I’m a longtime Nvidia ( NVDA 4.05% ) I am worried about the current situation with Nvidia stock.

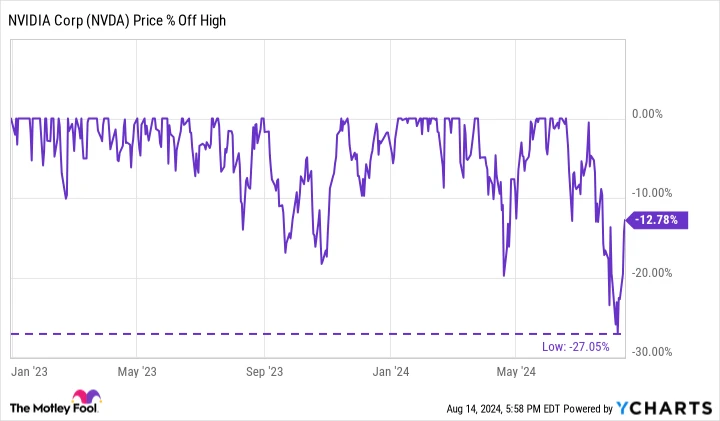

Think about this: Nvidia’s stock has faced its initial 20% decline since the beginning of 2023.

Put differently, a weakness in Nvidia’s position has been identified by the market. While Nvidia has already rebounded from its recent lows and may continue to rise and reach new peaks, should investors be concerned that Nvidia’s impressive long-term growth trend is nearing its conclusion? Let’s explore this further.

Credit: Getty Images.

What is the current situation with Nvidia?

After peaking at $140.76 in June, Nvidia’s stock has dropped by 27%. Although this may not appear significant, it is important to note that Nvidia was previously at its highest value. market cap With a value exceeding $3.2 trillion, it briefly held the title of the world’s biggest publicly traded company.

Throughout its decline, it lost over $650 billion in worth, which is approximately the same as the combined market value of Tesla The tenth largest company in the United States.

Nvidia’s recent decline in stock price is significant, not only due to the financial losses incurred. that could be retrieved in a comparable brief period. No, not bigger Questions have arisen about the sharp decline in Nvidia’s stock price and whether it was avoidable. have been the outcome of A key vulnerability for the company and its stock.

Let’s find out what the numbers indicate.

Comparing Nvidia: How does it stack up?

Certainly: Nvidia’s stock has experienced a significant increase in value in recent years. Now, let’s simplify the reasons for this success. I believe it can be attributed to two main factors:

- Rising sales

- Increasing anticipation of upcoming revenue

In other words Nvidia’s stock price has surged due to a significant increase in its revenue, with expectations for future revenue also on the rise. Can that carry on?

When examining Nvidia’s income for the previous two years, it becomes evident why its stock value has significantly increased. The company has experienced a threefold growth in revenue, soaring from $25 billion annually to more than $75 billion annually, primarily driven by the substantial sales of graphics processing units (GPUs) which power artificial intelligence (AI) applications.

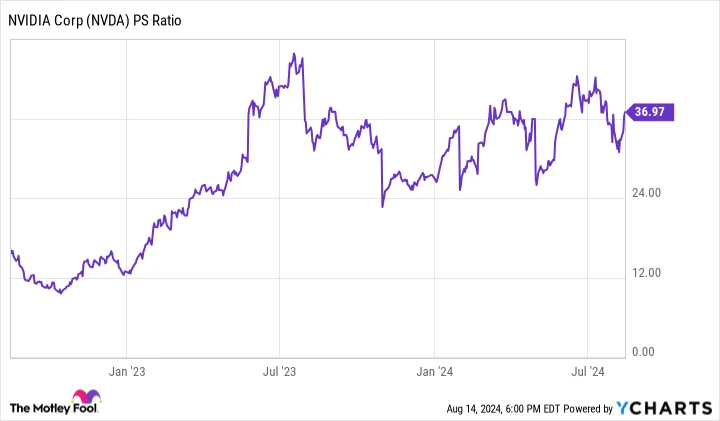

However, the stock’s success cannot be solely attributed to this factor. In addition to the significant increase in revenue, investors have shown a willingness to pay a higher price for every dollar of revenue due to heightened anticipations of future revenue growth. Consequently, Nvidia’s price-to-sales ratio has also climbed. While it was below 10 times in 2022, it surged to an impressive 42 times just a few weeks ago.

NVDA PS Ratio data by YCharts

The reason behind this shift can be attributed to the anticipation of investors for substantial growth in Nvidia’s sales. Analysts predict that Nvidia will see a significant increase in sales, almost reaching $120 billion this year. Nevertheless, this is where apprehensions start to emerge.

If those analysts were to reduce their projections for Nvidia’s revenue growth, or worse, start decreasing their sales estimates, it could raise doubts about the high valuation premium that investors have been willing to pay for the company (as indicated by Nvidia’s P/S ratio). This could consequently lead to a substantial decline in the stock price.

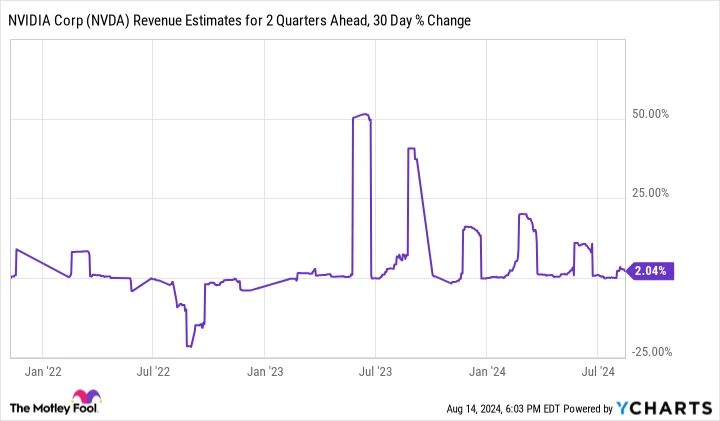

For some To determine if this can be done, let’s analyze the chart displaying the changes made by Wall Street analysts to their revenue predictions in the past three years.

The projected revenue for NVDA for the next two quarters and the percentage change over the past 30 days. data by YCharts

The graph displays the changes made by analysts in their predictions for Nvidia’s upcoming revenue (anticipated for two quarters ahead) in the past month. The highest points on the graph indicate… large Rises indicate positive movements for the stock, while declines indicate negative movements for the stock.

There have been numerous high points compared to low points in the past two years, but the size of these high points has been steadily decreasing. This implies that with every three-monthly report, Analysts are getting closer to meeting Nvidia’s sales forecast. Put differently, reality is beginning to align with the predictions of Wall Street. If that pattern continues, those aspects are expected to balance out next. perhaps Reverse – the company’s guidance might not meet expectations. , and analysts Nvidia will need to lower their revenue predictions, leading to dips in the chart and a decline in the company’s stock price.

What is the key lesson for investors to learn from this?

To sum it up Nvidia’s stock has experienced a rapid and significant increase in value for nearly two years. This growth is mirrored in its sales and projected sales figures. However, the elevated expectations have also inflated the stock’s value, making it susceptible to a sudden decline. Due to this volatility, investors should exercise caution when considering investing in Nvidia stock, as while the company is still positioned favorably for the future, its current unpredictability may not align with the risk profile of certain investment portfolios. right now .