Finding a high-quality dividend stock can be challenging when the overall market yield is low at 1.3%. However, with enough effort and research, it is possible to discover such stocks. A good starting point is to consider stocks that are not performing well. Archer-Daniels Midland Corporation ( ADM 1.00% ) and UPS ( UPS 0.73% ) Both currently have yields that are historically high.

Archer-Daniels Midland is returning to its usual state.

Archer-Daniels Midland, commonly known by its stock symbol ADM, has a dividend yield The increase today is 3.4%, which is more than double the previous level. S&P 500 The yield of the stock is currently higher than the average yield of 2.7% over the past 10 years, as indicated by the index. This increase in yield is primarily due to a notable decrease in the stock price, with ADM experiencing a decline of over 18% just in this year.

ADM is a major player in the agricultural commodities industry, boasting a large business focused on processing and managing these products. With a substantial revenue of $28 billion, it is a well-established leader in the field. market cap As an essential component of the worldwide food industry, ADM’s business is crucial and challenging to replicate due to its extensive operations and presence, granting it a somewhat secure position in the market.

Unfortunately, ADM’s market performance heavily relies on commodities, leading to significant fluctuations in its revenue and profit margins annually. The reason for the stock’s decline is the decrease in commodity prices following a significant peak post-coronavirus pandemic. Investors are responding to this sudden commodity price fluctuation by selling off the stock, despite the fact that the company is simply returning to a more stable operating level.

Looking at the long term rather than short term, ADM’s strong position in the industry ensures that its business is set up for continued success. It is worth mentioning that the company has consistently raised its dividend for around fifty years, indicating that it continues to be a dependable choice for dividend investors.

With its exceptionally high dividend yield, investors seeking to invest in stable companies for the long run should consider examining Archer-Daniels Midland closely.

UPS is attempting to launch once more.

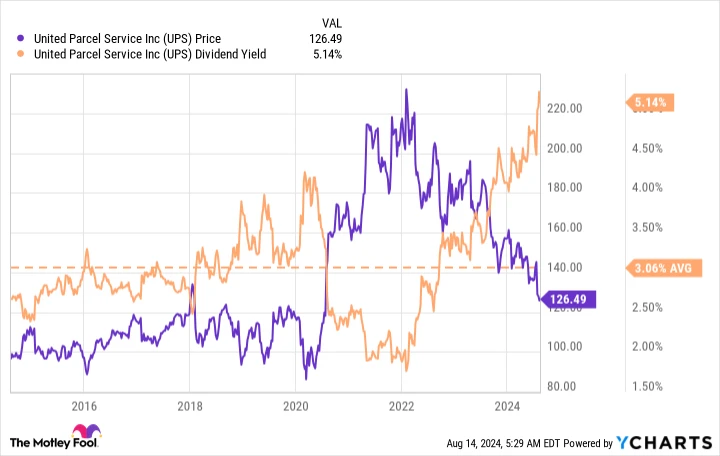

The dividend yield of UPS is approximately 5.1%, which is four times higher than the yield on the mentioned investment. S&P 500 index The current yield is significantly higher than the average yield of around 3.1% over the past 10 years for this stock. Similar to ADM, the reason behind this unusually high yield is a significant decrease in the stock price, as shown in the chart below. The stock has declined by almost 18% year-to-date.

UPS is a leading package delivery service in the United States and globally, with a market capitalization exceeding $110 billion. The company has a strong presence in the industry and a well-established logistics network comprising numerous sorting facilities, aircraft, and vehicles that would be challenging to duplicate. Amazon ( AMZN 0.66% ) While it has been expanding its distribution capabilities, Amazon continues to heavily rely on UPS for its services. Currently, Amazon views UPS more as a collaborator rather than a competitor. This partnership highlights the challenge of completely removing UPS from the package delivery equation.

Unfortunately, UPS’s business has become a bit too large, and although Amazon has not taken over the company, its own distribution operations have posed a minor challenge. In response, UPS is taking steps to streamline its operations while concentrating on its most successful market segments, such as medical deliveries. This restructuring has faced some challenges, as the company’s earnings for the second quarter of 2024 fell below investors’ expectations. However, there is some positive news as UPS saw an increase in the number of packages it handled following a series of decreases after the peak in demand during the coronavirus pandemic. Overall, the quarterly update had both positive and negative aspects.

With a consistent track record of increasing dividends for about 15 years and a high yield, it is advisable for long-term investors to view this stock positively. It is a well-established industry leader that you would likely want to purchase and keep for many years.

All companies experience difficult periods.

Every business faces ups and downs, rather than progressing in a linear manner. It is common for companies to experience both good and bad times. Sometimes, it is beneficial to invest in a stock when the company is going through challenges, as is the situation with ADM and UPS at present. The crucial point to note is that both of these companies have large and irreplaceable businesses, providing them with long-term stability. Over time, they are expected to overcome their current difficulties and continue to provide dividends to investors who are patient enough to endure short-term uncertainties.