to exceed the expectations of Wall Street once more, as it has done in the previous four quarters, due to its strong performance. leading position in the artificial intelligence chip industry .

The company experienced a significant increase in demand for its AI graphics processing units (GPUs), which are driving the expansion of Nvidia’s data-center division. In the first quarter of fiscal year 2025 (ending on April 28), Nvidia’s data-center sales surged by 427% compared to the previous year, reaching $22.6 billion. The total revenue also soared by 262% year over year to $26 billion.

Nvidia’s strong expansion in data centers is expected to persist in the second quarter of the fiscal year and beyond, despite speculation about a potential delay of four to six weeks in the production of its upcoming Blackwell chips. This is due to the high demand for Nvidia’s current H100 and H200 processors.

CFO Colette Kress made a comment about Nvidia’s performance in May. meeting to discuss financial performance The company continued to ramp up production of its older top-of-the-line processor, the H100, even though a newer model like the H200 was already on the market. Meanwhile, Nvidia was struggling to keep up with the high demand for the H200 and anticipates that supply shortages will persist into the following year.

It is reported that Nvidia may earn an impressive $210 billion in revenue from the sales of their upcoming Blackwell processors next year. This represents a substantial growth compared to the $47.5 billion revenue generated from data-center sales in fiscal 2024. As a result, analysts anticipate Nvidia’s revenue to almost double in fiscal 2025, reaching $120.5 billion by the end of January next year, up from $60.9 billion in fiscal 2024.

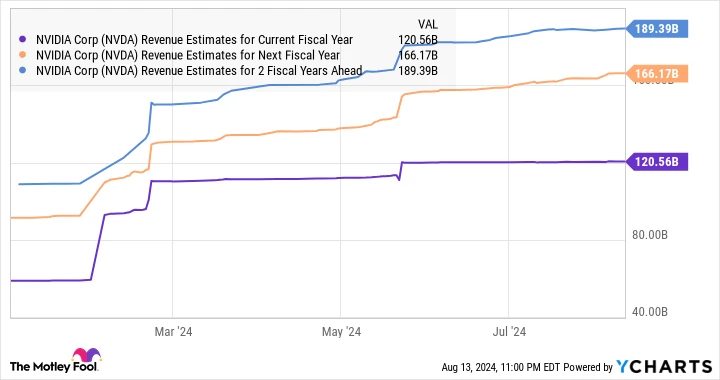

Moreover, according to the chart below, analysts have increased their projections for Nvidia’s growth in the upcoming fiscal years.

Revenue projections for the ongoing fiscal year for NVDA. data by YCharts.

This suggests that Nvidia is likely to continue being a leading stock for growth in 2024 and beyond, making it a good choice for investors seeking growth opportunities in the rapidly expanding field of AI.

SoundHound AI is becoming increasingly popular in a rapidly expanding AI sector.

SoundHound AI offers a platform that enables customers to create voice AI solutions like chatbots and conversational voice assistants. The company is confident in the capabilities of its platform. The total available market for a product or service. It has the potential to reach a staggering value of $140 billion, and the positive aspect is that it is making significant progress towards seizing this opportunity.

In the second quarter of 2024, the company posted a significant increase in revenue, with a growth of 54% amounting to $13.5 million compared to the previous year. SoundHound AI made a strategic move by purchasing Amelia, an enterprise AI software company, for $80 million to enhance its presence in the generative AI-driven customer-service sector. Following the acquisition, SoundHound is set to cater to 200 prominent clients worldwide, including leading financial institutions and Fortune 500 corporations.

As a result of acquiring a new company and the increasing popularity of SoundHound in the restaurant and automotive industries, the company has revised its revenue projection for 2024 to a minimum of $80 million, up from the previous estimate of $71 million. Additionally, SoundHound anticipates a rapid growth in revenue in 2025, surpassing $150 million.

The revenue forecast for SoundHound in 2024 suggests that the company’s sales are projected to grow by 74% this year, surpassing the 47% revenue growth recorded in 2023. Moreover, the 2025 guidance shows that the company anticipates an 87% increase in revenue for next year.

It has been observed that SoundHound has identified a large potential market for its voice AI technology, indicating a strong possibility of maintaining impressive growth in the future. As a result, investors interested in purchasing the company’s stocks may find it promising. growth stock Currently, it might be a good idea to include SoundHound in your investment portfolio. The stock has shown significant growth following its recent performance, and given the potential outlook for the company, there is a possibility for further increase in its value.