Having high standards is not a negative thing as long as you meet the requirements. This is a software company that specializes in data analytics and artificial intelligence (AI). Palantir Technologies is a company that specializes in data analysis and software development. ( PLTR 0.71% ) This occurred when Palantir disclosed its Q2 earnings, leading investors to quickly purchase shares. While AI has received significant attention in recent years, Palantir stands out as one of the companies actually achieving tangible outcomes.

The main question at hand is whether the financial results of Palantir warrant investing in a stock that has gained significant popularity on Wall Street.

Here is the information you should be aware of.

The progress of artificial intelligence continues to gain momentum.

Palantir gained recognition by collaborating with the government. By utilizing its platforms, Gotham and Foundry, the company creates personalized software that processes data instantly. Although Palantir emphasizes that its technology does not supplant human intelligence, augments it Palantir’s technology has been instrumental in supporting the U.S. government with sensitive operations, such as reportedly assisting in the discovery of notorious terrorist Osama bin Laden in the past.

Currently, Palantir maintains a strong connection with the government, from which it receives more than half of its overall revenue. The remaining revenue is generated through Palantir’s entrance into the private industry, where it utilizes its technology to assist businesses in a range of areas, such as enhancing supply chain efficiency and detecting fraudulent activities.

In the previous spring, the company introduced AIP, a platform specifically designed for business purposes. AI CEO Alex Karp’s applications. has observed the significant need AIP has had a notable impact on boosting the company’s revenue growth since last summer.

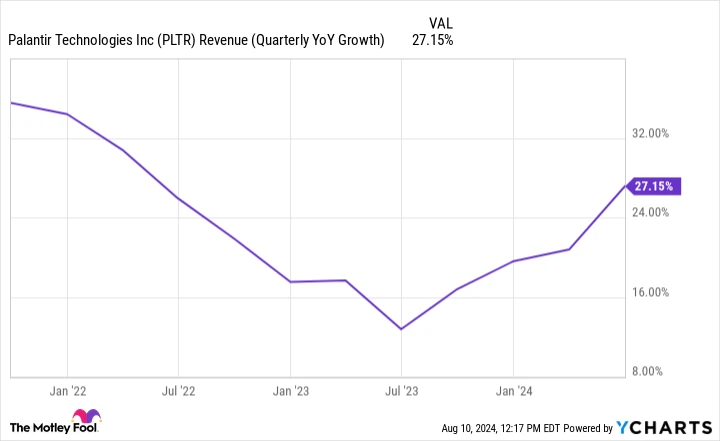

Data by YCharts .

The financial results for the second quarter indicate that the momentum of artificial intelligence remains robust. The number of commercial customers in the United States has risen to 295, marking an 83% increase compared to the previous year and a 13% rise from the last quarter. Moreover, the total value of agreements that are yet to be invoiced for U.S. commercial clients has surged by 103% since the same period last year. Essentially, Palantir’s commercial expansion is not only significant but also accelerating. However, it is continuing to increase in speed. .

There were additional useful pieces of information Palantir’s Q2 results were notable primarily due to its significant progress in the field of artificial intelligence.

According to the financials, Palantir is believed to have a competitive advantage.

The financial performance of the company continues to get better, indicating that Palantir possesses competitive strengths and a distinctive product. Two specific metrics stand out in this regard.

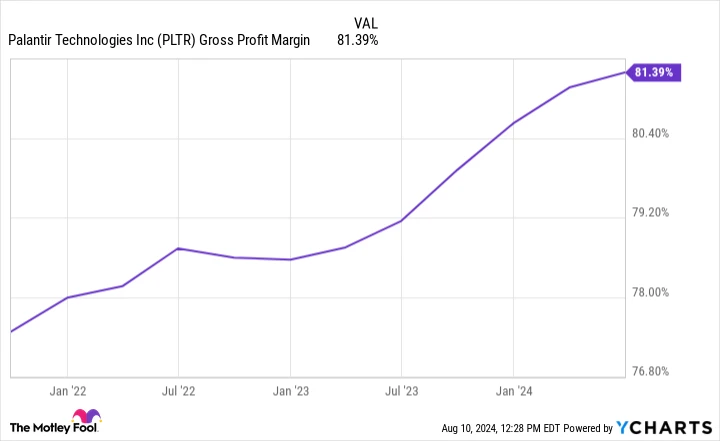

Palantir’s initial step was to… The gross profit margin is a financial metric that represents the percentage of revenue left after deducting the cost of goods sold. is continuing to rise, indicating that Palantir has the ability to set prices.

Data by YCharts .

Moreover, the Rule of 40 metric of the company reinforces this idea. This rule calculates a company’s ability to grow profitably by combining its revenue growth rate and the percentage of revenue converted into operating income. It helps identify businesses that may be growing unsustainably by selling products at a loss. As the name suggests, companies should aim for a total of at least 40 when adding their revenue growth rate and operating margin. Palantir had a strong adjusted operating margin of 57% in Q1, which increased to 64% in Q2.

A rising Rule of 40 score also signifies a robust business model.

Is the effort put into the stock worth the potential reward?

These figures indicate a successful company, however, it is equally important to consider the cost you are willing to pay.

The stock is currently valued at more than 85 times its projected earnings for 2024. While a strong growth rate could support such a high valuation, it is challenging to argue for it in this situation. Based on the latest consensus from analysts, Palantir is expected to increase its earnings by an average of 24% per year over the next three to five years.

Investors have the ability to utilize PEG ratio When assessing a stock, I typically aim for a Price/Earnings to Growth (PEG) ratio of 1.5 or lower to evaluate its valuation relative to its growth potential. maybe An outstanding company typically has a PEG ratio of 2. However, Palantir’s PEG ratio is currently 3.5, which is significantly higher. This means that the company would need to greatly exceed expectations in the future in order for its current stock price to be considered a good investment.

Is it possible for that to occur? Certainly, however, it seems that the potential downside outweighs the potential upside in this situation. In case the market becomes unstable again, similar to what happened a few weeks ago, investors may have the opportunity to purchase shares at a lower, more attractive price. A reasonable price is sufficient for a long-term investor interested in a stock like this.