Although numerous technology companies are recovering and approaching their highest values of the year, certain stocks, including those in the rapidly expanding artificial intelligence (AI) sector, are currently being sold at a lower price.

These markdowns may stem from a solvable issue, competitive worries, or simply a lack of investor awareness. However, for each of the three top-notch stocks mentioned, their recent declines could present a valuable chance to make a purchase.

CrowdStrike

In 1999 BusinessWeek Warren Buffett was quoted as saying that the ideal situation for investors is when a strong company faces temporary difficulties, as it presents an opportunity to acquire shares at a discounted price.

Leader in the field of cybersecurity CrowdStrike ( CRWD 1.62% ) There has been a recent negative event. The company released a software update on July 18 that quickly caused Windows systems using its software to crash. This resulted in widespread flight cancellations, delays in nonemergency surgeries, and overall disruption to businesses globally.

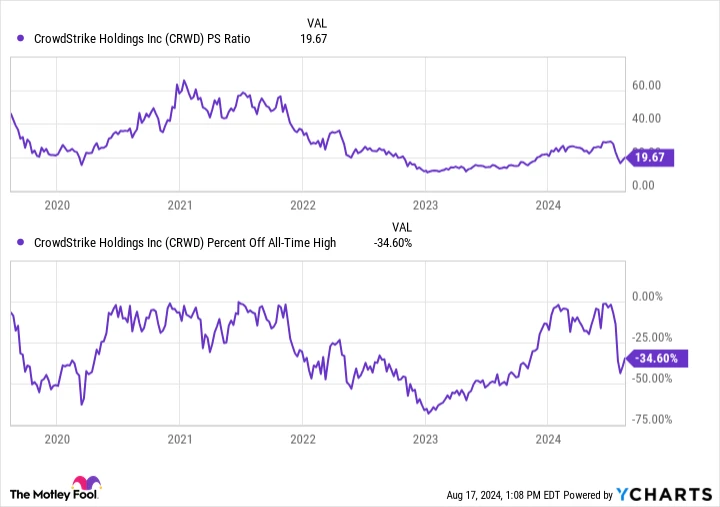

The stock experienced a 35% decrease after reaching record highs. Despite not being typically considered inexpensive, CrowdStrike’s stock price did not significantly drop. price-to-sales The price-to-sales ratio has decreased to below 20. Although it is not as low as it was in early 2023 during high inflation, the valuation is approaching a similar level.

CRWD PS Ratio data by YCharts .

Without a doubt, the consequences of the incident will be expensive in the short term, possibly resulting in legal fines, decreased revenue, or both. However, it is important to consider a few key points.

Initially, the issue did not result from a cyberattack but was caused by a mistake within CrowdStrike’s testing division. This appears to be a correctable operational issue.

Before the event occurred, CrowdStrike was quickly establishing itself as a top player in the cybersecurity sector. The Falcon agents were the first to utilize big data and AI to enhance their capabilities well before AI became popular. By adding additional product modules to its range, CrowdStrike has evolved into a comprehensive platform that streamlines the cybersecurity expenses for its customers.

The company has been experiencing impressive growth and profitability compared to its competitors. I anticipate that management will eventually make the needed adjustments to improve CrowdStrike’s internal processes, leading to a return to profitable growth. It might take a few quarters to recover fully, but investors with a long-term perspective should view this setback as a chance to invest.

Alphabet

A Federal judge made a ruling on Monday, Aug. 5. Alphabet ‘s ( GOOG 2.22% ) ( GOOGL 2.28% ) Google held a monopoly by establishing exclusive agreements for distribution with vendors like. Apple In the week that followed, there were reports that the Justice Department was contemplating splitting up the large search engine company. With this news, along with a drop in stock prices after their earnings report in July, Alphabet has decreased by 16% from its highest value. However, the current stock price is trading at a low multiple of 23 times earnings, which is a significant discount compared to other companies in the market. Seven magnificent individuals .

Nevertheless, if the Justice Department were to make any excessively aggressive actions, it is probable that they would be challenged and could be tied up in legal proceedings for an extended period. At the same time, the majority of financial experts anticipate that extreme actions such as a breakup successfully completing the appeals stage are unlikely.

It is possible that the government might compel Google to cease paying Apple to be the default search engine on the iPhone. However, this could have a positive outcome since it is said to cost Apple more than $20 billion annually for this arrangement.

Although offering iPhone users more options may result in reduced revenue, the impact is likely to be insignificant when taking into account the overall expenses. For instance, European regulators mandated Alphabet to provide users with a selection of search engines on Android devices in the past. Despite this requirement, Google did not experience a significant loss in market share.

Credit: Getty Images.

Despite Alphabet’s stock declining following the release of earnings, the company actually achieved positive results. Google Search and YouTube are both experiencing double-digit growth, while Google Cloud showed a significant increase of 29% and is starting to make a more substantial contribution to profits, generating $1.17 billion in operating income.

Investors are becoming anxious about the quantity of capital expenses Entering the realm of AI investment, Google has significantly increased its capital expenditure each year to $13.2 billion. While other major tech companies are not following suit, their stocks are not trading at such low prices, and none of them have as much cash reserves as Alphabet. Additionally, this investment could prove to be lucrative, as all the key players in Silicon Valley are investing in it.

Alphabet has developed many of the key technologies used in AI, and it is likely that Google’s AI products will be competitive with others in the market. Alphabet’s stock, which is the least expensive among the top seven companies, has become a good deal due to recent negative news affecting its value.

Kulicke & Soffa Industries is the name of the company.

Kulicke & Soffa Industries is the name of the company. ( KLIC 1.15% ) Although not widely recognized, this company’s expertise in advanced packaging technology indicates that a significant number of electronic devices you utilize may have been put together using its equipment.

Following a surge in demand during the pandemic, Kulicke & Soffa experienced a significant decrease in sales of their essential ball-bonder equipment used for packaging electronic devices such as phones and computers. Although these customers have started to show signs of improvement, the markets they cater to have not fully bounced back yet. Additionally, the company’s industrial and automotive wedge-bonding equipment has also faced a downturn due to the decline in the electric vehicle market.

The management noted that the usual duration for the bonding equipment cycles is six quarters, but the current downturn has already lasted nine quarters, including the current one. Despite this, the company expects revenue to remain steady in the current quarter and aims to maintain a modest yet positive level of profitability.

However, due to the extended downward trend, it is anticipated that the upcoming upward cycle, possibly occurring next year, could be robust. Additionally, Kulicke & Soffa is venturing into a high-growth sector within the rapidly expanding field of advanced packaging for chiplet semiconductors. It is expected that a significant portion of future cutting-edge chips will be manufactured using specialized “chiplets,” indicating a substantial growth potential in this area.

During the earnings call, the company highlighted the significant growth of its thermocompression bonding (TCB) tools for this specific use, increasing from $10 million in 2021 to an anticipated $100 million in the following year. This projected revenue would account for approximately 14% of the previous revenue. With TCB becoming a more substantial part of the company’s operations, it is expected to drive substantial growth by 2025.

Kulicke & Soffa operates in a sector that experiences significant fluctuations in earnings, with profits reaching $7 per share in 2022 and dropping to approximately $1 per share the following year. The stock is currently valued at slightly above 10 times its average earnings between these two extremes. Additionally, the company has been increasing its activities. buying back shares This is a technology stock with a small market capitalization that you should keep an eye on.