Warren Buffett has been accumulating wealth for a longer period than many readers have been alive by being opportunistic when others are cautious. Based on a well-known indicator, it appears that the time is approaching to adopt a more aggressive investment approach.

One important indicator of fear in the stock market is the. CBOE S&P 500 Volatility Index can be paraphrased as the Volatility Index for the S&P 500 by the Chicago Board Options Exchange. The Volatility Index, known as VIX, surged to over 60 points on the morning of Monday, August 5th. This is the highest level it has reached since the markets were severely affected by the COVID-19 pandemic in the spring of 2020.

The scenario seemed bleak on August 5th, when S&P 500 The index dropped to 8.5% below the highest point it reached in July. It needs to decrease by 10% before we can consider it a downturn. market correction – a natural phase in which the prices of assets or securities adjust to more accurate or realistic levels after experiencing periods of overvaluation or undervaluation. .

We may feel uneasy when the value of stocks in our investment portfolios decreases during market downturns, but there is a positive aspect for investors with long-term goals. The key is to remember that the price at which you purchase an investment impacts your potential earnings. Therefore, when high-quality company stocks decline in value due to broader economic factors, it can be seen as a chance for growth rather than a setback.

Stocks of a cutting-edge company that I have a financial stake in, TransMedics Group is the name of the company. ( TMDX 0.64% ) The value of the stocks I purchased has increased by over 100%. I am interested in acquiring more, but the market conditions are uncertain. valuation The current level of risk associated with this stock exceeds my tolerance. However, I am looking forward to purchasing more shares if a market downturn causes its price to decrease.

The reason for the significant rise in TransMedics’ stock value.

TransMedics sells a system called the organ care system (OCS) to hospitals and transplant centers. The company’s stock surged by 84.5% from the end of 2023 to Aug. 7 due to increased sales of the OCS, as it is the sole FDA-approved solution for preserving various solid organs.

Due to a shortage of charter flights, TransMedics purchased an aviation company last summer. This acquisition provides the company with additional bargaining power when dealing with hospitals and transplant centers. By offering transportation services at a premium price, the company’s total revenue surged by 125% in the first half of 2024 to reach $211.2 million compared to the previous year.

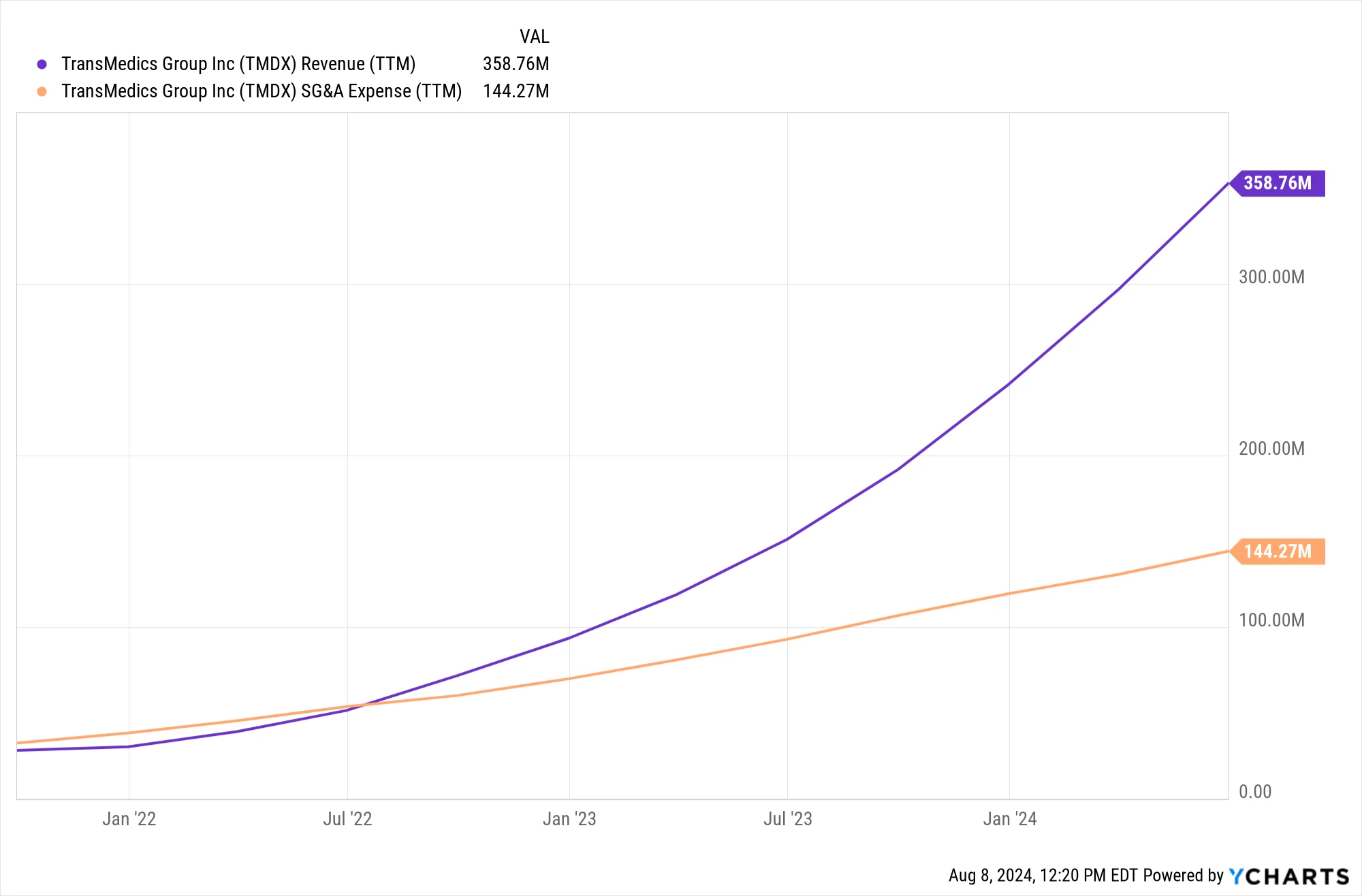

Transmedics had to hire additional staff to slightly more than double their revenue. Sales, general, and administrative expenses increased by only 45% compared to the previous year in the first half of 2024.

Total revenue earned over the past twelve months. data by YCharts TTM stands for the past 12 months.

Strong sales exceeding expenses significantly resulted in a net income increase to $24.4 million in the first half of 2024, compared to a loss in the same period the previous year.

Why TransMedics has not yet completed exceeding expectations

TransMedics is revolutionizing the storage of donated hearts, lungs, and livers by offering a more advanced alternative to the traditional method of keeping them on ice during transportation to the operating room.

The TransMedics OCS system circulates warm blood through organs that have been donated, resulting in significant benefits. For instance, according to the Inspire study, recipients of lungs preserved using OCS were approximately 50% less likely to suffer from severe primary graft dysfunction compared to recipients of lungs preserved through cold storage.

This organization’s Organ Care System (OCS) not only enhances results but also transforms organs that were previously deemed unsuitable into viable options. Previously, hearts donated after circulatory death (DCD) were often disregarded in preference for hearts donated after brain death (DBD), which are less frequently available.

Currently, the FDA has only approved TransMedics as the system for DCD heart transplantation. Surgeons are typically open to transplanting DCD hearts that have been preserved in a TransMedics OCS, as the survival rates after transplantation are better compared to DBD hearts preserved using cold storage.

What should be searched for

TransMedics currently has a market capitalization of $4.9 billion based on recent prices. While the company’s revenue has significantly increased, the valuation appears to be disproportionately high considering its earnings of only $24.4 million in the first six months of the year.

After the completion of the acquisition of its aviation business, things have calmed down and there is potential for earnings to increase in the upcoming quarters. However, those who purchase at current prices may face significant and rapid financial losses if, unexpectedly, the net income does not begin to rise significantly.

Investors considering purchasing TransMedics stock at current prices should be aware that it comes with higher risk levels that may not be suitable for most. Those who prefer lower-risk investments should consider waiting for a substantial price drop before investing in this promising growth stock.