SoFi Technologies is a company. ( SOFI -0.45% ) The company has achieved significant advancements in broadening its business to serve as a comprehensive solution for customers’ financial requirements. Additionally, it has enlarged its technological infrastructure, allowing non-banking entities to provide financial services to their clientele.

SoFi has reported its third consecutive profitable quarter thanks to the success of its expanding businesses. However, the stock has been struggling and is currently down by a third this year. The main challenge for SoFi is its substantial personal loan portfolio and associated issues. charge-offs .

Shareholders received encouraging updates during the company’s second-quarter financial report. However, the key question remains: does this development warrant purchasing the stock today? Let’s examine both the favorable and unfavorable aspects for SoFi and discuss the future outlook.

The creditworthiness of SoFi has raised worries.

Initially, SoFi focused on assisting clients in refinancing their student loan obligations. However, the situation shifted in 2020 with the outbreak of the pandemic, leading to a temporary suspension of student loan repayments by the government. This sudden development forced prominent lenders such as SoFi to quickly adapt and modify their business strategies.

One aspect that SoFi focused on was loaning money to individuals SoFi’s entry into the mortgage business was a logical next step for the company, as it had already established itself in the lending sector. Within a span of three years, SoFi’s personal loan issuance increased significantly from $2.6 billion to $13.8 billion by the conclusion of 2023.

This strategic shift has supported SoFi’s business growth, but it has also exposed the company to the uncertainties of the economic environment. The primary worry revolves around consumers facing increasing net charge-offs and payment delays within the banking industry.

In the second quarter, SoFi’s annualized net charge-off rate rose to 3.84% from 3.45% in the preceding quarter. SoFi offloaded $69 million worth of overdue loans during this period. If these loans had not been sold, the annualized net charge-off rate for personal loans would have been approximately 5.4%. Investors are worried about SoFi’s loan portfolio and the likelihood of loan revaluation if credit losses persist.

Photo credit: Getty Images.

In a positive development, the percentage of personal loans that were 90 days or more overdue decreased from 0.72% in the first quarter to 0.64% in the quarter. Anthony Noto, the Chief Executive Officer, expressed optimism about the improving credit trends during the company’s Q2 earnings call with investors.

Noto and Chief Financial Officer Chris LaPointe noted a trend where newer personal loans have shown better credit performance compared to older loans. As a result, the company decided to tighten lending criteria and reduce the speed of issuing personal loans towards the end of 2022, leading to improved performance of these newer loans.

Here are the main factors behind SoFi’s expansion in the current year.

Worries regarding the creditworthiness of SoFi persist, casting a shadow over the company’s recent positive developments. Despite this, SoFi has achieved profitability in three consecutive quarters and has increased its annual earnings forecasts. This is driven by the growth of its Financial Services and Tech Platform divisions, which are playing a larger role in its business operations.

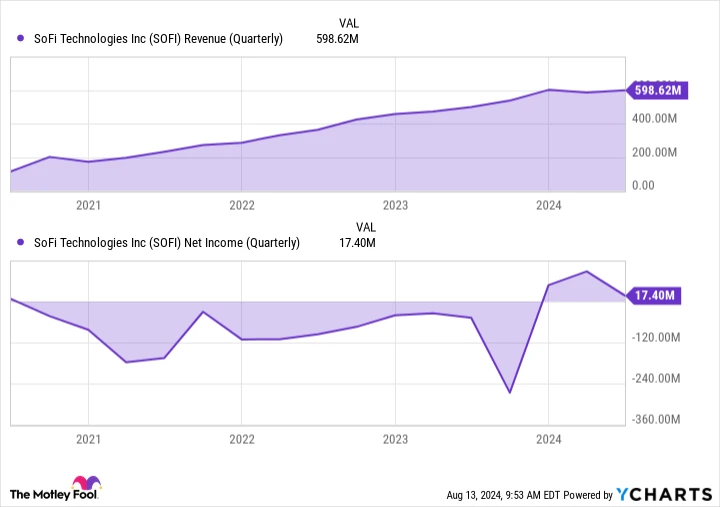

SoFi’s revenue in the second quarter exceeded the expected average, reaching $598 million compared to the estimated $565 million. The Financial Services segment, which includes products like SoFi Money, SoFi Invest, credit card services, and personal finance management, saw a significant growth of 80% from the previous year, generating $176 million. On the other hand, the Technology Platform segment earned $95 million in revenue, marking a 9% increase from the previous year.

Quarterly SOFI Revenue data by YCharts.

These two sections make up approximately 45% of SoFi’s adjusted net revenue and have emerged as a growingly significant component of its entire operation In the previous year, these segments accounted for 38% of the adjusted net revenue, while the percentage was 32% in the year prior.

SoFi anticipates an 80% increase in its financial services revenue compared to the previous year, with its technology platform projected to grow at a rate ranging from the mid-teens to high teens. The company foresees a slight decrease of around 5% in lending revenue from last year due to its stricter lending criteria. Moreover, SoFi has revised its annual revenue forecast to $2.45 billion, surpassing its initial projection of $2.41 billion, and it predicts a net income of $180 million.

Should you purchase, sell, or retain SoFi?

SoFi has successfully transformed its business in recent years despite facing difficulties in the lending industry. Although its financial services and technology platform divisions are expanding consistently, worries among investors regarding the quality of credit have become a dominant issue overshadowing this growth.

Management is confident that the loan portfolio has reached a turning point and is expected to improve from now on. Investors should keep an eye on the performance of SoFi’s personal loan portfolio, specifically focusing on net charge-offs and delinquencies, as these factors may impact the stock in the near future.

Due to this, SoFi’s stock is exposed to additional fluctuations as events progress and may not be appropriate for all investors. Despite this, the overall growth potential in the long run is still strong. With the stock currently priced at only 2.9 times its sales, close to its lowest valuation since its IPO, I believe SoFi represents a great investment opportunity at present. investors who are prepared to hold for an extended period of time over the next five years or longer.