From 2018 to 2023, 3M, an industrial conglomerate, experienced a gradual decline. The company’s stock faced several challenges, including legal battles, growth concerns, and financial pressure from a costly dividend. However, over the past year, significant changes have greatly improved market sentiment toward the stock.

3M took decisive action by reducing its dividend to improve cash flow, spinning off its healthcare division, nearing settlements for most of its lawsuits, and appointing a new CEO in March. These strategic moves contributed to a remarkable 50% increase in 3M’s stock value over the past year.

Considering this rapid ascent, one might wonder if it’s too late to purchase shares of this revitalized industry giant. Here’s what you need to know.

3M’s rally is justified

Often, uncertainty can be more detrimental than a company’s actual issues. By addressing its various challenges, 3M instilled confidence in investors that the company was on the right track.

The legal disputes were perhaps the most significant obstacles for 3M, making their resolution critical. The settlements will be costly, with $10.3 billion related to PFAS chemical lawsuits and another $6.0 billion for defective earplugs. The earplug settlement will be paid out through 2029, while the PFAS case extends into the 2030s. While these settlements are a long-term financial burden, they don’t completely hinder 3M’s cash flow.

New CEO William Brown is expected to leave his mark on 3M, and investors have already responded positively. During the Q2 earnings call, 3M discussed shifting focus from aging products to faster-growing markets such as auto electrification, industrial automation, data centers, semiconductors, and climate technology. Brown also mentioned evaluating 3M’s research and development spending and exploring potential mergers and acquisitions. This comprehensive approach could rejuvenate a company that has arguably become stagnant.

Although 3M sacrificed its dividend growth streak and lost its Dividend King status, the new dividend amounted to just 33% of the company’s free cash flow in Q2. This leaves room for share repurchases (with management buying back $400 million worth of stock in Q2) and growth investments. Additionally, investors still benefit from a 2.1% dividend yield.

Overall, 3M appears to be in a better position today than in recent years.

The growth outlook for 3M is uncertain

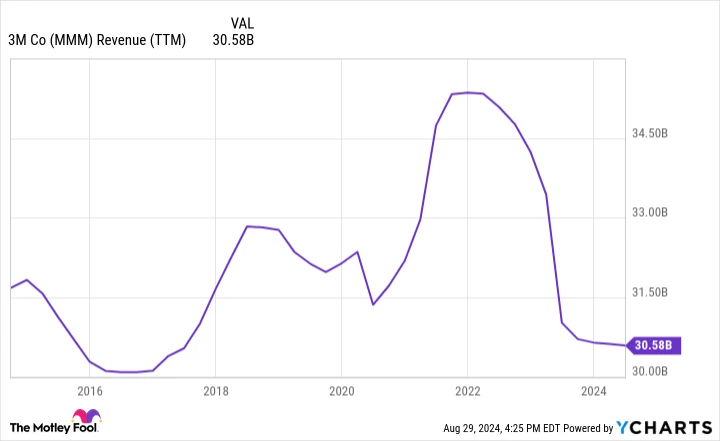

While change is promising, it takes time for new leadership to assess, decide, implement, and see results within the business. The pandemic period saw high demand for 3M’s respirators, but as things stabilize, 3M now holds less annual revenue than it did a decade ago:

MMM Revenue (TTM) data by YCharts

Assessing 3M’s growth prospects is challenging without knowing the changes a new CEO might implement over the coming six to 18 months. William Brown acknowledged during the Q2 call that shifts toward growth will take time and are currently too small to have a significant impact. Therefore, investors may want to temper short- and medium-term expectations.

Currently, analysts project that 3M’s earnings will grow by an average of 7.5% annually over the next three to five years. This is solid for a mature company, but investors should be cautious not to overpay for such a stock.

Should investors still consider buying 3M stock?

After such a remarkable surge, it’s reasonable to question how much short-term upside remains for 3M stock. Shares are now trading at a forward P/E of over 18. While not outrageously expensive for a company with mid- to high-single-digit earnings growth, 3M seems to have left bargain territory. One could argue that 3M is fairly valued for its projected growth, offering investors the potential for 9% to 10% annual returns when considering both earnings growth and dividends. The stock’s long-term success will likely hinge on the changes William Brown implements at 3M and their effectiveness.

It’s not too late to contemplate purchasing 3M stock if you’re seeking solid growth potential and a respectable dividend. However, any quick gains have likely already been realized.