Drugs like Ozempic, Wegovy, Mounjaro, and Zepbound are gaining popularity in the pharmaceutical sector for their weight loss benefits. Eli Lilly and Novo Nordisk The leading companies in the field of diabetes and obesity treatment owe their success to their glucagon-like peptide-1 (GLP-1) agonists. However, there are several other companies aiming to overthrow these established industry leaders.

In general, competitors are putting large amounts of money into. exploration and invention to introduce their own GLP-1 medications to the market.

A new company that has recently joined the market for weight loss products without A unique drug is the telemedicine company. The health company named Hims & Hers. ( HIMS 1.81% ) Rather than creating a new solution to compete with current treatments, Hims & Hers joined the weight loss competition indirectly by providing options to patients. variations of Ozempic and other similar treatments.

I view this strategy as both contentious and potentially leading to significant negative consequences for the company.

What are weight loss medications that are combined or mixed together called?

Have you visited a major city where street vendors are selling counterfeit designer handbags and clothing that closely resemble items found in retail stores?

The main distinction between these more affordable options and products available at a well-known store is that these imitations are probably crafted from cheaper materials and may not have the same durability as the authentic items. These reproductions lack the support of a major corporation with significant financial resources and a reputable brand name.

The idea of compounded medications is alike.

Semaglutide is the main active ingredient in both Ozempic and Wegovy, and Novo Nordisk is the company that holds a significant stake in these products. Intellectual property refers to creations of the mind, such as inventions, literary and artistic works, and symbols, names, and images used in commerce. The unique chemical composition of semaglutide makes it extremely difficult to replicate on a molecular scale.

When it comes to weight loss drugs, compounded semaglutide might include components that undergo testing in studies but are not included in the final FDA-approved formulation of the medication, potentially due to safety concerns.

According to the FDA, compounded medications do not have FDA approval, which implies that the FDA does not assess the safety, efficacy, or quality of compounded drugs prior to their release in the market.

Credit: Getty Images.

What is the reason behind Hims & Hers’ actions?

Ozempic, Mounjaro, and other similar treatments come with a high price tag that cannot be denied. Conventional GLP-1 agonists can amount to almost $1,000 per month if paid for out of pocket. Health insurance company Will not pay for the expenses.

As per the information on the Hims & Hers website, the company’s reason for providing compounded GLP-1 injections is to give customers the opportunity to use medications containing the identical active ingredient found in Ozempic® and Wegovy® without having to deal with the current challenges of shortages and high prices that are restricting access to the branded drugs.

It is widely known that individuals are willing to go to extreme lengths to shed weight. However, it seems that Him & Hers is aiming to enhance its profits by focusing on the concept of “body politics” rather than prioritizing high-quality healthcare services.

Comparing their compounded semaglutide to Ozempic and Wegovy because they all contain the same active ingredient is similar to claiming two shoes are identical just because they have shoelaces. Using a compounded semaglutide is not at all comparable to taking Ozempic or Wegovy, as it is an unregulated product.

The scarcities leading individuals to opt for combined GLP-1 agonists may be temporary. This year, Novo invested $16.5 billion in the purchase of multiple manufacturing plants. from Catalent The main reason for the agreement was to enhance its current manufacturing capacities and boost production for Ozempic and Wegovy.

Lilly proceeded to acquire its own company following this model in April. Lilly purchased a facility that produces injectable medications from Nexus Pharmaceuticals. to boost the availability of Mounjaro and Zepbound.

I advise investors against believing that Hims & Hers will come to the rescue as Eli Lilly and Novo Nordisk are struggling to meet expectations. The amount of a product or service available and the desire of consumers to purchase it. dynamics.

Why do I anticipate a decrease in the future?

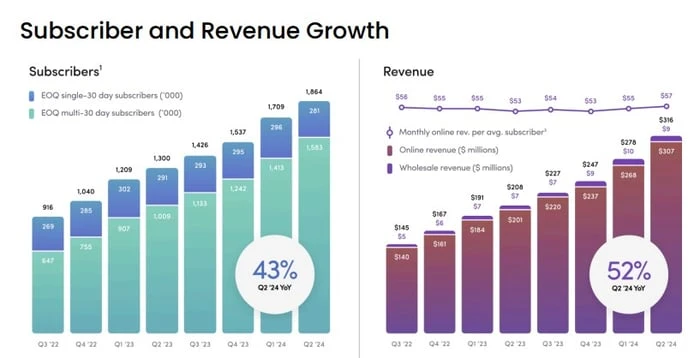

Up to this point in 2024, the stock of Hims & Hers has increased by 74%, surpassing the performance of others. S&P 500 and The Nasdaq Composite Index Most of these profits are likely due to the significant expansion in the company’s subscription services.

Photo credit: Hims & Hers.

The data shown in the charts suggests that Hims & Hers has been effective in gaining and retaining subscribers, but I believe that their decision to enter the compounded semaglutide market may have negative consequences.

The FDA cautions that a significant concern with compounded GLP-1 medications is the potential for dosing mistakes, which can occur when patients incorrectly measure and administer doses of the medication themselves or when healthcare providers make errors in calculating the doses.

If patients who are prescribed compounded semaglutide from Hims & Hers encounter serious health problems, the company may find itself in the midst of a challenging public relations crisis and may potentially be subject to legal actions or penalties imposed by the Department of Justice (DOJ).

Conversely, although both Lilly and Novo shares have experienced significant growth in the past year, it seems that each company has distinct characteristics. to have a strong and well-defined plan for the future ahead — indicating that patient investors may experience additional increases in the future.

Bolder investors may be interested in exploring a quantity of options for Lilly and Novo Companies that are investing a lot of time and money in drug development currently. However, I believe there is too much risk associated with Hims & Hers at the moment. The company may have taken on more than it can handle, potentially sacrificing short-term growth.

Investors seeking to invest in the weight loss industry should focus on established companies with a strong presence and avoid risky investments like Hims & Hers.