The stocks known as the “Magnificent Seven”– Apple , Microsoft , Nvidia , Amazon , Alphabet , Meta Platforms , and Tesla — have shown better performance than the stock market in the past five years. As an illustration, middle-level performer among the group, Microsoft, has a Compound Annual Growth Rate (CAGR) is a measure used to determine the average annual growth rate of an investment over a specified period of time, taking into account the effect of compounding. a growth of 26% over the course of this time. This amounts to almost twice the profit earned by the S&P 500 (15%).

However, when it comes to investing, it is crucial to focus on the future rather than dwell on the past. It is essential to consider what factors could potentially propel a surging stock to even greater heights.Which of these stocks has the potential to secure investors’ financial futures?Here are the pair of themhave my eye onright now.

Credit: Getty Images.

Meta Platforms

The first Seven impressive individualsInvestors can achieve financial security with stocks that have long-term potential. Meta Platforms .

Meta is the company that runs social networking platforms.includingFacebook and Instagram collectively have over 3.3 billion users. users who are active on a monthly basis This is approximately equivalent to 40% of the entire global population.

Given the large number of users on its platforms, it is not surprisingthat theThe company generates billions in revenue from placing advertisements on its networks.During the second quarter of this yearMeta disclosed a revenue of $39 billion, with the majority of it coming from various sources.–some 98%–Originated from advertising revenue.

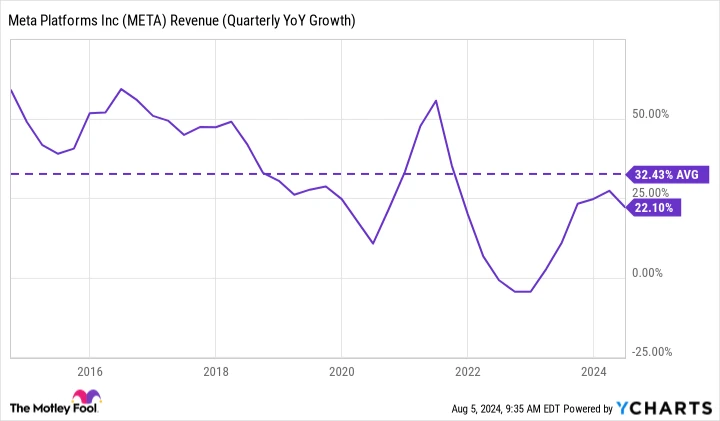

However, even with its large scale and strong emphasis on digital advertising, it continues to show exceptional growth. The company achieved a remarkable 22% year-over-year increase in total revenue in the latest quarter, a noteworthy achievement for a company of its size. In fact, it has maintained an impressive average of 32% growth in revenue each quarter.dating back to2014.

Quarterly year-over-year growth in META revenue. , data by YCharts uses the abbreviation “YoY” to represent year over year.

Additionally, Meta’s growth is not limited to its revenue numbers alone. Free cash flow (FCF) per share is another important financial indicator that demonstrates the amount of cash a company is producing per share.The amount of cash flow available for Meta per share after deducting capital expenditures.has been consistently increasing.The company currently produces a free cash flow of $18.82 per share.upfrom a price that was $6.60 lower than it was two years ago.

This is important for investors as free cash flow per share indicates the amount of money a company is producing.whichcan be utilized for dividend distributions, repurchasing shares, paying off debts, and fulfilling other objectives.Put differently, it allows the management of a company to provide benefits to its shareholders.

Meta’s business model is successful due to its large size and high profit margins.is likely tosustain providing benefits to shareholders over an extended period of timeto come.This makes it a stock that could potentially secure the financial future of investors.

Alphabet

Similar toThe company Meta Platforms is also known as Alphabet.majorParticipant in the online advertising industry.

Via its Google Search and YouTube divisions,The company makes billions of dollars in revenue from advertisements.Alphabet generated $85 billion in revenue during the second quarter, which is close to. $1 billion every day .$65 billion, which accounts for 76%, of thistotalOriginated from promotions on Google Search, Google Network, and YouTube.

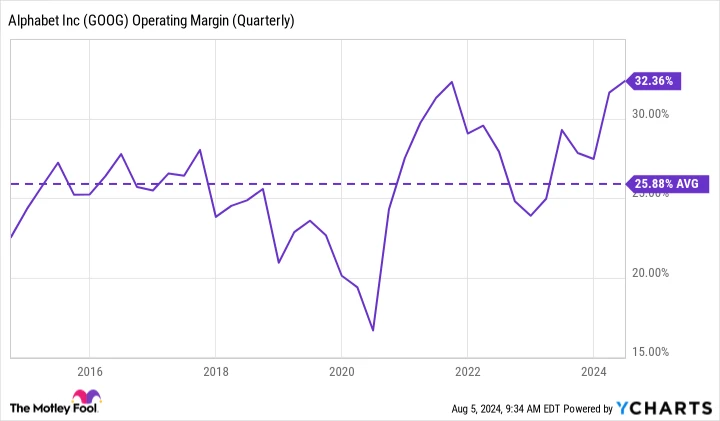

Alphabet’s remarkable efficiency in converting its revenue into profits is truly impressive. Operating margin refers to the percentage of revenue left after subtracting operating expenses from the total revenue. 32% is the highest percentage.more thanFor more than ten years and significantly higher than its average of 26% over that period.

The quarterly operating margin for GOOG. data by YCharts.

High profitability refers to a situation where a business is generating significant profits.keyfor any stock. It signifies that a company is effectively handling its activities and generating earnings as a result.be usedto increase returns for shareholders or expand its operations.

Although Alphabet faces difficulties such as an ongoing federal antitrust case and significant market volatility in recent weeks, it continues to navigate through these challenges.

However, it is important for investors with a long-term perspective to consider that times of uncertainty can actually be opportune moments to make investments. Renowned investor Warren Buffett advised that investors should go against the crowd, being cautious when others are overly optimistic and seizing opportunities when others are scared. Considering Alphabet’s strong business model and stable operating margin, wise investors should be considering investing in this tech powerhouse.