Regrettably, the current conflict in Ukraine and increasing hostilities in the Middle East following the terrorist attack on Israel last year serve as distressing examples of the harsh realities of war. The United States’ prominent role in global politics often leads the country to become involved in such crises.

It may be challenging to overlook the human impact of war, and not everyone is comfortable with investing in companies that create and sell weapons and technology for the defense of America and its interests.

For individuals interested in stable and reliable defense stocks, there are choices available. Two excellent illustrations are stocks that are projected to provide dividends over a long period and are currently priced fairly.

These two defense stocks have a competitive edge due to their wide range of products and services.

Northrop Grumman is the name of a company. ( NOC 0.52% ) and Lockheed Martin is an American aerospace and defense company. ( LMT 0.68% ) They distinguish themselves with a wide range of products that cover various domains such as land, air, sea, and space, filled with essential products that are important for both offensive and defensive purposes in the United States.

Northrop Grumman has four divisions: Aeronautics, Defense, Mission, and Space. In addition to the well-known stealth bomber, the company manufactures various other products such as unmanned vehicles, space launch vehicles, cyber systems for offense and defense, missile defense systems, interceptors, and more.

Lockheed Martin runs four separate divisions: Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space. The company manufactures well-known military assets for the United States such as Black Hawk helicopters, F-35 Lightning fighter jets, Javelin missiles, naval weapons systems, antiballistic missile defense systems, and other products.

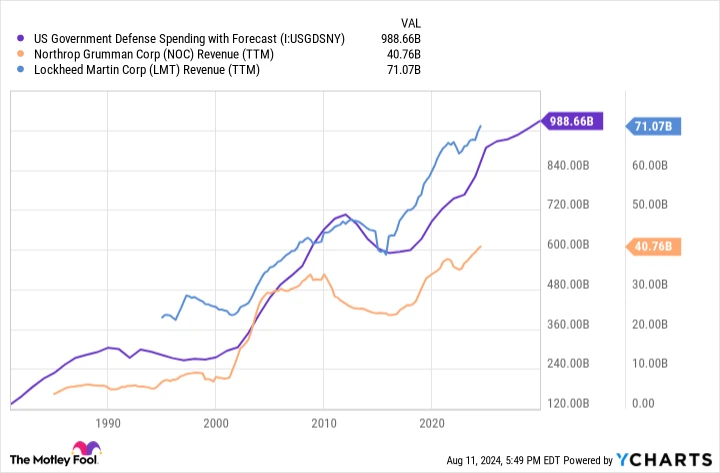

Both companies mainly cater to the U.S. military, which consistently increases its expenditure. Although the U.S. Defense budget may face occasional scrutiny and cuts, military spending tends to rise over time, leading to growth for Northrop Grumman and Lockheed Martin.

Forecast of United States government defense expenditures. data by YCharts

Reliable dividends

Investors can gauge a company’s performance by evaluating its track record of consistently increasing dividends, particularly in the defense sector. Consider the substantial investment required for research and development to create cutting-edge defensive and offensive technologies. Additionally, the production of such equipment is both costly and complex. On top of these challenges, these companies also allocate funds for dividend payouts, adding to their financial commitments. and raise it annually!

Simply put, Northrop Grumman and Lockheed Martin face challenges in their operations. They require exceptional leadership to create cutting-edge products, expand the business successfully, and still have enough funds for increasing dividends.

Both Northrop Grumman and Lockheed Martin have consistently increased their dividends over the years. Northrop Grumman has raised its dividend for 21 years in a row, while Lockheed Martin has done so for 22 years. This includes navigating through the financial crisis of 2008-2009 and the COVID-19 pandemic. Both companies provide a strong combination of dividend yield and growth. Northrop Grumman currently offers a starting yield of 1.7% and has achieved a 10-year annualized growth rate of 11.9%. On the other hand, Lockheed Martin’s starting yield is 2.3%, with a 10-year annualized growth rate of 9.8%.

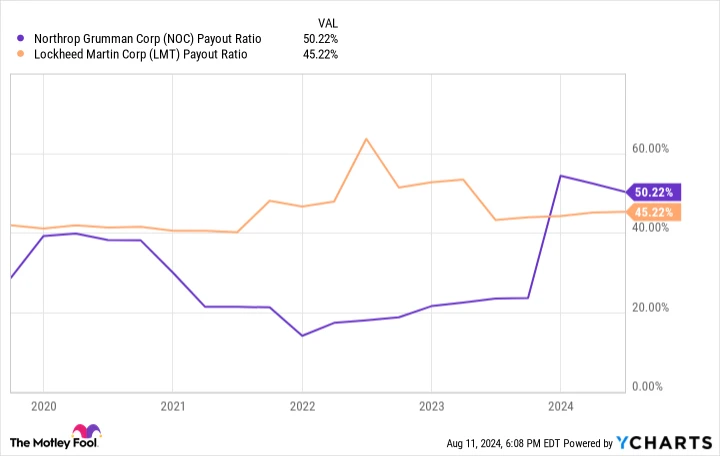

Dividend growth surpasses inflation by a significant margin, and both companies have ample space for further growth. The percentage of earnings that a company pays out to its shareholders as dividends. earn about half of their income.

NOC Dividend Coverage Ratio data by YCharts

In conclusion, both companies have key military projects that are expected to drive continuous growth and support dividend payments in the future. Northrop Grumman is working on the B-21 Raider, a cutting-edge stealth bomber that is anticipated to be in development until the 2050s and bring in more than $200 billion in value over its lifespan.

In the meantime, Lockheed Martin has gained attention for its F-35 Lightning II program, which is considered the biggest weapons project globally. It is projected to be worth $2 trillion over its lifetime, with plans to continue until 2088. While Northrop Grumman and Lockheed Martin have other projects, these programs provide insight for investors into the companies’ future outlook.

Both stocks are priced fairly at the current time.

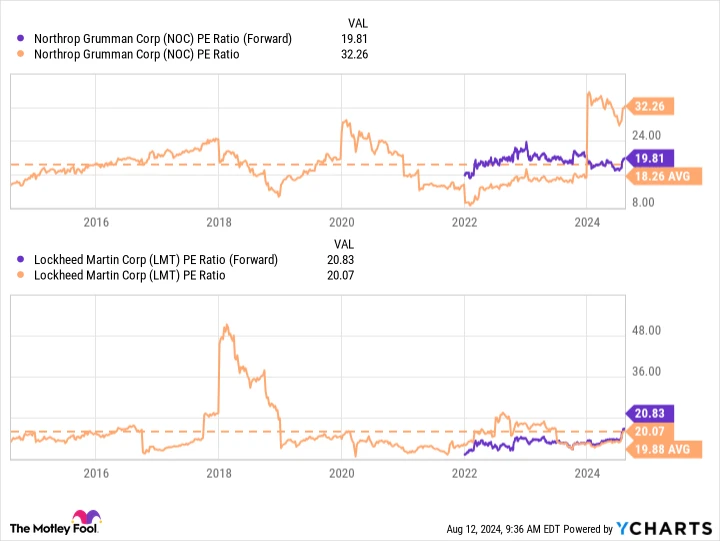

Defense industry stocks have experienced an increase in value in the last year, mainly influenced by the ongoing events in Ukraine and the Middle East. However, Northrop Grumman and Lockheed Martin remain affordable options, as their stock prices are trading near their typical levels. the ratio of a company’s stock price to its earnings per share over the last ten years:

Forward NOC PE Ratio data by YCharts

Both stocks have performed better than expected. S&P 500 In the future, it remains to be seen if the strong performance will persist. However, it is evident that both companies are prepared to consistently increase dividend payouts for investors in the coming days.