Devon Energy ( DVN 2.13% ) This company is a good choice for those interested in an upstream energy company. However, if you are seeking a high-yield energy stock within the energy sector, there are better options available. Beginning with this MLP that offers a yield of 7.4%, could be a solid starting point.

The major drawback of Devon Energy’s high yield.

Devon Energy achieved a record high in oil production during the second quarter of 2024. The company raised its annual production forecast for the second quarter in a row and also enhanced its share repurchase program. Additionally, Devon Energy is actively growing its assets through acquisitions and has identified a substantial amount of drilling prospects that can sustain operations for at least a decade. This makes it an attractive choice for investors interested in upstream activities. entity that generates power .

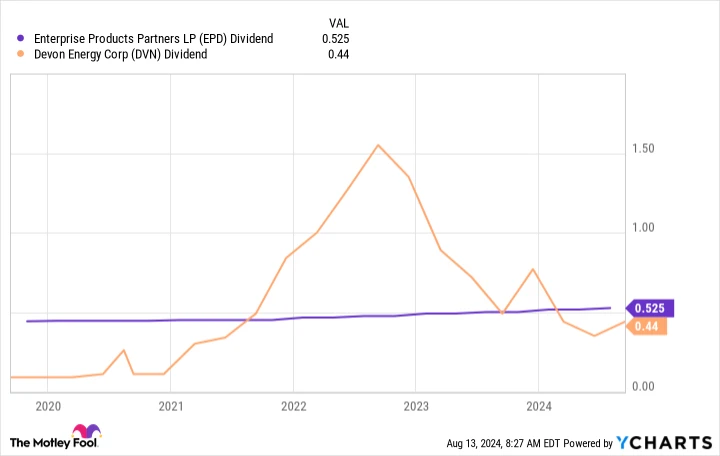

If you are seeking a stock with a high yield, you might be surprised. the percentage of a company’s stock price that is paid out as dividends The current rate is approximately 4.4%, significantly surpassing the market’s low 1.2% rate and exceeding the average energy stock’s 3.1% yield by over a percentage point. Energy Select Sector SPDR ETF is an exchange-traded fund focused on the energy sector. Devon’s dividend payment can fluctuate significantly from one quarter to the next as it is dependent on the financial performance of the energy company. This means that the income generated from Devon may not be reliable during periods of declining energy prices, as the company’s financial results will also suffer when oil prices decrease.

Enterprise Products Partners has experienced 26 consecutive years of growth.

On the opposite side of the reliability scale is Enterprise Products Partners is the name of the company. ( EPD 0.45% ) , which has expanded its distribution for 26 years in a row. This energy company has a credit rating of investment grade. A master limited partnership is a type of business structure that combines the tax benefits of a partnership with the liquidity of publicly traded securities. Enterprise MLP has a distribution coverage ratio of 1.7, indicating it generates more distributable cash flow than needed. The company prioritizes stability, evident from its successful track record in providing consistent returns to investors seeking high yields. Moreover, Enterprise MLP offers an attractive distribution yield of 7.4%, making it a top choice for those interested in high-yield energy investments.

The crucial point in the narrative is that Enterprise is not a company that generates energy like Devon. Instead, it operates in the midstream sector, owning the energy infrastructure. pipelines , which facilitate the transportation of oil and natural gas globally. This is a significant development for individuals seeking dividends from their investments.

Devon’s financial performance is significantly impacted by energy prices, whereas Enterprise generates revenue by charging fees for the utilization of its crucial infrastructure assets. The value of the energy resources passing through its network is not as crucial as the demand for energy itself. Energy demand typically remains robust even during periods of low energy prices. As a result, Enterprise experiences consistent cash flows over time, enabling the company to distribute substantial payments throughout the entire energy market cycle.

EPD Dividend data by YCharts

Profit expansion is achieved through higher rates, additional assets, and obtaining other businesses. However, the potential for growth is limited, so investors should be aware that most of the returns will come from the yield. If you are seeking high-yield stocks, this should not be a concern for you.

Enterprise is the trustworthy option.

There are compelling arguments for dividend investors to include Devon Energy in their portfolio, as the dividend is likely to increase at the same time as your everyday energy expenses, such as fuel and heating costs. This can act as a safeguard against rising living expenses. However, for those aiming to establish a substantial and dependable income flow, opting for a high-yield investment like Enterprise Products Partners would be more beneficial. The company’s operations prioritize stability, leading to a consistent rise in distributions over time.