Warren Buffett famously advised to be cautious when others are overly confident and to take advantage when others are hesitant. Keeping this in perspective, here are three technology stocks that investors should contemplate investing in during times of market fear.

1. Alphabet

Alphabet ( GOOGL 0.58% ) Stocks have recently dropped due to worries about rising competition in the search industry and a court decision labeling the company’s Google search engine as a monopoly.

Even though Alphabet has been convicted of antitrust violations, the process of reaching a final decision in court and implementing any necessary solutions is expected to be lengthy and may extend until 2026. The court’s decision primarily centered around Alphabet’s payments to phone manufacturers to have their search engine set as the default option on mobile devices, so modifications to these contracts are likely to occur.

At the same time, investors are concerned about the financial impact. machine intelligence The effect that AI-driven search engines such as Google will have on their business model. OpenAI and Perplexity impact the company will experience.

Both of these problems appear to be easily solvable. To begin with, Alphabet has begun to introduce new ideas in the field of search, not only by utilizing artificial intelligence (AI), but also by incorporating functions like visual search and circle to search. The former enables users to perform a search using their smartphone’s camera, while the latter allows users to draw a circle or write on an image or text to receive additional information about a topic without exiting an application.

Given Alphabet’s extensive data history, association with online search, strong cash generation, and potential revenue streams from AI, it will be challenging for a smaller competitor with financial losses and limited scale to significantly challenge Google’s search dominance. Even though the recent court decision may facilitate users switching default search engines, Google has approximately two years to maintain its technological edge in search and deter many users from making a switch.

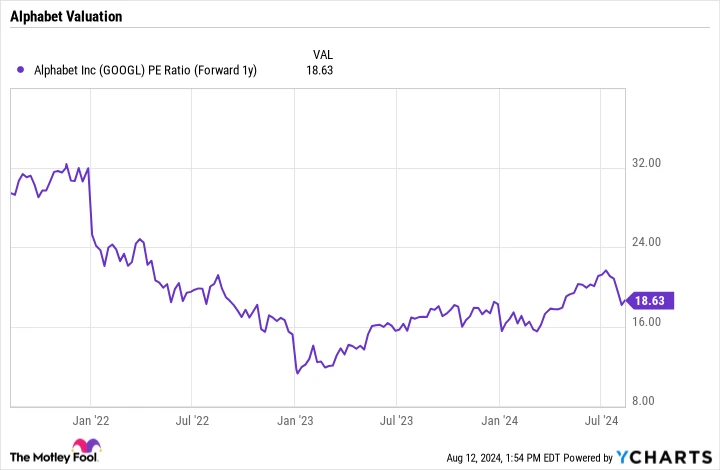

Trading at a price-to-earnings ratio (P/E) that is projected or estimated for the future With a ratio of less than 19, the stock is considered a good deal considering the potential for growth ahead.

Google’s forward one-year price-to-earnings ratio (PE ratio). data by YCharts

Taiwan Semiconductor Manufacturing Corporation is a leading company in the semiconductor industry.

Shares of The company known as Taiwan Semiconductor Manufacturing Company. ( TSM 2.35% ) TSMC, also known as Taiwan Semiconductor Manufacturing Company, experienced a decline in its stock value during the summer due to reports of stricter rules on exporting semiconductors to China. This was compounded by statements made by Donald Trump, a presidential candidate at the time, accusing Taiwan of monopolizing the chip industry at the expense of the United States and suggesting that Taiwan should fund its own military expenses.

While there are potential geopolitical risks associated with investing in TSMC due to Taiwan’s significant role in chip production and the potential impact of any disruptions, it is believed that these risks are exaggerated. Additionally, being the top semiconductor contract manufacturer globally, the company is expected to profit from the expansion of AI infrastructure.

In the second quarter, the company experienced a significant increase in revenue of almost 33%, reaching $20.8 billion compared to the previous year. Furthermore, the company achieved its highest sales month to date in July, with revenue soaring by 45%. To cope with the increased demand, the company is expanding its production capacity. It is anticipated that prices for certain smaller nodes will be raised by up to 10% next year, which is likely to result in substantial growth for the company in the coming year.

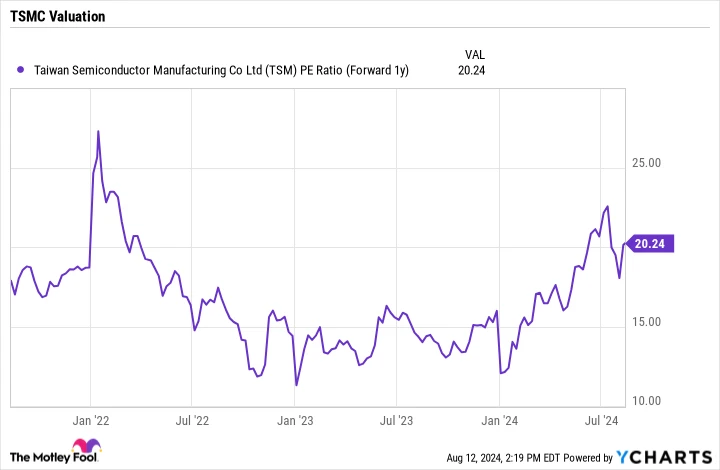

The stock is currently undervalued at a 20 times forward P/E ratio using 2025 analyst predictions, making it a compelling investment opportunity due to its promising growth prospects.

TSM Price-to-Earnings Ratio (Projected for the Next 12 Months) data by YCharts

Credit: Getty Images.

3. Nvidia

Following a period of significant growth, the stocks of Nvidia ( NVDA 4.05% ) They have reduced concerns about the stock rising too quickly and the potential delays for their latest Blackwell chip. Although delays are expected, the strong demand for their chips suggests that it will have little effect on their performance. Customers are still eager to purchase their current-generation Hopper chips.

Even though there are concerns about a potential slowdown in AI infrastructure investment, leading companies in the AI industry indicate that there will be a rise in spending in the future. Currently, customers are more worried about not having sufficient capacity rather than investing too much in it. Furthermore, the more sophisticated… big language models As they grow, they will require more computing power.

For example, Meta Platforms It was recently mentioned that the Llama 4 LLM would require ten times the computing power for training in comparison to the Llama 3. This indicates a significant increase in the computing resources needed. processing units specialized in handling graphics from Nvidia.

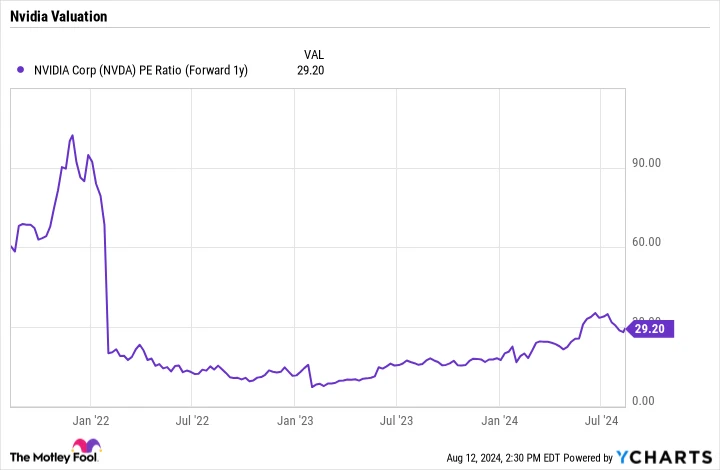

Given the sustained demand, Nvidia’s stock appears to be undervalued, trading at less than 30 times the estimated earnings for next year. It seems like a favorable opportunity to purchase during this price decline.

NVDA’s forward price-to-earnings ratio for the next year. data by YCharts