Taking into account the current prices and dividends, the average dividend yield of stocks at the present moment is determined. Vitesse Energy ( VTS -0.20% ) , the JPMorgan Equity Premium Income Exchange-Traded Fund ( JEPI 0.41% ) , and Whirlpool ( WHR -1.53% ) The dividend yield for each of the three stocks is 7.8%. While they are all appealing options, they also come with their own risks. Before including these stocks in a high-yield portfolio, it’s important to be aware of the following information.

Vitesse Energy has a dividend yield of 9.1%.

Vitesse is a company that explores and produces oil and gas. with a distinction Rather than possessing and managing assets directly, the company concentrates on investing in small ownership stakes in assets generated by prominent companies. Moreover, the management team employs a flexible approach by hedging a portion of its oil production to safeguard against potential losses due to a decrease in oil prices. oil .

This model is appealing because it centers on the company’s ability to create value by focusing on its core strength of acquiring profitable stakes in oil wells and subsequently generating revenue through oil and gas extraction.

With that being said, it is important to consider the potential risks. To begin with, the hedging approach is discretionary, meaning that one must depend to some extent on the competence of the management in hedging effectively. Additionally, a substantial decrease in oil prices could negatively impact Vitesse Energy as it might reduce the cost-effectiveness of oil production for oil companies. Lastly, there is a possibility that the management might struggle to recognize acquisitions that would add value to the company.

Overall, Vitesse appeals to investors who are optimistic about oil and those who are satisfied with the current price. Moreover, if you trust the leadership of industry expert Bob Gerrity, then Vitesse is a great stock to consider adding to a varied portfolio that generates income.

The JPMorgan Equity Premium Income ETF offers a dividend yield of 6.8%.

One important aspect to grasp about this ETF is that puts at least 80% of its funds into In the case of actively managed U.S. equities, it offers investors the opportunity to participate in the U.S. stock market and benefit from the dividend returns produced by the stocks in its portfolio.

Credit: Getty Images.

Additionally, it allocates a maximum of 20% of its funds towards purchasing equity-linked notes (ELNs) that offer out-of-the-money call options. S&P 500 This serves as a protection against sudden market fluctuations and substantial drops in stock prices. It is important to mention that this enables the ETF to gain a premium during periods of strong performance by the S&P 500. negative During a month with slight increases, the ETF will make some profit, but it will experience losses on the ELNs in a strongly bullish month for the S&P 500.

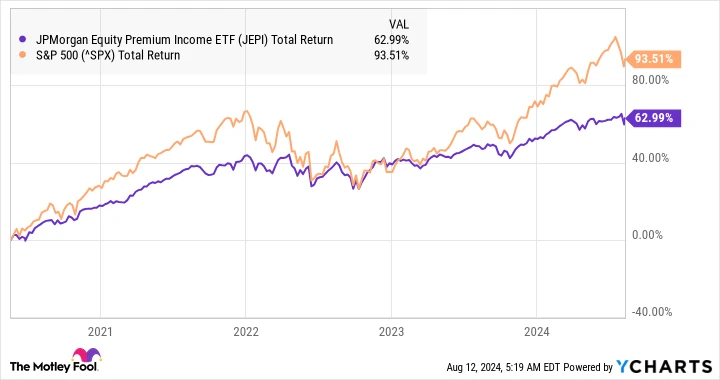

Simply put, the ETF is likely to show positive performance, but may not do as well as the overall market during periods of significant market growth. Despite this, it can still provide a good level of income. The increase in stock value may be counteracted by losses from the ELN strategy. However, the ETF is safeguarded against losses in equity markets when they decrease because of the ELN strategy.

The fund performs best in a setting where stock markets are gradually increasing, enabling it to generate income from dividends, earn premiums through the ELN strategy, and see growth in the value of its stock investments.

This is evidenced by examining its past performance.

JEPI Total Return Level can be described as… data by YCharts

In general, this is a favorable choice for investors seeking regular monthly earnings and concerned about potential losses in the stock market.

Whirlpool has a dividend yield of 7.5%.

This company encounters challenges. There are notable risks in the short term but a wealth of opportunities in the long term. The continuation of relatively high interest rates and a resulting decrease in sales of existing homes have a negative effect on consumer spending on large household appliances.

MDA sales in North America are being hindered, affecting profit margins. This is because purchases made on a discretionary basis, such as planned kitchens, tend to have higher margins compared to lower-margin replacement demand for products like refrigerators and washing machines. Consequently, the company reduced its projections for margins, earnings, and cash flow for the full year during its recent earnings call.

In the event that Whirpool experiences worsening conditions in its target markets, there is a possibility that its dividend could be impacted, or alternatively, its efforts to decrease its $6.3 billion in long-term debt may be delayed.

In contrast, the management team is of the opinion that the rise in prices during the spring season contributed to the enhancement of profit margins for the North American MDA segment, increasing from 5.6% in the first quarter to 6.3% in the second quarter. Additionally, the management anticipates that the North American MDA segment will achieve margins of 9% by the end of the year.

Furthermore, the remaining three segments (which contributed 38% of the segment profit in the second quarter) all experienced an increase in earnings compared to the previous year.

Credit: Getty Images.

The stock’s potential for growth is driven by the expected improvement in interest rates and the revival of the housing market, which may not begin until at least 2025. During this period, Whirlpool will have to navigate challenges. The situation may deteriorate before showing signs of improvement, but the stock appears to be undervalued with a trailing price-to-earnings ratio of under 10.