The The Dow Jones Industrial Average It is recognized for including 30 top-performing elements from a range of stock market areas. However, even stocks in the Dow Jones Industrial Average can experience significant declines in value.

Dow components Salesforce ( CRM 1.37% ) , Chevron ( CVX 0.35% ) , and Home Depot ( HD 0.09% ) Stock prices have declined by 12% to 24% from their highest points of the past 52 weeks and have seen a decrease in value since the beginning of the year, even though broader market indexes such as the Dow have shown gains. S&P 500 , and The Nasdaq Composite index .

Here is the reason for each one of them. stocks that pay dividends emerge as attractive investments for long-term investors.

Credit: Getty Images.

Contents

Salesforce is a well-rounded purchase.

Investors may have been taken aback when Salesforce, known as a high-growth stock, was included in the Dow in August 2020. At that point, Salesforce was not consistently making a profit and did not distribute dividends. However, over the years, Salesforce has evolved significantly as a company. It now places less emphasis solely on generating revenue and reinvesting all earnings into the business. Instead, the company has become very profitable, introduced its first quarterly dividend earlier this year, and is repurchasing a substantial amount of its own shares.

Salesforce offers stock-based compensation to employees as a form of reward, but this practice can result in a decrease in the ownership percentage of existing shareholders. In the past ten years, Salesforce’s total number of shares has gone up by 54%. Nonetheless, the company has engaged in stock buybacks in the recent years to counter the effects of stock-based compensation, leading to a 1% reduction in its share count over the last three years.

Salesforce has borrowed an idea from Microsoft ‘s Microsoft’s playbook involved paying a substantial $10.7 billion in stock-based compensation over the past year, marking a 123% increase over five years. Despite this, the company successfully decreased its outstanding share count by 2.6% through buybacks. Implementing such a strategy requires a highly profitable business. However, when executed correctly, it can aid in attracting and retaining top talent for companies without compromising shareholder value.

Salesforce is considered to be a well-rounded tech stock in the market. Although the dividend yield is low at 0.7%, it is important to note that the company has recently started paying dividends. the ratio of a company’s current stock price to its earnings per share The price-to-earnings ratio stands at 24.5, indicating that Salesforce is relatively cheap when compared to its previous valuation. However, a major concern regarding Salesforce is that The rate of growth has decreased. The company has not effectively capitalized on artificial intelligence for generating revenue. Nevertheless, it would be unwise to disregard Salesforce’s dominant position in the industry and its potential for growth. sustained expansion in business software over an extended period .

Many tech stocks are currently popular, but most of them come with high price tags. Salesforce is a standout option for investors seeking a more reasonably priced stock. Unlike other companies focused solely on growth, Salesforce prioritizes profitability and returning capital to shareholders through buybacks and dividends.

Chevron remains a preferred choice in the oil industry.

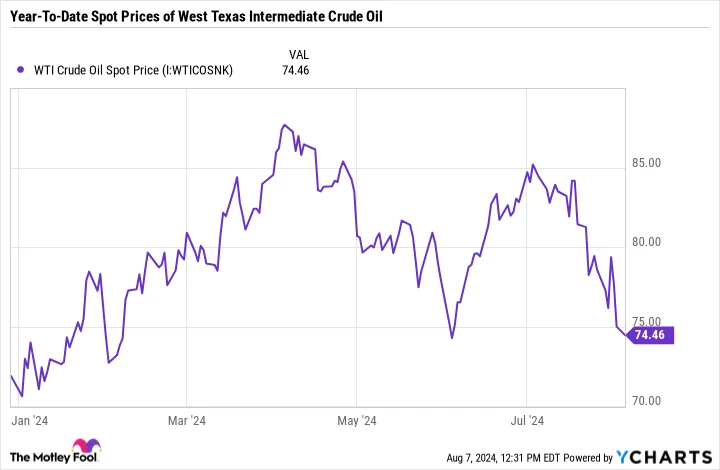

Despite achieving good outcomes, Chevron’s stock is currently close to its lowest point in the past 52 weeks. The decrease in oil prices has played a significant role in this situation.

WTI crude oil prices, which are considered the benchmark in the United States, have been consistently above $75 per barrel for the majority of the year. Nevertheless, there has been a recent decline in oil prices, causing WTI prices to drop below this threshold.

The current price of WTI crude oil. data by YCharts

The company most similar to Chevron — ExxonMobil — has performed well so far this year and is currently close to reaching its all-time high, with just a 5% difference. While ExxonMobil and Chevron operate in the same industry, they exhibit unique characteristics, particularly in terms of their merger and acquisition strategies.

Exxon successfully acquired Pioneer Natural Resources in May, but Chevron has not made any advancements in its acquisition process. Hess . It’s been It has been 10 months since Chevron. The initial declaration was to acquire the exploration and production company for a sum of $53 billion, however, numerous obstacles hinder its progress .

While Chevron may not currently have the same level of cleanliness as Exxon, it is still considered a very attractive investment. Chevron has been increasing its dividends regularly, and a decrease in the stock price has resulted in Chevron’s yield rising to 4.6% over the past two years. Chevron distributed $50 billion to its shareholders in the form of dividends and share repurchases. — demonstrating the magnitude of its large profits.

Chevron has the ability to finance its activities and pay dividends even in times of low oil prices. $50 per barrel When considering the current oil prices, Chevron proves to be a reliable dividend stock worth investing in, with a comfortable margin of error.

Home Depot has the potential to come out of a general industry decline even more robust than before.

Home Depot’s stock price has remained relatively stable throughout the year due to several potentially justifiable factors. To begin with, The growth of Home Depot has come to a standstill. The company is responsive to changes in the overall economy. During this current earnings season, several companies have mentioned that consumers continue to be careful and picky about how they spend their money , particularly on non-essential items.

Home Depot sees advantages in a robust economy and a thriving real estate market. The company benefits from reduced interest rates, which translate to more affordable loans, decreased mortgage rates, and cost-effective financing for home renovation endeavors. Regrettably, the current situation does not reflect these favorable conditions.

Nevertheless, cyclical companies can vary in terms of their performance. While some companies experience extreme highs and lows due to economic conditions or fluctuations in commodity prices, Home Depot tends to either thrive or remain stable.

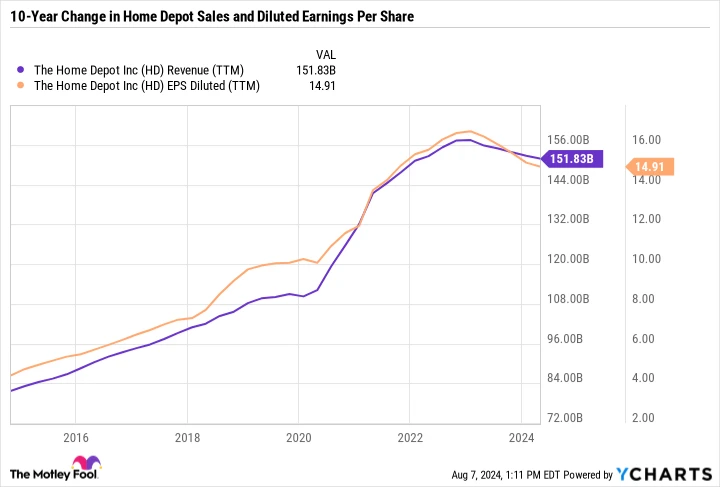

In the past ten years, Home Depot has experienced almost a twofold increase in sales and more than a threefold increase in diluted earnings per share. However, in recent years, there has been a slight decrease in both Home Depot’s earnings and sales.

Trailing twelve months revenue for a company. data by YCharts

Although Home Depot’s performance may not meet expectations in the short run, there is no indication that the fundamental investment thesis has altered. Home Depot executed a significant action earlier this year. large $18 billion purchase Due to its ample cash reserves for investing throughout all market cycles, Home Depot is well-equipped. Additionally, it is important to note that the company’s dividend is sustainable and within its means. payout ratio There is a 57% rate of healthiness.

Home Depot is a solid, top-performing company that is currently a good investment with a P/E ratio of 23.2 and a yield of 2.5%.

Take a step back and consider the future.

While Salesforce, Chevron, and Home Depot belong to different sectors, they share a common trait of experiencing sluggish or declining growth, particularly evident in the case of Home Depot.

Investors who are focused on short-term gains may dismiss all three companies, but those with a long-term perspective are more interested in a company’s future potential rather than its current status. Salesforce, Chevron, and Home Depot are maintaining their top positions in their respective industries, which makes them attractive investment options at the moment.