Palantir Technologies is the name of a company. ( PLTR 0.71% ) The data analytics company has seen a surge of over 200% in the last five years. In addition to experiencing substantial growth in this period, the company has also started to make a profit. Its credibility is increasing, and it could soon be included in the stock market. S&P 500 index.

The technology company has just completed another successful quarter, achieving new milestones. With this performance, could it be that the stock has silenced its critics and become a reliable investment option now?

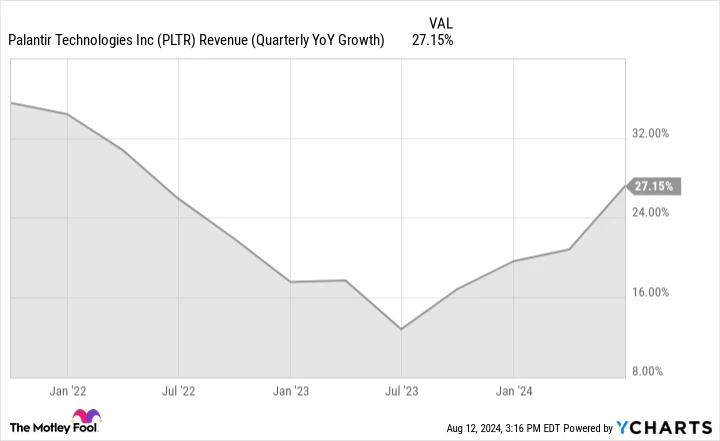

Palantir’s rate of expansion is continuously increasing.

One major issue I previously had with Palantir was its slow growth rate, which did not align with management’s assertions of high demand fueled by AI technology. Despite conducting numerous demonstrations with potential clients to highlight its AI-driven platform, AIP, designed to enhance decision-making and streamline daily operations, Palantir’s growth was stagnant.

In the most recent quarter, which concluded in June, Palantir achieved a new milestone with revenue reaching $678.1 million, representing a 27% growth compared to the previous year. This indicates a continued acceleration in the company’s rate of expansion for another quarter.

Quarterly Year-over-Year Growth in PLTR’s Revenue data by YCharts

What is causing Palantir’s stock to not rise significantly?

With its rapid growth, particularly during a period of economic challenges such as inflation and decreasing consumer interest, you may be questioning why Palantir’s stock is not experiencing a significant increase.

The issue could be attributed to the large number of shares Palantir has. Palantir has over 2.2 billion shares in circulation, which is quite substantial. Despite the company achieving a solid 20% profit margin and a net income of $134.1 million in the last quarter, this translates to an earnings per share of only $0.06 when you divide the profit by the total number of shares.

As a result, this negatively impacts the stock’s value. For example, if the stock is priced at approximately $29 and the company’s yearly earnings per share amount to only $0.17, investors are essentially paying a high price for each earning. The ratio of a company’s stock price to its earnings per share is referred to as the price-to-earnings multiple. With a price-to-earnings ratio of 170, the stock is valued at 29 times its revenue. The ratio of a company’s stock price to its earnings growth rate. Taking into account potential future expansion, Palantir’s valuation sits at a multiple of almost 2, which remains slightly elevated.

In the technology industry, investors are typically eager to invest in companies with rapid growth, even at high prices. However, there is significant skepticism surrounding Palantir’s stock valuation, despite its strong growth performance. The company’s impressive growth may not be deemed sufficient to support its current valuation levels.

The current valuation of Palantir is considered too high for it to be a good investment at this time.

Palantir is performing strongly by being profitable and experiencing growth in its business. However, these factors alone do not necessarily qualify the stock as a favorable investment. To enhance investor confidence and foster a more optimistic outlook on the company, Palantir could consider purchasing its own shares and significantly decreasing the total number of shares available on the market.

Regrettably, unless the company reduces its number of shares or significantly increases its profits, investors may still consider the stock too costly to purchase at its present price. The risk of purchasing at these elevated valuations is that investors may be paying for anticipated future expansion. With numerous stocks exhibiting vulnerabilities, there could be more advantageous alternatives available. Investors who focus on companies that have the potential for significant growth in the future. Therefore, I believe that these outcomes will not be sufficient to significantly increase Palantir’s stock price this year.