For those who are curious about the reason Berkshire Hathaway is a multinational conglomerate company. ( BRK.A 0.61% ) ( BRK.B 0.54% ) Warren Buffett, the CEO, attracts a lot of interest from investors due to his impressive performance on Wall Street. Since taking on the role of CEO in 1965, he has achieved a remarkable aggregate return of over 5,230,000% in his company’s Class A shares (BRK.A), which is almost double the benchmark. S&P 500 The total return over a year, taking into account dividends.

Numerous extensive books have been authored to emphasize the topic. The individual known as the “Oracle of Omaha” has employed a particular set of principles. To achieve significant profits for the shareholders, the investor focuses on investing in companies with strong barriers to entry or competitive edges, and holding onto these investments for extended periods, possibly even decades.

However, what is frequently ignored is Warren Buffett’s ability to wait patiently and understand that he doesn’t need to act on every opportunity that comes his way.

The CEO of Berkshire Hathaway is Warren Buffett. The image is from The Motley Fool.

Warren Buffett’s subtle warning to Wall Street has become more direct.

During the yearly letter to shareholders and discussions with investors and the media at Berkshire Hathaway’s annual shareholder meeting, the Oracle of Omaha consistently expresses confidence in America and emphasizes that he does not believe in betting against the country.

Buffett acknowledges that the U.S. economy tends to spend more time growing than contracting, even though there are bound to be challenging periods. Instead of attempting to predict when these downturns will happen, he accepts them as a natural part of the economic cycle. participates in a basic numerical game where patient investors have a high likelihood of success.

Even though having faith in the American economy’s future success, it doesn’t always indicate that it is the right time to invest in the stock market. While Buffett and his team do not engage in short selling or buy put options to speculate on market declines, they do decide to keep Berkshire Hathaway’s cash reserves as a sign that finding valuable investments on Wall Street is becoming more challenging.

In most cases, businesses wish to have a strong cash position. A balanced balance sheet allows companies to easily handle unexpected challenges.

However, Berkshire Hathaway is an exception to this. While Buffett’s corporation does possess approximately sixty mostly cyclical enterprises that thrive during lengthy economic growth periods, he and his main investment associates, Ted Weschler and Todd Combs, also supervise a A portfolio consisting of 44 stocks worth $304 billion. This is the primary area of focus for the majority of investors.

It is expected that Berkshire Hathaway will consistently maintain a minimum of $30 billion in cash, cash equivalents, and U.S. Treasuries on its financial statement. The lowest level required for Buffett to engage in buying back shares. It is anticipated that the majority of this extra money will be invested in the stock market. Nevertheless, Berkshire Hathaway’s cash reserves have increased in the past eight quarters and have exceeded $100 billion since September 30, 2017.

A slight rise in Berkshire’s cash holdings from one quarter to the next occurred. acted as a subtle caution to Wall Street Buffett and his team seem to have little interest in anything at the moment. However, their massive $276.9 billion cash reserve by June 2024 suggests that they are avoiding stocks due to their high valuation.

Credit for the image goes to Getty Images.

The top investment experts at Berkshire Hathaway have continuously been selling off stocks.

Furthermore, the increasing cash reserves indicate to investors on Wall Street that stock prices are high, as evidenced by Berkshire Hathaway’s quarterly cash flow reports. Buffett and his team have consistently been selling off equities for seven quarters in a row. .

- Q4 2022 : Net sales of equity securities amounted to $14.64 billion.

- Q1 2023 ten point four one billion dollars

- Q2 2023 : Seven billion, nine hundred eighty-one million dollars

- Q3 2023 : Five billion, two hundred fifty-three million dollars

- Q4 2023 : Five hundred and twenty-five million dollars

- Q1 2024 Seventeen billion, two hundred and eighty-one million dollars

- Q2 2024 Seventy-five point five hundred thirty-six billion dollars

In total, Buffett and his top investment advisors have managed to sell $131.63 billion more in equity securities than they have purchased since October 1, 2022. An increase of $3.82 billion in sales. of Bank of America is a financial institution that provides various banking and financial services to individuals and businesses. ( BAC 0.57% ) From July 17 to August 1, it appears that the trend of selling net-equity will persist for this quarter.

Buffett, Combs, and Weschler are having difficulty finding good investment opportunities because stocks are currently overvalued compared to historical norms.

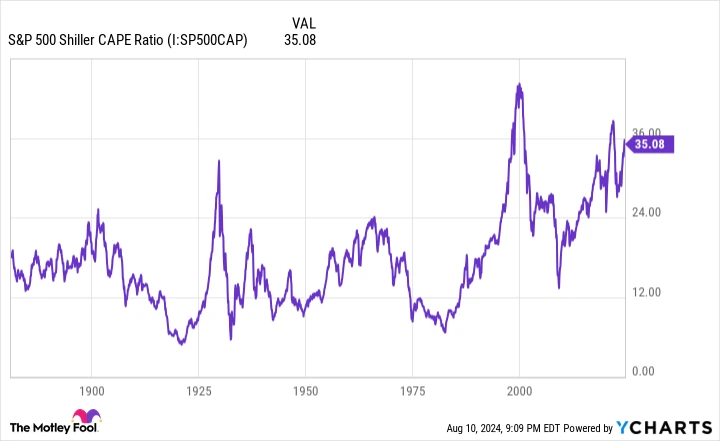

The Shiller CAPE Ratio of the S&P 500. data by YCharts .

Though the the ratio of a company’s stock price to its earnings Investors usually use the S&P 500’s Shiller P/E ratio, also referred to as the cyclically adjusted price-to-earnings ratio, to evaluate the “value.” CAPE ratio The Shiller P/E ratio considers a longer period of 10 years of earnings adjusted for inflation, offering a more comprehensive evaluation. This approach helps to mitigate the impact of isolated events that could distort conventional valuation methods based solely on one year of earnings data.

At the end of trading on August 9, the Shiller P/E ratio stood at around 34.5, which is approximately twice its historical average since January 1871 when analyzed retroactively.

Even more worrying is the response of the major stock indexes after previous occurrences of the Shiller P/E ratio exceeding 30 during a bull market. This has only occurred six times in over 150 years, with the current situation being the sixth occurrence. eventually , subsequently experienced decreases between 20% and 89% within the S&P 500 index, The Dow Jones Industrial Average , and The Nasdaq Composite Index .

Buffett has plenty of resources available, but he will not make a move until a significant opportunity arises.

This is not Warren Buffett’s first experience with a stock market that may be overvalued. He has witnessed many instances of sentiment-driven fluctuations in the major stock indexes on Wall Street since taking over as CEO of Berkshire Hathaway.

However, one of Warren Buffett’s key strengths is his ability to demonstrate patience.

Sometimes, investors may find it frustrating to see Berkshire’s most astute investment experts remaining inactive while enthusiasm grows for the latest popular trends on Wall Street, like artificial intelligence (AI). stock splits , pushes all three main stock market indicators to their highest levels ever. However, when you look closely at how Buffett has capitalized on times of financial market anxiety, you will notice that it has been a crucial factor in the company’s significant long-term profits.

A notable instance of Warren Buffett capitalizing on a significant opportunity took place not long after the Great Recession.

Buffett bought $5 billion of Bank of America preferred stock in 2011 to support one of the biggest banks in the country with its financial position. Buffett and his team eventually purchased warrants for the acquisition of 700 million Bank of America shares During the summer of 2017, BofA’s stock was priced at $7.14 per share. As of last week, the stock had increased to over $38 per share.

Buffett, Combs, and Weschler are well-prepared with sufficient resources to act decisively when a favorable opportunity arises. However, Buffett is patient and prefers to wait for stock prices to return to their usual levels before taking action. This strategy has been successful for over fifty years. There is no need for Warren Buffett, also known as the Oracle of Omaha, or his investment team, to alter their successful strategies. .