The Chief Executive Officer of the company is Warren Buffett. Berkshire Hathaway is a multinational conglomerate company. ( BRK.A 0.61% ) ( BRK.B 0.54% ) He is famously referred to as the Oracle of Omaha, a recognition of his exceptional investment skills that have resulted in Berkshire Hathaway’s stock outperforming others. S&P 500 Investing in Berkshire Hathaway can lead to good returns in the long run, but it is not advisable to pursue high returns by buying this stock. It is recommended to have a thorough understanding of the company before considering owning shares of Berkshire Hathaway. Here are some reasons why you may not want to invest in this renowned company on Wall Street.

Contents

Berkshire Hathaway is not experiencing much progress today.

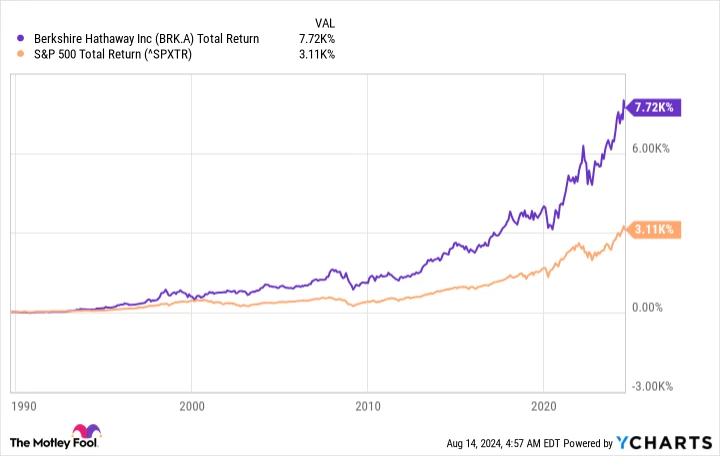

While Berkshire Hathaway has consistently outperformed the S&P 500 in the long run, it’s important to note that this is based on past performance and does not necessarily indicate future results, as all investors are cautioned.

Total return level of Berkshire Hathaway Class A shares. data by YCharts

This is significant today because a highly influential individual, Warren Buffett, has expressed his views on the future of Berkshire Hathaway. In the 2023 annual report of the company, he mentioned, “Overall, we do not foresee any exceptional performance.” This perspective is influenced by various factors such as the high market valuations currently prevalent and the scale of Berkshire Hathaway’s operations.

The main point to remember is that Buffett is advising investors to lower their expectations for Berkshire Hathaway. If you are looking to invest in a company that will significantly surpass the market as it has done previously, that is unlikely to occur.

Berkshire Hathaway is a massive and intricate organization.

Certain investors prefer to deeply understand the companies they invest in. If you are one of those individuals, you may not appreciate Berkshire Hathaway due to its immense size, valued at $900 billion. market cap It can be challenging to understand the company as it is essentially a huge conglomerate, comprising significant ventures in insurance, utilities, pipelines, and railroads. These four divisions are usually analyzed individually. balance sheet Furthermore, the company possesses various smaller enterprises that operate in a range of sectors from retail to manufacturing, and everything in between. The annual report of the company extensively covers the detailed description of its business operations, unlike most companies that typically require only a brief overview in their reports.

Furthermore, there is also the collection of stocks owned by an individual or entity Berkshire Hathaway has significant investments in publicly traded companies without holding controlling stakes. The portfolio is focused on a select few stocks, which can be adjusted frequently. For example, Buffett made changes to the portfolio recently. half were sold Berkshire Hathaway’s ownership share in technology giant Apple .

Overall, it is challenging, if not unfeasible, to closely monitor the activities happening within Berkshire Hathaway with significant accuracy. Trust is required in this situation. Buffett’s method of managing a company If you like to have control, owning Berkshire Hathaway may be challenging for you.

Berkshire Hathaway is preparing for a significant transformation.

For many years, Berkshire Hathaway has served as the investment platform for CEO Warren Buffett. His business partner played a crucial role in supporting him on the path to achieving remarkable success. Charlie Munger , who passed away in 2023 at the age of 99. He was not significantly older than Buffett. Consequently, it is very probable that a new CEO will be taking over the leadership of Berkshire Hathaway in the near future.

Buffett has addressed the succession concern by appointing Greg Abel as his likely successor. Abel has been a part of Berkshire Hathaway for a considerable period and is well-versed in the company’s culture, which is promising. However, it remains uncertain how he will steer the company until he assumes the leadership role. Chosen successors may not always meet expectations, as seen in past instances. The company known as General Electric. and Disney Demonstrated can result in negative consequences for investors. Additionally, it should be highlighted that Berkshire Hathaway has evolved significantly from the company that existed when Buffett achieved his impressive performance history. The organization that Abel is set to lead is now significantly bigger and more intricate.

If you want to invest with Buffett, then Berkshire Hathaway is the best option. However, it is uncertain how much longer Buffett will remain as the CEO. If you are concerned about significant changes in management, then investing in Berkshire Hathaway at present may not be suitable for you.

Berkshire Hathaway is a reputable company, however…

Purchasing or possessing Berkshire Hathaway is perfectly fine as it is a reputable and efficiently managed corporation with a successful track record. However, it may not be suitable for all investors. Expecting the same level of performance from the company as it had when it was smaller may lead to disappointment. Gaining a thorough comprehension of your investment in this large company may prove challenging. Additionally, if you are investing primarily because of Warren Buffett, it is worth noting that a new CEO will be taking over from him in the near future.