Artificial intelligence (AI) has significantly impacted many technology stocks, leading to remarkable increases in their share prices. Two companies that are reaping the benefits of the AI trend are AMD ( AMD -0.27% ) , or AMD, and Super Micro Computer can be rewritten as “an extremely compact computer.” ( SMCI 1.70% ) , which is often referred to as Supermicro.

Both companies experienced strong customer demand for their AI products in the past year, leading to significant increases in their stock prices. AMD’s stock rose from $93.12 in 2023 to $227.30 in March, while Supermicro’s shares climbed from $226.59 to $1,229 in the same period.

Due to the recent decline in the overall stock market, AMD and Supermicro are currently trading significantly below their peak levels. This presents a chance to acquire shares, but which of these artificial intelligence-focused stocks is the more favorable investment option?

AMD experiences a significant increase in sales due to the use of artificial intelligence technology.

Over the last year, AMD’s business has changed significantly due to its position as the manufacturer of semiconductor chips that are essential for the computing capabilities of AI algorithms.

In 2023, each of the company’s four operational segments accounted for at least 20% of the total revenue for the year. However, the scenario changed significantly in 2024.

The large semiconductor company’s data center division specializes in selling chips that are optimized for artificial intelligence applications. Cloud computing refers to the practice of using a network of remote servers hosted on the Internet to store, manage, and process data, rather than a local server or a personal computer. Currently, a significant portion of the revenue for companies comes from this division, accounting for almost half of the total revenue. To illustrate, in the second quarter, this sector contributed $2.8 billion to AMD’s $5.8 billion sales, with data center revenue showing a remarkable 115% growth compared to the previous year.

The AI chips designed for the PC industry are experiencing strong sales, with a 49% increase in Q2 revenue compared to the previous year, reaching $1.5 billion. On the other hand, other areas of AMD’s business saw a decrease in sales.

The chips designed for the gaming sector and the embedded products utilized in various industries like automotive encountered a situation. period of decline in a repetitive pattern The revenue of the gaming segment decreased by 59% to $648 million from $1.6 billion in 2023, as there was a decrease in customer demand in these regions. Additionally, embedded sales also saw a decline of 41% year over year to $861 million.

The AMD management expects a recovery in the embedded business in the latter part of this year. This, coupled with the growth in AI-driven sales, is projected to boost AMD’s third-quarter revenue to approximately $6.7 billion, marking a double-digit rise from the $5.8 billion in 2023.

The achievement of Supermicro within the artificial intelligence environment.

AMD supplies the processors for devices like computer servers, while Supermicro manufactures the servers and storage solutions required for AI to perform its tasks efficiently.

Supermicro’s products have significantly contributed to the AI ecosystem, leading to a notable 143% increase in sales to $5.3 billion in the fourth quarter of its fiscal year, which ended on June 30. This quarterly revenue exceeded the total revenue of $5.2 billion that Supermicro achieved throughout the entire year 2022.

The company promotes its unique “building blocks” design as a factor that sets it apart from competitors. Supermicro’s products are made up of interchangeable parts, allowing the company to easily make tailored adjustments to fulfill a customer’s requirements. This strategy has aided Supermicro in achieving revenue growth that is over 5 times higher than the industry average in the previous year, as reported by the company.

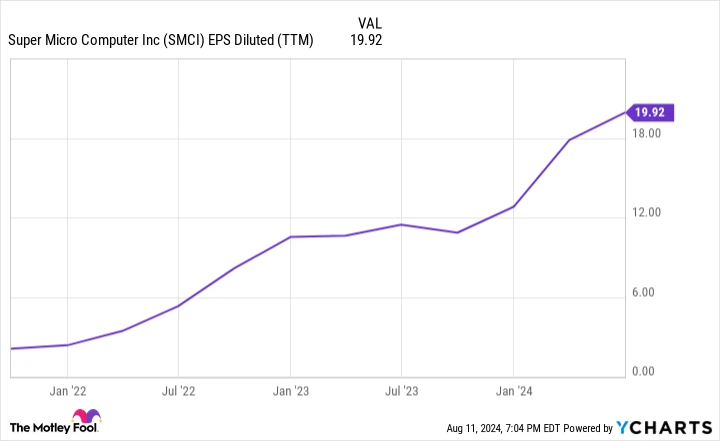

Supermicro experienced impressive revenue growth which resulted in robust financial performance. The company’s net profit surged to $352.7 million in the fourth quarter, marking an increase from $193.6 million in the 2023 fiscal year. This led to an increase in its diluted earnings per share. EPS In the fourth quarter, the earnings per share increased to $5.51 from $3.43 in the prior year, continuing a trend of consistent EPS growth over several years.

Data by YCharts .

Furthermore, at the end of the 2024 fiscal year, the company had a strong financial position with total assets of $9.9 billion exceeding total liabilities of $4.5 billion. The cash and equivalents in the fourth quarter were $1.7 billion.

Supermicro has recently revealed a stock split of 10-for-1 following its remarkable performance and significant increase in stock price during the previous year. stock split , scheduled for October 1st.

Deciding between investing in AMD or Super Micro Computer shares.

It can be challenging to choose between investing in AMD or Supermicro. Both companies are gaining from the AI market’s expansion and are well-regarded by financial analysts on Wall Street.

Wall Street analysts generally recommend buying AMD stock with a median share price expectation of $190. The consensus on Supermicro shares is… rating for being overweight The average cost is $693.

In a perfect scenario, it would be beneficial to have ownership of both stocks. However, if you are forced to select only one, Supermicro is preferred over AMD. The main reason for this choice is the valuation of the stocks.

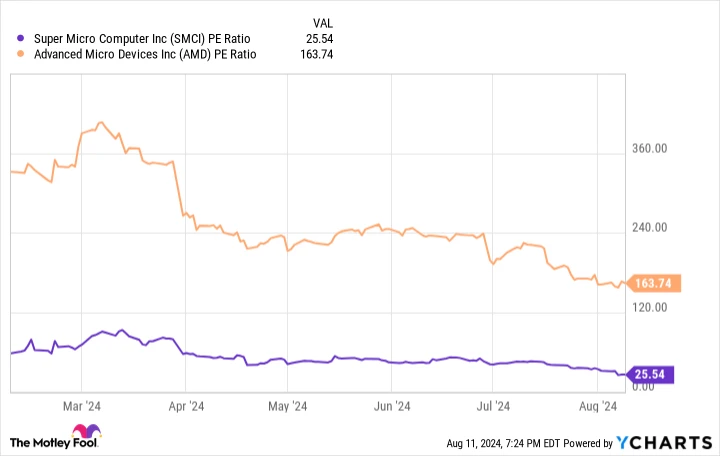

Even though both stocks have decreased from their highest prices in the past year, Supermicro appears to be a more favorable choice when considering their price-to-earnings ratio. P/E ratio ), a commonly used measure to evaluate worth.

Data by YCharts .

The price-to-earnings ratio of AMD is more than 6 times higher than Supermicro’s P/E ratio of 25.5. In fact, AMD’s stocks are pricier than those of its main competitor. Nvidia Nvidia currently has a P/E ratio of 61.3. As Nvidia is the leading company in AI-optimized chip market, this supports the argument that AMD stocks are too expensive.

Given Supermicro’s impressive increase in sales, solid financial performance, continuously growing earnings per share, and effective product strategy, Supermicro is currently the more favorable choice for investing in AI among these two stocks.