I am of the opinion that a chain of retail stores specializing in car parts Auto Parts Advance ( AAP 0.52% ) In a few years, the company has the potential to generate $1 billion in profit annually. Currently, the stock is significantly undervalued according to my unconventional belief.

At present, the stock of Advance Auto Parts has dropped approximately 75% from its peak in 2021. It is often disregarded by investors due to its unexciting and potentially obsolete nature. Consequently, few are paying attention to the company’s efforts to enhance its profitability in the coming years. This overlooked situation presents an opportunity that I aim to bring to attention.

Here is the reason why Advance stock is underperforming.

Based on findings from the study S&P Global Vehicle age on American roads is increasing, with the average age of cars and light trucks being 12.6 years in 2024. Passenger cars are even older, with an average age of 14 years.

Furthermore, it should be noted that non-mortgage debt in the United States is reaching record levels, standing at $4.9 trillion as of the second quarter of 2024, as reported by the Federal Reserve Bank of New York. Given the current high interest rates, it may not be the best time for individuals to acquire more debt to purchase new vehicles. In simpler terms, this scenario suggests that it is more likely for people to continue using their existing vehicles for a longer period of time.

Auto-parts retailers like Advance Auto Parts play a crucial role in this scenario. Even though the company’s stock performance has been weak, there is still a strong demand for its products. Consumers are consistently investing in maintaining their older vehicles. Sales from stores that have been open for a certain period of time, typically a year or more. The company experienced a slight decrease of less than 1% in sales during the first quarter of 2024, as well as in its fiscal year 2023. However, it is important to note that this decrease follows a period of exceptionally high sales.

In terms of value, Advance’s competitors O’Reilly Automotive is the name of the company. ( ORLY 1.30% ) and Autozone ( AZO 1.28% ) They are also facing unprecedented levels of demand, which is a common trend in the industry.

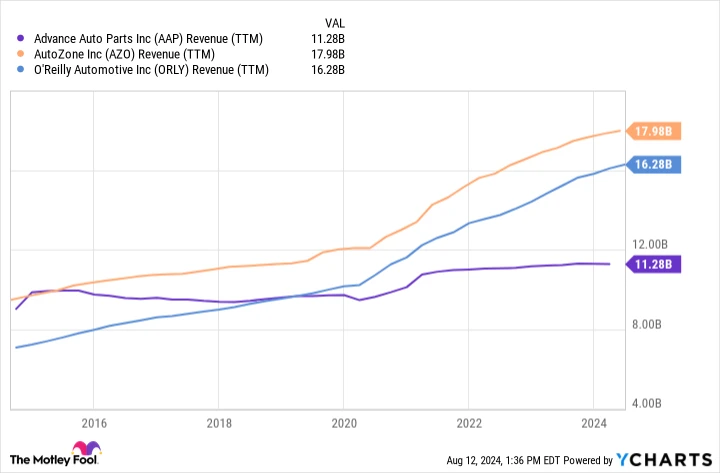

AAP Total revenue over the trailing twelve months. data by YCharts.

Over the last five years, Autozone and O’Reilly’s shares have seen returns that are more than twice the initial investment. S&P 500 , while Advance stock has significantly lagged behind. The reason behind this stark difference in performance is quite apparent. Both Autozone and O’Reilly have outperformed Advance stock. profit margin On the other hand, the profit margin for Advance has fallen significantly, dropping to less than 1%.

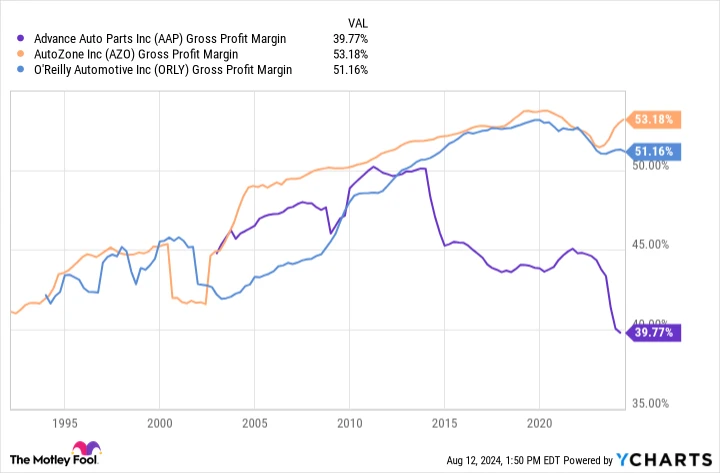

For over ten years, Advance has consistently fallen behind its competitors in terms of profit margins. This can be attributed to the company’s inefficient supply chain operations that have been in place for a considerable period of time. The gross profit margin is a measure that indicates the profitability of a company by comparing its revenue from sales to the costs directly associated with producing the goods or services sold. The text indicates that the company’s performance has fallen behind the industry average, although a comparison chart reveals that it used to be on par with its main competitors in the past.

AAP Gross Profit Margin is the percentage of revenue that exceeds the cost of goods sold, indicating how efficiently a company is producing and selling its products. data by YCharts.

The diagram above illustrates a sharp decrease in Advance’s gross profit margin, which occurred at the same time as a significant acquisition. Following this acquisition, the company has been running two separate supply chains, leading to a lack of efficiency in overall operations and causing margins to decline.

The current situation is unique for Advance stock.

Doing the same thing and hoping for different outcomes is not effective, that’s why I’m pleased to announce that Advance is now moving away from the usual way of doing things. In September, the company appointed Shane O’Kelly as its new CEO. Shane O’Kelly is an expert in supply chain management and previously served as the CEO of HD Supply, which is the main reason he was chosen for the position.

The supply chain analysis has been finished, and Advance has determined that it requires a total of 14 distribution centers to operate efficiently. Currently, the company has 13 out of the needed 14 centers and is in search of one more suitable facility. It is worth noting that the company currently operates 38 distribution centers, which is more than twice the number required for optimal functioning.

The upcoming extensive restructuring highlights the inefficiency of Advance’s current operations. However, there is hope for improvement as the transformation is set to commence, although it will require several years to fully implement. The changes are expected to boost profitability in the long run.

I think a restructured Advance could achieve a profit margin of 10%, which is lower than its competitors. This goal is not overly difficult to reach. To provide context, the company generated over $11 billion in sales in 2023. If it can maintain sales above $10 billion, it would result in over $1 billion in annual revenue. net income in this situation.

The total value of a company’s outstanding shares of stock. As of the current time, Advance stock is valued at $3.6 billion. If it is traded at a ratio of 10:1… the profit it will make in the future The stock has the potential to triple in value and still remain significantly cheaper than the average valuation of S&P 500 stocks.

Put simply, I think these assumptions are on the cautious side for Advance. The key factor is addressing its supply chain weaknesses. However, I find this prediction to be realistic, as this is the expertise the company was looking for in its new CEO.