Over the past few weeks, the stock market has experienced extreme volatility, leaving many investors feeling the effects of the abrupt fluctuations.

Although market downturns can be unsettling, they can also present great opportunities for purchasing stocks at a lower price. Currently, many stocks are available at a discounted rate, making it a favorable moment to invest. By waiting for the market to decline further, you may be able to acquire stocks at an even greater discount.

Yet, there are instances when it might not be advisable to put money into the stock market, even if the reduced prices seem appealing. If any of these three conditions pertain to you, it could be prudent to refrain from investing at this time to safeguard your financial situation.

Picture credit: Getty Images.

You lack a financial safety net.

A robust emergency fund It is important, particularly in times of market instability. If you put all your extra money into investments and the market drops, you might be forced to withdraw your funds at a less favorable moment in case of an unforeseen financial need.

Selling off your investments may not just crystallize any potential losses but it might also entail significant taxes or fees, even if you are solely investing through a corporation. 401(k) or IRA Taking out money from your savings before reaching the age of 59 1/2 may lead to a 10% fine as well as taxes on the withdrawn sum.

It is recommended to have a sufficient amount of money saved in an emergency fund to cover living expenses for a period of three to six months. This will ensure that you can manage unexpected expenses or unemployment without having to withdraw funds from investments.

You are unable to hold onto your money in the market for an extended period of time.

In order to increase your profits in the stock market and reduce risk, it is advisable to maintain your investments for a minimum of several years. Ideally, it is recommended to remain invested in the market for multiple decades.

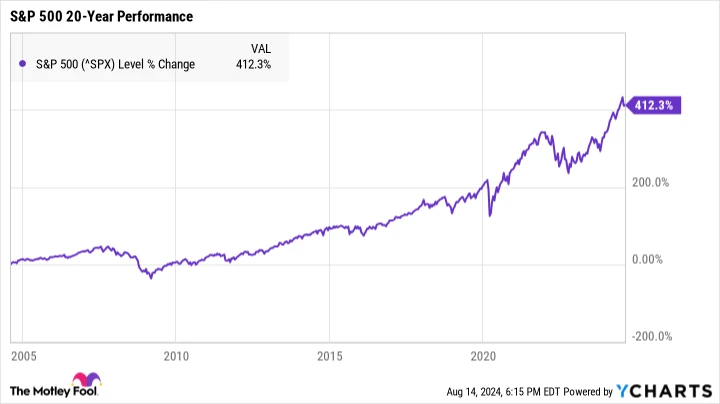

Having a long-term plan in place can help protect your finances and minimize the effects of market fluctuations. If you are only able to invest for a short period, such as two to three months, you run the risk of significant decreases in stock prices when you decide to sell. However, if you remain invested for a longer period, like 20 years, it is highly probable that the market will have generated favorable returns during that timeframe.

Studies indicate that the probability of experiencing financial losses decreases the longer you maintain your investments. Analysts at the investment company Capital Group conducted research on this matter. S&P 500 By examining past records, it was observed that investing in a certain asset yielded positive results. A fund that tracks the performance of the S&P 500 index. If you invest in the stock and sell it after just one year, there is a 27% probability that you will experience a financial loss.

On the condition that the investment is kept for three years, the likelihood of experiencing losses is only 16%. This probability decreases to 6% over a 10-year span. Having a perspective focused on the long term can help safeguard your funds, and if this extended timeframe is not feasible for you currently, it might be wise to postpone investing for the time being.

You are in debt that has a high interest rate.

Investing in the stock market while simultaneously reducing debt is a viable strategy that can be advantageous. Allowing your investments more time to increase can lead to higher potential returns. Therefore, delaying investing until you have cleared all your debts can put you at a significant disadvantage.

If you are burdened with a significant amount of debt that has a high interest rate, like credit card debt, it may be a good idea to prioritize paying it off before you start investing.

The entire stock market has gained a profit. an average yearly gain of approximately 10% In the past, the average interest rate on credit cards was 24.92% in 2024, as reported by Lending Tree. If you are spending more on interest payments than you are earning from your investments, it might be wiser to focus on paying off your debt before investing further.

Engaging in the stock market can be a great method to create wealth, however, having a suitable strategy is crucial. It’s important to recognize that not everyone may currently be in a position to invest, and that’s perfectly fine. By focusing on enhancing your financial well-being before entering the stock market, you can optimize your profits when you eventually decide to get involved.