Microcomputers are smaller computers that can perform various tasks. ( SMCI 8.60% ) This year, there has been high demand for the stock, but recently its value has been plummeting. Within a short span of six months, it has dropped by 27%. While its year-to-date performance remains strong at 90%, it seems evident that investors are becoming worried about the possibility of the stock reaching its highest point.

The corporation, also referred to as Supermicro, has seen significant expansion attributed to the adoption of artificial intelligence (AI) by businesses upgrading their servers and IT systems. Supermicro has not only achieved a double-digit growth rate but has also more than doubled its revenue in the last quarter. Nevertheless, relying solely on revenue growth may not be sufficient to drive the stock price much higher. Despite Supermicro’s recent strong growth, investors should be wary of a troubling figure – its gross profit.

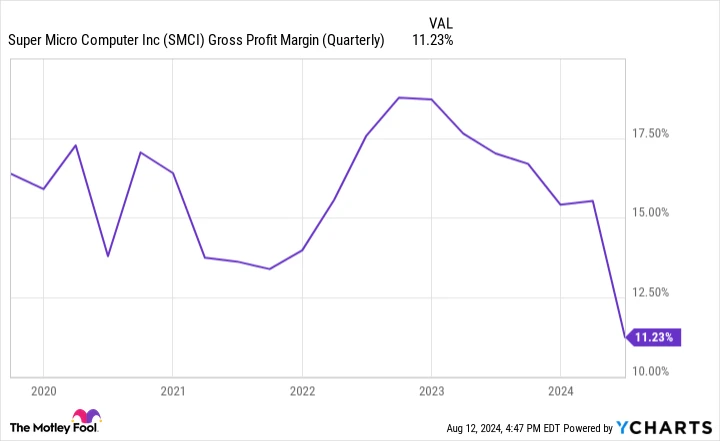

Supermicro’s profit margins have been decreasing.

While sales growth is positive, it may not be significant if a company’s cost of revenue is elevated. When costs are high, the gross profit available to cover operating expenses decreases. Poor profit margins may not translate to improved earnings. This is why investors show optimism towards rapidly growing companies, as they anticipate higher profits, enhanced earnings multiples, and ultimately, a greater stock valuation.

In the previous quarter, ending in June, Supermicro’s gross margin declined to 11%, down from the already modest 17% a year earlier. This indicates that out of every $1 earned in revenue, $0.89 is spent on costs. These costs are solely tied to revenue and exclude marketing, promotional, and administrative expenses.

Supermicro has encountered this issue before.

Supermicro’s business has not typically yielded high profit margins, usually hovering around 15%. However, in the most recent quarter, the margins decreased to a record low.

Quarterly Gross Profit Margin for SMCI data by YCharts

The difference between a company having 11% or 15% profit margins may not seem significant to investors, but it is still important to monitor. The real concern arises if the company’s overhead expenses and other costs begin to rise. For example, in the last quarter, Supermicro had operating expenses that accounted for less than 5% of its sales. If this percentage increases, it could worsen the challenges associated with the company’s narrow profit margins. Moreover, if there is a slowdown in demand, the situation could deteriorate rapidly.

Supermicro experienced a significant increase in revenue, with a remarkable growth of 143% to $5.3 billion. Despite this, the gross profit only rose by 60% to $596.3 million, and the operating income increased by 51% to $343.4 million. While these figures are impressive, there is a concern that Supermicro’s growth rate will eventually decrease. It is unlikely that companies will continue to invest heavily in IT upgrades and servers indefinitely. The surge in AI-related expenditures may slow down next year, particularly if a recession occurs, which could negatively impact the company’s profitability due to its challenging profit margins.

Would it be wise to invest in Supermicro stock?

Supermicro is considered to have a reasonable valuation, even though its profit margins are not very high. Analysts suggest that its current valuation is 15 times its projected earnings, which is not considered high compared to the average valuation of tech stocks. price-to-earnings ratio anticipated in the future of 29.

The stock of Supermicro continues to be a promising investment choice since the company has not traditionally had very high profit margins. Despite this, Supermicro has effectively managed its costs, which enables it to operate successfully even with low margins. Considering its current valuation and the company’s robust performance, the AI stock from Supermicro remains a favorable option for investors.

Supermicro stock remains a good investment option, even if its growth rate decreases, as long as it is valued appropriately. The margin of safety refers to the difference between the actual or estimated sales of a product and the break-even point, which is the point where total revenue equals total costs. This could support holding onto it even in the face of possible challenges in the upcoming period. While there is a degree of risk involved, it might not be significant enough to discourage investors from an opportunity that continues to demonstrate strong potential. AI stock .