Warren Buffett, a renowned investor, is famous for adopting a Investing with a focus on the future and for an extended period of time. He has maintained a few stocks in his investment portfolio. Berkshire Hathaway is a multinational conglomerate holding company based in the United States. ( BRK.B 0.54% ) Berkshire’s longest-held investment dates back several decades. The corporation known as Coca-Cola. , which Buffett began purchasing in 1988.

Nevertheless, the prominent investor known as the Oracle of Omaha has shown a penchant for selling as of late. This was evidenced by his recent decision to reduce his ownership in his most substantial holding. Apple He has reduced his ownership by almost 50% and has also been divesting shares in a company that used to be his second-largest investment. Bank of America can be paraphrased as the American banking institution. .

The reason behind Buffett’s decision to sell is unclear, but he has managed to accumulate a significant amount of cash through this action. This could be a strategic move related to managing his investment portfolio or could be influenced by the current stock market valuations. It is also possible that he is considering a major acquisition. While there is speculation that Buffett’s selling indicates he anticipates an economic or market decline, this is not typical of his usual behavior unless he believes that stock valuations are significantly overinflated.

With that being said, Buffett seems to be eager to sell. Let’s examine two additional stocks that he may consider selling.

Contents

- 1 Visa and Mastercard are two major credit card companies.

- 2 1. Spreading investments across different assets or markets to reduce risk.

- 3 Ambiguities in the law

- 4 A possible decrease in consumer spending and overinflated asset prices.

- 5 Make sure not to overlook this second opportunity for a possibly profitable chance.

Visa and Mastercard are two major credit card companies.

Buffett has a strong liking for financial companies that operate in the credit card sector. Following a reduction in his investment in Bank of America, his second-largest holding is now in this industry. American Express is a financial services company known for its credit card products and other financial services. , a company that functions as both a credit card processor and issuer. Buffett mentioned in his annual shareholder letter that he intends to retain the stock for an extended period of time.

He also has investments in a credit card company. Capital One , Citigroup Additionally, Bank of America, along with credit card processors, Visa ( V 2.17% ) and Mastercard ( MA 1.86% ) .

Buffett may consider selling the latter two stocks next. Let’s examine the reasons behind this potential decision.

1. Spreading investments across different assets or markets to reduce risk.

Berkshire Hathaway has significant investments in the credit card sector. Prior to the recent divestment, American Express accounted for over 10% of Berkshire’s investment portfolio, with Visa ranking as the 14th largest holding and Mastercard as the 16th largest. In addition to these, Berkshire also holds positions in credit card issuers such as Bank of America, which currently stands as its third-largest holding.

If Buffett wanted to decrease his investments in consumer spending or make Berkshire’s portfolio more diverse, it would be logical to sell or decrease his holdings in Visa and Mastercard. While the stakes are significant, they are not large enough to greatly impact the share prices if sold.

The investments Berkshire holds in these companies are not significant enough to require any Form-4 filings to disclose any selling activity.

Ambiguities in the law

Visa and Mastercard are encountering legal complications following a judge’s dismissal of a proposed agreement with retailers in an antitrust lawsuit involving fees. The lawsuit focused on the collaboration between the two credit card companies and banks to raise interchange fees. This collaboration also restricted retailers from steering customers towards more cost-effective options like debit card transactions, which have significantly lower processing costs.

The original agreement was mostly seen as a victory for both companies as it included a temporary five-year limit on slightly decreased. transaction fees Nevertheless, a judge determined that the agreement was not fair to both big and small businesses, as big retailers would not gain as much from it. This is because big retailers typically negotiate lower rates individually and pay less than the standard rates, meaning that reducing the standard rates would not be advantageous for them.

The judge concurred with major retailers that the agreement failed to tackle important anticompetitive behaviors like the honor-all cards policy. This rule mandates that if a merchant agrees to accept Visa or Mastercard cards from one bank, they must accept cards from all banks that issue Visa or Mastercard. To put it differently, if a store agreed to take a Visa card issued by Bank of America, they would also be required to accept Visa cards issued by Citigroup and Capital One, even if they carried higher charges.

The outcome of court cases can be uncertain, but Visa and Mastercard may potentially encounter challenges as a result of this case in the future.

Picture credit: Getty Images.

A possible decrease in consumer spending and overinflated asset prices.

If Buffett anticipates a decrease in consumer spending, then it is likely that no other companies are as closely linked to global consumer expenditure as Visa and Mastercard. The preference for card transactions over cash has become evident over time, so any decline in spending will have a significant impact on these two major credit card companies.

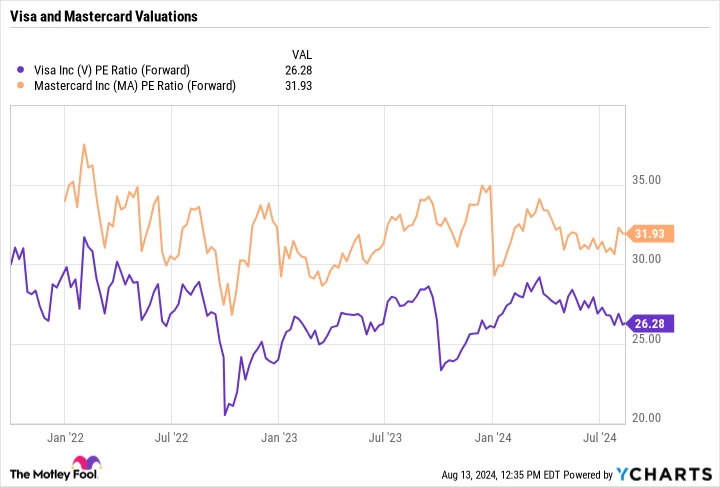

A decrease in consumer spending alone might not be enough for Buffett to sell his investments due to his focus on long-term gains. However, when coupled with high market prices, it could lead him to consider selling to secure his profits. Visa is currently in this situation. the price-to-earnings ratio (P/E) anticipated in the future Mastercard has a forward P/E ratio of 32, while Visa has a ratio exceeding 26. Both companies experienced revenue growth of 10% to 11% in the last quarter. However, considering the possibility of a decrease in consumer spending and lower income from legal proceedings, their current valuations are not considered to be at a discounted level.

Forward Price-to-Earnings Ratio data by YCharts.

Although I believe Buffett would not sell either stock based on just one of the reasons mentioned, I think the accumulation of factors might lead to him considering both for sale soon.

Make sure not to overlook this second opportunity for a possibly profitable chance.

Have you ever experienced the feeling of regret for not investing in the top-performing stocks? If so, you may be interested in what I have to share.

Our team of analysts only issues a report on rare occasions. “Double Down” stock can be described as a stock that is being purchased at a price that is lower than its previous purchase price. Advice for businesses that are expected to experience significant growth soon. If you fear that you may have missed the opportunity to invest, now is the ideal moment to make a purchase before it becomes unattainable. The statistics clearly demonstrate the potential.

- Amazon: If you had put $1,000 into the investment when we increased it in 2010, you would possess $20,001 !*

- Apple: If you put $1,000 into the investment when we increased it in 2008, You would possess a total of forty-two thousand five hundred and eleven dollars. !*

- Netflix: If you had put $1,000 into the investment when we increased it in 2004, you would possess three hundred and fifty-seven thousand six hundred and sixty-nine dollars !*

Currently, we are sending out “Double Down” notifications for three amazing companies, and there may not be a similar opportunity available in the near future.