AI stands for artificial intelligence. According to its strongest supporters, it is considered the most significant advancement in technology since the internet. Its impact on the industry has been substantial, spearheaded by the leading figure of the AI revolution. Nvidia ( NVDA 1.67% ) AI stocks experienced significant growth in recent years, resulting in substantial profits for many investors.

The past month or thereabouts has been quite challenging. The Nasdaq Composite Index It has experienced a decrease of over 10% from its highest point in early July. Most major technology companies have reported their financial results for the second quarter of 2024, and despite numerous positive developments — Meta Platforms The company reported a 22% increase in revenue compared to the previous year for the quarter. However, investors were concerned about the higher-than-anticipated expenses that the companies intend to invest in AI infrastructure.

The recent general market concerns, along with the hope that the Federal Reserve can achieve a smooth economic transition, have negatively impacted Nvidia. The company’s stock has decreased by more than 22% since July 10. However, I view this as a positive development. It presents a chance for investors who have faith in the company to purchase its stock at a lower price, and I am one of them. As Nvidia is scheduled to announce its Q2 financial results on Aug. 28, there are two compelling reasons to consider buying the stock before the release.

Major technology companies have no intention of reducing their spending in the near future.

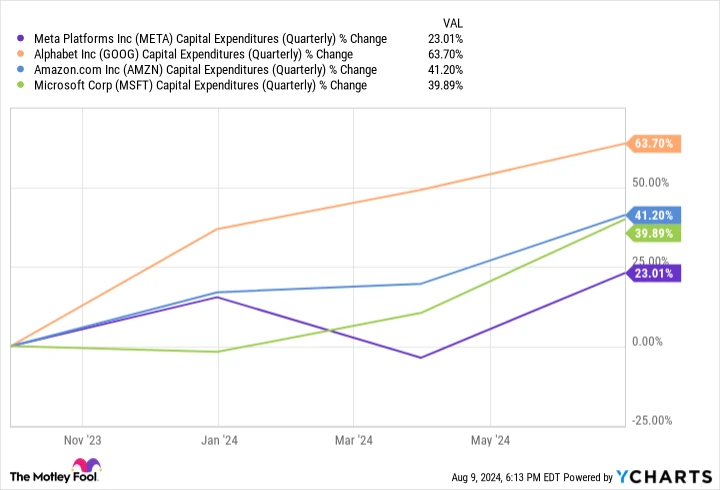

In the most recent earnings calls, the CEOs of major tech companies that are driving Nvidia’s impressive profits responded to inquiries about their firms’ projections for the future. Capital expenditures, often abbreviated as capex, refer to the funds used by a company to acquire, upgrade, or maintain physical assets such as property, equipment, or buildings. , particularly those pertaining to artificial intelligence. Alphabet, For example, the company invested approximately $32.3 billion in capital expenditures in 2023. This year, it is projected to reach $50 billion, indicating a significant growth. This growth is not unique to this company, as illustrated by the chart displaying the net change in capital expenditures from Alphabet and other companies over the previous year.

Quarterly expenses for capital investments by META. data by YCharts

There seems to be no end in sight for the substantial investment in AI infrastructure. The potential in AI is immense, and companies are eager to stay ahead in the race. Sundar Pichai, the CEO of Alphabet, emphasized during the earnings call that the consequences of not investing enough are far worse than investing too much. While Nvidia’s chips are a crucial component of AI infrastructure, they are not the only one. However, Nvidia is expected to continue receiving significant funding for the foreseeable future. Despite the need to protect its market share, Nvidia is well-positioned to do so.

Evidence indicates that artificial intelligence is providing tangible benefits in practical applications.

However, it remains uncertain whether AI can provide enough tangible benefits to justify its high expenses. In my opinion, the verdict is still pending, but Meta’s latest financial results have boosted my confidence. As previously noted, Meta experienced a 22% increase in revenue compared to the previous year, along with a significant 73% rise in earnings per share. CEO Mark Zuckerberg attributed some of this growth to AI during the recent earnings call. Meta leveraged AI to enhance its content algorithm, resulting in increased user interaction. This ultimately drove more usage of the platform, leading to higher advertising revenue.

Zuckerberg discussed his intentions to utilize AI to create complete marketing campaigns, including the strategy and creative content, for advertisers. This could create a new source of income for the company. This concept exemplifies the significant revenue potential of AI. As more examples of its practical benefits emerge, companies are likely to increase their investments in AI, which is advantageous for Nvidia.